Amazon Investment: Why I'm Not Selling Despite 560% Gains

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Amazon Investment: Why I'm Not Selling Despite 560% Gains

The tech giant Amazon has seen its stock price skyrocket, leaving many investors wondering if it's time to cash out. But for some seasoned investors, like myself, the question isn't if to sell, but why we wouldn't. While I've personally seen a staggering 560% return on my Amazon investment, I'm holding onto my shares – and here's why.

The Allure of Long-Term Growth

My decision to hold onto my Amazon stock isn't based on short-term market fluctuations. Instead, it stems from a deep belief in Amazon's long-term growth potential. The company's dominance in e-commerce, coupled with its aggressive expansion into cloud computing (AWS), advertising, and other promising sectors, paints a compelling picture for continued success. This isn't just about the immediate gains; it's about participating in a company poised to shape the future of commerce and technology.

Amazon's Diversified Revenue Streams:

One of the key reasons for my confidence lies in Amazon's incredibly diversified revenue streams. While e-commerce remains a significant portion of their business, the phenomenal success of Amazon Web Services (AWS) provides a crucial buffer against potential downturns in other areas. AWS's market leadership in cloud computing guarantees a consistent and robust revenue stream, making Amazon less vulnerable to the volatility often seen in other tech companies. This diversification mitigates risk and enhances long-term stability.

Beyond the Numbers: Analyzing Amazon's Strategic Moves

Analyzing Amazon’s strategic moves is crucial to understanding its continued growth. Recent investments in areas like grocery delivery (Whole Foods Market), healthcare initiatives, and advanced technologies like artificial intelligence and robotics showcase Amazon's commitment to innovation and expansion into lucrative new markets. These strategic acquisitions and internal developments provide further justification for my long-term investment strategy. This proactive approach to future markets ensures Amazon remains at the forefront of technological advancement.

The Importance of a Long-Term Investment Strategy

The 560% gain is undeniably impressive, but it’s important to remember that investing is a marathon, not a sprint. My investment strategy emphasizes long-term growth over short-term gains. While taking profits is always a consideration, selling now would mean missing out on potential future growth fueled by Amazon's continuing innovations and market dominance.

Managing Risk and Diversification:

While I'm bullish on Amazon, I also recognize the importance of diversification in any investment portfolio. My investment in Amazon represents a significant but not overwhelming portion of my overall portfolio. This balanced approach helps manage risk and prevents overexposure to any single company, even one as successful as Amazon. Learn more about effective portfolio diversification strategies [link to relevant article/resource].

Conclusion: Holding On for the Ride

Despite the significant gains I've already realized, I remain confident in Amazon's future. The company's diversified revenue streams, strategic expansion, and commitment to innovation make it a compelling long-term investment. While market conditions can always shift, my decision to hold onto my Amazon shares reflects a belief in the company's sustained growth trajectory. This is a personal decision, and thorough research and a well-defined investment strategy are crucial before making any investment choices. Consult with a financial advisor to determine the best course of action for your individual circumstances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Amazon Investment: Why I'm Not Selling Despite 560% Gains. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Public Health Concerns The Spread Of The Screwworm

May 28, 2025

Public Health Concerns The Spread Of The Screwworm

May 28, 2025 -

Residents Fight Back New Housing Approved In Historic Village Lacking Sewage Infrastructure

May 28, 2025

Residents Fight Back New Housing Approved In Historic Village Lacking Sewage Infrastructure

May 28, 2025 -

Analysis Two Sigmas 236 55 Million Stake In Bank Of America Bac

May 28, 2025

Analysis Two Sigmas 236 55 Million Stake In Bank Of America Bac

May 28, 2025 -

American Music Awards 2025 Celebrating The Years Best In Music

May 28, 2025

American Music Awards 2025 Celebrating The Years Best In Music

May 28, 2025 -

Birmingham Capital Management Offloads Bank Of America Shares A Significant Sale

May 28, 2025

Birmingham Capital Management Offloads Bank Of America Shares A Significant Sale

May 28, 2025

Latest Posts

-

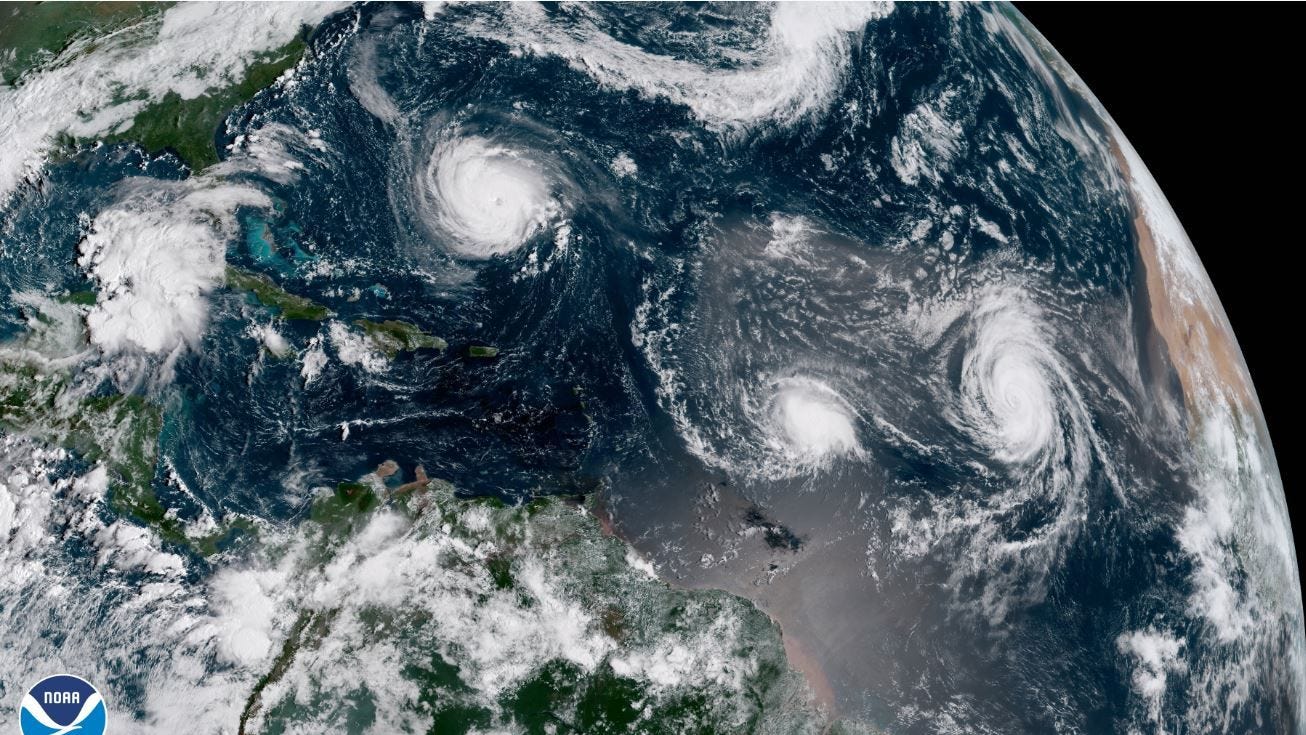

Hurricane Season 2025 Expert Answers To Your Key Questions

May 29, 2025

Hurricane Season 2025 Expert Answers To Your Key Questions

May 29, 2025 -

Kfc Investment Boosts Uk And Ireland Economy With 7 000 New Roles

May 29, 2025

Kfc Investment Boosts Uk And Ireland Economy With 7 000 New Roles

May 29, 2025 -

Tensions Boil Over At Nih Staff Stage Walkout Amidst Research Funding Cuts

May 29, 2025

Tensions Boil Over At Nih Staff Stage Walkout Amidst Research Funding Cuts

May 29, 2025 -

King Charles Canadian Visit A Look At His Impact Amidst Trumps Statehood Claim

May 29, 2025

King Charles Canadian Visit A Look At His Impact Amidst Trumps Statehood Claim

May 29, 2025 -

Canadian Trip Highlights King Charles Influence Trumps Statehood Claim Creates Friction

May 29, 2025

Canadian Trip Highlights King Charles Influence Trumps Statehood Claim Creates Friction

May 29, 2025