Amazon (AMZN) Stock Momentum: A Deep Dive Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Amazon (AMZN) Stock Momentum: A Deep Dive Analysis

Amazon (AMZN) stock has experienced a rollercoaster ride in recent years, captivating investors and analysts alike. This deep dive analysis explores the current momentum of AMZN stock, examining key factors influencing its price fluctuations and offering insights into potential future trajectories. Understanding Amazon's multifaceted business model and the broader economic landscape is crucial for navigating this dynamic investment landscape.

Recent Performance and Market Sentiment:

Amazon's stock price has shown signs of recovery after a period of decline. Several factors have contributed to this shift in market sentiment, including:

- Stronger-than-expected Q[insert most recent quarter] earnings: Amazon's recent financial reports revealed positive surprises in key areas, boosting investor confidence. While specific numbers will vary depending on the reporting period, focusing on revenue growth, profitability in AWS (Amazon Web Services), and overall operating efficiency is key. (Link to relevant financial news source)

- Increased focus on cost-cutting measures: Amazon's efforts to streamline operations and reduce expenses have been well-received by investors concerned about profitability. This includes layoffs and a focus on improving efficiency within its vast logistics network.

- Continued growth in AWS: Amazon Web Services remains a significant driver of revenue and profit, showing consistent growth despite economic headwinds. The continued adoption of cloud computing solutions fuels optimism about AWS's long-term prospects. (Link to AWS website)

Factors Influencing AMZN Stock Momentum:

Several factors play crucial roles in shaping Amazon's stock momentum. These include:

- E-commerce market competition: Amazon faces intense competition from other e-commerce giants, influencing its market share and overall growth trajectory. Understanding the competitive landscape and Amazon's strategic responses is vital.

- Inflation and macroeconomic conditions: Global economic uncertainty and inflationary pressures impact consumer spending, directly influencing Amazon's sales and profitability.

- Supply chain challenges: Ongoing disruptions to global supply chains can affect Amazon's ability to deliver products efficiently and on time, impacting customer satisfaction and operational costs.

- Regulatory scrutiny and antitrust concerns: Government regulations and antitrust investigations pose potential challenges for Amazon's future growth and expansion.

H2: Long-Term Outlook and Investment Considerations:

Predicting the future of any stock is inherently challenging, but considering Amazon's diversified business model, its dominant position in e-commerce and cloud computing, and its ongoing innovation, there's reason for both optimism and caution.

Key Considerations for Investors:

- Diversification: Amazon's stock should be considered as part of a well-diversified portfolio. Relying solely on AMZN stock carries significant risk.

- Risk Tolerance: Investing in Amazon involves a degree of risk due to its sensitivity to macroeconomic conditions and competition. Investors should assess their risk tolerance before making any investment decisions.

- Long-Term Perspective: Amazon's long-term growth potential is significant, but short-term volatility is expected. A long-term investment strategy is often recommended.

H2: Conclusion:

Amazon (AMZN) stock presents a compelling case study in the complexities of investing in a large-cap technology company. While its recent performance shows signs of recovery, understanding the various factors influencing its momentum is essential for informed investment decisions. Thorough research, consideration of macroeconomic factors, and a well-defined risk management strategy are crucial for navigating the dynamic landscape of AMZN stock. Consult with a qualified financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Amazon (AMZN) Stock Momentum: A Deep Dive Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Massive Russian Air Attack Strikes Ukraine Overnight Onslaught

May 27, 2025

Massive Russian Air Attack Strikes Ukraine Overnight Onslaught

May 27, 2025 -

Breakthrough In Michael Gaine Case Remains Identified In County Kerry

May 27, 2025

Breakthrough In Michael Gaine Case Remains Identified In County Kerry

May 27, 2025 -

Using Coffee Grounds As Lawn Fertilizer The Ultimate Guide

May 27, 2025

Using Coffee Grounds As Lawn Fertilizer The Ultimate Guide

May 27, 2025 -

Predicting The Winner Sramkova Vs Swiatek French Open Match Preview

May 27, 2025

Predicting The Winner Sramkova Vs Swiatek French Open Match Preview

May 27, 2025 -

Understanding Your Social Security Payments June 2025 Schedule

May 27, 2025

Understanding Your Social Security Payments June 2025 Schedule

May 27, 2025

Latest Posts

-

Ideology And Budget Cuts Fuel Nih Staff Walkout At Directors Meeting

May 28, 2025

Ideology And Budget Cuts Fuel Nih Staff Walkout At Directors Meeting

May 28, 2025 -

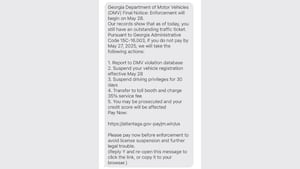

Fake Text Message From Ga Department Of Driver Services Is It A Scam

May 28, 2025

Fake Text Message From Ga Department Of Driver Services Is It A Scam

May 28, 2025 -

Thames Valley Police Man Charged In Crash That Injured Officer

May 28, 2025

Thames Valley Police Man Charged In Crash That Injured Officer

May 28, 2025 -

See Through Style Alexandra Daddarios Daring Dress Choice

May 28, 2025

See Through Style Alexandra Daddarios Daring Dress Choice

May 28, 2025 -

Are Americans Still Welcome In Canada Canadians Weigh In

May 28, 2025

Are Americans Still Welcome In Canada Canadians Weigh In

May 28, 2025