Amazon Stock (AMZN): Strong Momentum, But What's Next?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Amazon Stock (AMZN): Strong Momentum, But What's Next?

Amazon (AMZN) has demonstrated impressive resilience and growth in recent months, defying broader economic headwinds and leaving many investors wondering: what's next for this e-commerce and cloud computing giant? The stock has shown significant momentum, but navigating the future requires a careful consideration of several key factors.

Recent Performance and Key Drivers:

Amazon's recent strong performance can be attributed to a number of factors. Firstly, the company's robust cloud computing division, Amazon Web Services (AWS), continues to be a powerhouse, consistently exceeding expectations and driving substantial revenue. AWS's dominance in the cloud market provides a strong foundation for future growth, offering resilience against fluctuations in other sectors.

Secondly, Amazon's e-commerce business, while facing increased competition, remains a significant revenue generator. Strategic initiatives like expanding its advertising business and focusing on logistics and fulfillment continue to improve efficiency and profitability. The growth of Amazon Prime, with its attractive subscription model, further strengthens its competitive edge.

Finally, cost-cutting measures implemented by Amazon have contributed to improved margins, a key factor in bolstering investor confidence. This focus on efficiency demonstrates a proactive approach to managing expenses in a challenging economic environment.

Challenges and Potential Headwinds:

Despite the positive momentum, several challenges loom large. The ongoing inflationary pressures and potential for a recession remain significant risks. Consumer spending, a crucial component of Amazon's e-commerce success, could be negatively impacted by economic uncertainty.

Increased competition from other e-commerce players and the rising costs associated with labor and logistics also pose considerable threats. Maintaining its competitive advantage in a rapidly evolving market will require continuous innovation and strategic adaptation.

Furthermore, regulatory scrutiny and potential antitrust investigations continue to be a concern for Amazon. Navigating the complex regulatory landscape will require careful management and proactive engagement with regulatory bodies.

What to Expect in the Near Future:

Predicting the future of any stock is inherently challenging, but several factors suggest potential future trajectories for AMZN. Continued growth in AWS is likely to be a significant driver of overall performance. The success of Amazon's strategic initiatives, such as its expansion into advertising and its focus on logistics optimization, will also play a crucial role.

Investor sentiment will remain heavily influenced by macroeconomic conditions. A potential recession could negatively impact consumer spending and, consequently, Amazon's e-commerce business. Conversely, a period of economic stability or growth could significantly boost the company's performance.

Analyzing the AMZN Stock:

Before making any investment decisions, it's crucial to conduct thorough due diligence. Consider consulting with a financial advisor to assess your risk tolerance and investment goals. Analyzing financial statements, reviewing industry reports, and staying informed about market trends are essential steps in making informed investment choices. Remember, past performance is not necessarily indicative of future results.

Conclusion:

Amazon's stock (AMZN) presents a compelling case study in navigating a dynamic and challenging market. While current momentum is strong, investors should remain aware of the potential headwinds and carefully assess the risks before making any investment decisions. The future of AMZN will depend on its ability to adapt to evolving market conditions, maintain its competitive edge, and effectively manage various challenges. Staying informed about company news, financial performance, and macroeconomic trends is essential for navigating the complexities of this significant tech investment.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risks, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Amazon Stock (AMZN): Strong Momentum, But What's Next?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mountaineers Conquer Everest In Under A Week Raising Ethical Concerns

May 28, 2025

Mountaineers Conquer Everest In Under A Week Raising Ethical Concerns

May 28, 2025 -

Hs 2 Staff Supply West Midlands Contracts Under Review

May 28, 2025

Hs 2 Staff Supply West Midlands Contracts Under Review

May 28, 2025 -

North Koreas Failed Warship Launch Leads To High Ranking Arrest

May 28, 2025

North Koreas Failed Warship Launch Leads To High Ranking Arrest

May 28, 2025 -

Hs 2 Staffing Investigation Launched Into West Midlands Suppliers

May 28, 2025

Hs 2 Staffing Investigation Launched Into West Midlands Suppliers

May 28, 2025 -

Brigitte Macron Shove Video Macrons Official Response And Public Reaction

May 28, 2025

Brigitte Macron Shove Video Macrons Official Response And Public Reaction

May 28, 2025

Latest Posts

-

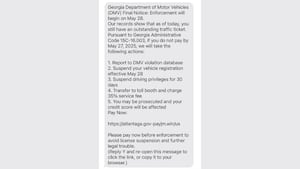

Georgia Dds Scam Text What To Do If You Received It

May 29, 2025

Georgia Dds Scam Text What To Do If You Received It

May 29, 2025 -

Royal Tour And Political Controversy King Charles In Canada As Trump Pushes For Statehood

May 29, 2025

Royal Tour And Political Controversy King Charles In Canada As Trump Pushes For Statehood

May 29, 2025 -

Trumps Harvard Outburst A Deeper Dive Into The Maga Fundraising Controversy

May 29, 2025

Trumps Harvard Outburst A Deeper Dive Into The Maga Fundraising Controversy

May 29, 2025 -

Unlocking Value 2025 Memorial Tournament Sleeper Picks And Odds

May 29, 2025

Unlocking Value 2025 Memorial Tournament Sleeper Picks And Odds

May 29, 2025 -

Local Authorities Fight Back Against Rising Georgia Dmv Imposter Scams

May 29, 2025

Local Authorities Fight Back Against Rising Georgia Dmv Imposter Scams

May 29, 2025