Amazon's (AMZN) Stock Momentum: Risks And Rewards For Investors.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Amazon's (AMZN) Stock Momentum: Risks and Rewards for Investors

Amazon (AMZN) has been a juggernaut of the tech world for years, but its stock performance has shown increased volatility recently. For investors, this means a crucial question: is now the time to buy, sell, or hold? Understanding the inherent risks and potential rewards is key to navigating this complex investment landscape.

Amazon's Recent Performance: A Rollercoaster Ride

Amazon's stock price has experienced significant fluctuations in the past year, reflecting a broader market uncertainty and company-specific challenges. While its cloud computing arm, Amazon Web Services (AWS), continues to be a powerhouse, generating substantial revenue, other segments face headwinds. The e-commerce giant has struggled with increased competition, rising inflation, and shifting consumer spending habits. This has led to periods of both impressive growth and concerning dips, leaving many investors wondering about the future.

The Allure of Amazon: Why Investors Still Eye AMZN

Despite the challenges, several factors continue to make Amazon an attractive investment for many:

- Dominant Market Position: Amazon maintains a commanding presence in e-commerce, cloud computing, and digital advertising. This dominance translates to significant revenue streams and strong brand recognition.

- AWS's Continued Growth: Amazon Web Services remains a key driver of profitability, consistently outperforming expectations and showcasing the company's technological prowess. Its expansion into new markets and services further solidifies its position as a market leader.

- Long-Term Growth Potential: Amazon's vast ecosystem, encompassing everything from e-commerce and logistics to entertainment and healthcare, offers significant long-term growth potential. New initiatives and strategic acquisitions continually broaden its reach.

- Innovation and Diversification: Amazon consistently invests in research and development, exploring new technologies and markets. This diversification mitigates risk and opens doors to future revenue streams.

Navigating the Risks: What Could Go Wrong?

However, potential investors need to be aware of the significant risks associated with investing in Amazon:

- Increased Competition: The e-commerce landscape is increasingly competitive, with companies like Walmart and Shopify aggressively vying for market share. Maintaining its dominant position will require continuous innovation and strategic maneuvering.

- Economic Uncertainty: Macroeconomic factors, including inflation and potential recessions, can significantly impact consumer spending and, consequently, Amazon's revenue.

- Regulatory Scrutiny: Amazon faces increasing regulatory scrutiny regarding antitrust concerns and labor practices. Negative regulatory outcomes could impact its operations and profitability.

- Dependence on AWS: While AWS is a strength, over-reliance on a single segment can expose the company to greater risk if that segment experiences a downturn.

Making Informed Investment Decisions: The Bottom Line

Amazon's stock presents a compelling case for long-term investors, particularly those with a high risk tolerance. The potential rewards are considerable, driven by its dominant market positions and innovative spirit. However, the inherent risks, including increased competition and economic uncertainty, must be carefully considered. Before investing in AMZN, conduct thorough due diligence, consult with a financial advisor, and develop a well-defined investment strategy aligned with your risk profile and financial goals. Remember that past performance is not indicative of future results. Staying informed about Amazon's financial performance and industry trends is crucial for making informed investment decisions.

Further Reading:

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Amazon's (AMZN) Stock Momentum: Risks And Rewards For Investors.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Could Ai Be Conscious Exploring The Potential For Sentience

May 28, 2025

Could Ai Be Conscious Exploring The Potential For Sentience

May 28, 2025 -

Reduced Funding Cripples Federal Black Lung Disease Prevention Program

May 28, 2025

Reduced Funding Cripples Federal Black Lung Disease Prevention Program

May 28, 2025 -

Financial Avengers Portfolio Bank Of America Ranks Among Top 8 Holdings

May 28, 2025

Financial Avengers Portfolio Bank Of America Ranks Among Top 8 Holdings

May 28, 2025 -

Chinese Chemical Plant Explosion Casualties Reported Rescue Operation Launched

May 28, 2025

Chinese Chemical Plant Explosion Casualties Reported Rescue Operation Launched

May 28, 2025 -

Social Security Benefits Facing 15 Cuts In June 2025 Heres What To Expect

May 28, 2025

Social Security Benefits Facing 15 Cuts In June 2025 Heres What To Expect

May 28, 2025

Latest Posts

-

Sbet Stock Soars 1000 Unpacking The Reasons

May 30, 2025

Sbet Stock Soars 1000 Unpacking The Reasons

May 30, 2025 -

Day 4 Results Former Junior Athletes Outstanding Performances

May 30, 2025

Day 4 Results Former Junior Athletes Outstanding Performances

May 30, 2025 -

Althea Gibson To Be Honored In Special Us Open 2025 Theme

May 30, 2025

Althea Gibson To Be Honored In Special Us Open 2025 Theme

May 30, 2025 -

Officials Report Setbacks In Newark Airport Air Traffic Control Improvements

May 30, 2025

Officials Report Setbacks In Newark Airport Air Traffic Control Improvements

May 30, 2025 -

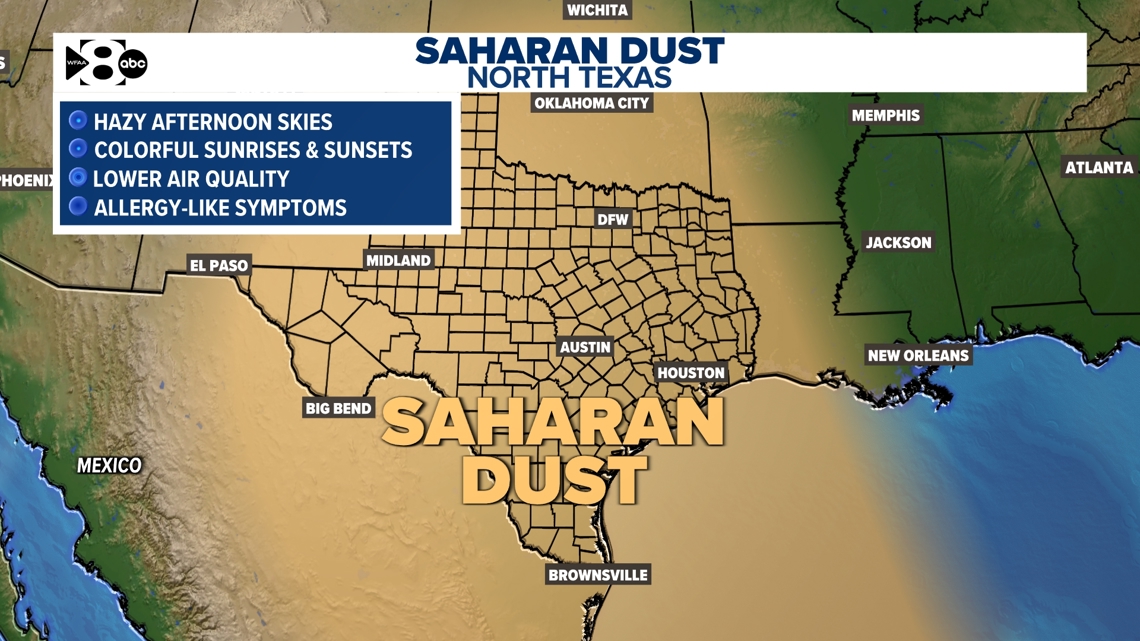

Saharan Dust In North Texas Air Quality And Health Concerns

May 30, 2025

Saharan Dust In North Texas Air Quality And Health Concerns

May 30, 2025