Analysis: Air Canada's $500 Million Share Buyback And Its Impact On Stock Price

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: Air Canada's $500 Million Share Buyback and its Impact on Stock Price

Air Canada's recent announcement of a $500 million share buyback program has sent ripples through the financial markets, sparking considerable debate among investors and analysts. This strategic move signifies the airline's confidence in its future prospects and its belief that its stock is currently undervalued. But what does this mean for Air Canada's stock price, and is this a shrewd move or a risky gamble? This analysis delves into the potential impacts of this significant buyback.

Understanding Air Canada's Share Buyback

Share buybacks, also known as stock repurchases, involve a company buying back its own shares from the open market. This reduces the number of outstanding shares, thereby increasing the earnings per share (EPS) for remaining shareholders. For Air Canada, this $500 million investment represents a substantial commitment, potentially boosting shareholder value. The timing, however, is crucial, given the ongoing volatility in the airline industry.

Potential Positive Impacts on Stock Price:

- Increased Earnings Per Share (EPS): As mentioned, reducing the number of outstanding shares directly increases EPS, making the company appear more profitable on a per-share basis. This can attract investors and drive up the stock price.

- Signal of Confidence: A large share buyback program often signals that the company's management believes its stock is undervalued and represents a good investment opportunity. This confidence can be contagious, influencing other investors to buy shares.

- Return of Capital to Shareholders: Instead of reinvesting profits into new projects or initiatives (which carry inherent risks), Air Canada is returning capital directly to its shareholders. This can be seen as a positive sign, particularly for investors seeking dividends or capital appreciation.

- Reduced Float: A lower number of outstanding shares can make the stock more attractive to institutional investors who may find it easier to manage their positions with a smaller float.

Potential Risks and Considerations:

- Opportunity Cost: The $500 million could have been invested in other growth opportunities, such as fleet modernization, route expansion, or technological upgrades. This missed opportunity cost needs careful consideration.

- Market Volatility: The airline industry is notoriously volatile, susceptible to economic downturns, fuel price fluctuations, and geopolitical events. A share buyback during periods of uncertainty can be a risky strategy.

- Timing of the Buyback: The success of a share buyback depends heavily on the timing. Buying back shares at a relatively high price point can be detrimental to shareholder value.

Analyst Opinions and Market Reaction:

Initial market reaction to the announcement was mixed. While some analysts lauded the move as a sign of confidence and a smart use of capital, others expressed concerns about the potential opportunity cost and the risks associated with the current market conditions. Many analysts will be closely monitoring Air Canada's performance in the coming quarters to assess the effectiveness of the buyback program. [Link to relevant financial news article analyzing analyst opinions].

Conclusion:

Air Canada's $500 million share buyback is a significant strategic move with both potential benefits and risks. Whether it proves to be a successful strategy in boosting the stock price remains to be seen. The effectiveness will hinge on factors such as the timing of the buybacks, the overall market performance, and Air Canada's future financial performance. Investors should continue to monitor the situation and consider the broader economic landscape before making any investment decisions based on this news. Further analysis and updates will be provided as the buyback program unfolds.

Keywords: Air Canada, share buyback, stock repurchase, stock price, EPS, earnings per share, investor confidence, market volatility, airline industry, financial analysis, investment strategy, stock market, Canadian stocks.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Air Canada's $500 Million Share Buyback And Its Impact On Stock Price. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nba Draft 2023 Le Brons Take On The Mavericks Selection Of Ausar Thompson

Jun 26, 2025

Nba Draft 2023 Le Brons Take On The Mavericks Selection Of Ausar Thompson

Jun 26, 2025 -

Gangs And Police Kill Venezuelan Tik Tok Influencer During Live Stream Following Corruption Accusations

Jun 26, 2025

Gangs And Police Kill Venezuelan Tik Tok Influencer During Live Stream Following Corruption Accusations

Jun 26, 2025 -

Concert Review The Weeknd Delivers Two Powerful Performances In Santa Clara

Jun 26, 2025

Concert Review The Weeknd Delivers Two Powerful Performances In Santa Clara

Jun 26, 2025 -

Island Drama Kaylor And Ja Na Clash With Other Islanders In Beyond The Villa

Jun 26, 2025

Island Drama Kaylor And Ja Na Clash With Other Islanders In Beyond The Villa

Jun 26, 2025 -

Vaccine Panel Controversy Kennedy Addresses Cassidys Accusation Of Deception

Jun 26, 2025

Vaccine Panel Controversy Kennedy Addresses Cassidys Accusation Of Deception

Jun 26, 2025

Latest Posts

-

Iran Crisis Trump Confirms Putin Offered Help According To Cnn

Jun 26, 2025

Iran Crisis Trump Confirms Putin Offered Help According To Cnn

Jun 26, 2025 -

Cnn On Iran Pro Government Demonstrators Reject Ceasefire As Solution

Jun 26, 2025

Cnn On Iran Pro Government Demonstrators Reject Ceasefire As Solution

Jun 26, 2025 -

Historic Night The Weeknds Empower Field Performance In Pictures

Jun 26, 2025

Historic Night The Weeknds Empower Field Performance In Pictures

Jun 26, 2025 -

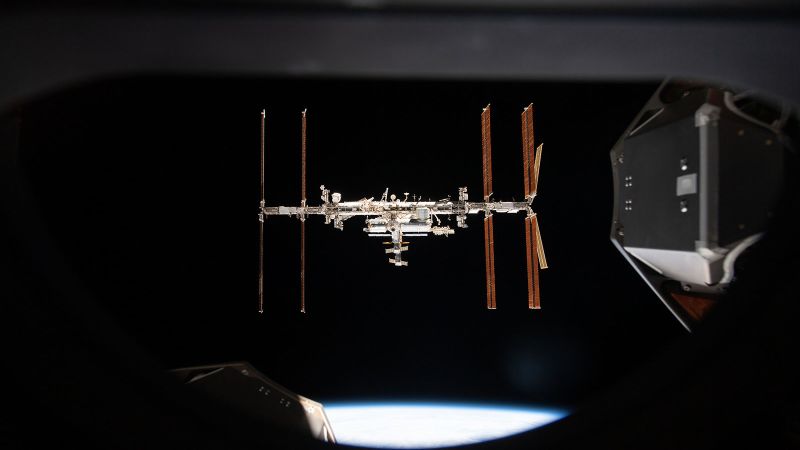

Four Astronauts Embark On Iss Mission As Nasa Battles Unidentified Leak

Jun 26, 2025

Four Astronauts Embark On Iss Mission As Nasa Battles Unidentified Leak

Jun 26, 2025 -

Exclusive Us Military Action In Iran Failed To Damage Nuclear Facilities

Jun 26, 2025

Exclusive Us Military Action In Iran Failed To Damage Nuclear Facilities

Jun 26, 2025