Analysis: April's Government Borrowing Figures Exceed Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: April's Government Borrowing Figures Exceed Expectations

Government borrowing in April soared past forecasts, sparking concerns about the UK's public finances. The figures, released by the Office for National Statistics (ONS) earlier this week, paint a concerning picture of the nation's economic health and raise questions about the government's fiscal strategy. This unexpected surge has sent ripples through financial markets and ignited a debate about the effectiveness of current economic policies.

April's Shocking Numbers: A Deeper Dive

The ONS reported that government borrowing in April reached £22.7 billion, significantly exceeding the £18 billion predicted by economists. This represents a considerable increase compared to April 2022, when borrowing stood at £12.3 billion. This substantial overshoot is attributed to a combination of factors, including lower-than-expected tax revenues and increased government spending. The combination of these factors is a troubling sign, particularly given the current inflationary pressures and cost-of-living crisis gripping the nation.

Key Factors Contributing to the Increased Borrowing

Several key factors contributed to this unexpected surge in government borrowing. Firstly, inflation continues to erode the real value of tax revenues, impacting the government's income stream. Secondly, increased government spending, driven largely by continued support for energy bills and rising social security payments amidst the cost-of-living crisis, further exacerbated the situation. Finally, the sluggish growth of the UK economy has limited the government's ability to increase tax revenues through economic expansion.

- Lower Tax Revenues: Inflation is eroding the purchasing power of the pound, leading to a decrease in the real value of tax revenues collected.

- Increased Social Security Payments: The cost of living crisis has increased the demand for social welfare programs, leading to higher government spending in this area.

- High Energy Bill Support: Government initiatives to help households cope with high energy prices have added significant costs to the public purse.

Market Reactions and Expert Opinions

The release of these figures sent shockwaves through financial markets, leading to a decline in the value of the pound against other major currencies. Many economists have expressed concern about the long-term implications of this high level of borrowing, particularly in light of the ongoing inflationary pressures. Some analysts suggest that the government needs to implement further austerity measures to control spending and reduce the national debt, while others advocate for increased investment in infrastructure and other growth-stimulating projects. This divergence in opinion highlights the complexity of the economic challenges facing the UK government.

What Lies Ahead for the UK Economy?

The unexpectedly high borrowing figures raise significant questions about the government's ability to manage the UK's public finances effectively. While the government has outlined plans to reduce the national debt over the medium term, the April figures cast doubt on the feasibility of these plans. The path forward will require careful consideration of various economic levers, including potential tax increases, spending cuts, and economic growth strategies. Further analysis and detailed government responses are crucial to navigating this challenging economic landscape.

For further insights into the UK economy, you may find these resources helpful:

- (Replace with actual link)

- (Replace with actual link)

This situation underscores the need for continuous monitoring of the UK's economic performance and necessitates a proactive approach from policymakers to address these significant challenges. The coming months will be critical in observing the government's response and its effectiveness in controlling public borrowing and stabilizing the economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: April's Government Borrowing Figures Exceed Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

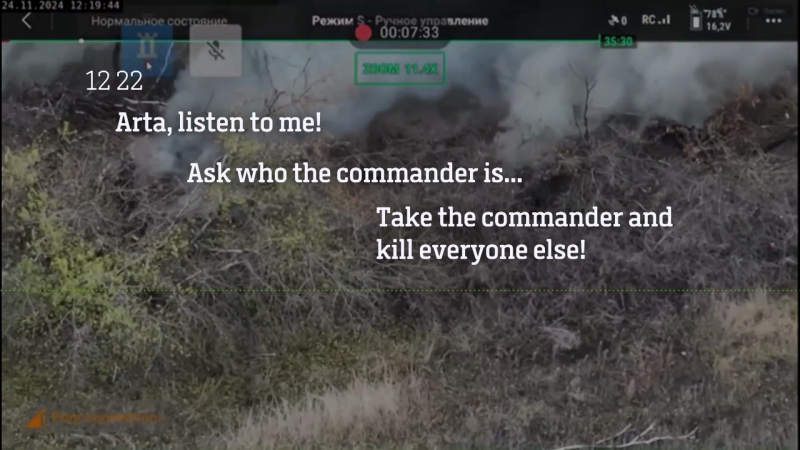

New Revelations Intercepted Radio Shows Callous Russian Order To Massacre Civilians

May 23, 2025

New Revelations Intercepted Radio Shows Callous Russian Order To Massacre Civilians

May 23, 2025 -

Censorship Concerns South Parks Move And The Potential For Episode Removal

May 23, 2025

Censorship Concerns South Parks Move And The Potential For Episode Removal

May 23, 2025 -

Mastering I Os 18 5 My Top 6 Regularly Used Intelligence Features

May 23, 2025

Mastering I Os 18 5 My Top 6 Regularly Used Intelligence Features

May 23, 2025 -

The Search For A Left Wing Media Powerhouse Democrats 2024 Aftermath

May 23, 2025

The Search For A Left Wing Media Powerhouse Democrats 2024 Aftermath

May 23, 2025 -

Chagos Islands Transfer Uk Plan Stalled By Legal Action

May 23, 2025

Chagos Islands Transfer Uk Plan Stalled By Legal Action

May 23, 2025

Latest Posts

-

New Era In Publishing Melania Trumps Voice Powered By Ai

May 24, 2025

New Era In Publishing Melania Trumps Voice Powered By Ai

May 24, 2025 -

Robert Pattinson And Bong Joon Ho Reunite Details On Their Upcoming Film

May 24, 2025

Robert Pattinson And Bong Joon Ho Reunite Details On Their Upcoming Film

May 24, 2025 -

Todays Wordle Answer May 22 1433 Hints To Help You Solve

May 24, 2025

Todays Wordle Answer May 22 1433 Hints To Help You Solve

May 24, 2025 -

Updated Italian Citizenship Law Eligibility Via Great Grandparents Explained

May 24, 2025

Updated Italian Citizenship Law Eligibility Via Great Grandparents Explained

May 24, 2025 -

Violent Criminal Early Release Plan Under Review Public Outcry Expected

May 24, 2025

Violent Criminal Early Release Plan Under Review Public Outcry Expected

May 24, 2025