Analysis: Government Borrowing Higher Than Expected In April

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: Government Borrowing Higher Than Expected in April – A Worrying Trend?

Government borrowing surged unexpectedly in April, raising concerns about the UK's fiscal health and sparking debate amongst economists. The figures, released by the Office for National Statistics (ONS), revealed a significantly larger deficit than predicted, prompting questions about the government's spending plans and the potential impact on the economy. This unexpected increase is a key development that requires careful scrutiny.

This article delves into the details of the April borrowing figures, analyzing the contributing factors and exploring the potential consequences for the UK's financial stability and future economic outlook.

Higher Than Expected Borrowing: The Key Figures

The ONS reported that public sector net borrowing – the difference between government spending and revenue – reached £22.9 billion in April. This figure significantly exceeds the £18 billion forecast by economists and represents a substantial increase compared to April 2022. The unexpected rise is largely attributed to higher-than-anticipated government spending coupled with lower-than-expected tax revenues.

- Increased Spending: Government spending on areas like social welfare programs and public services likely contributed significantly to the increased borrowing. Details on specific areas of increased expenditure are crucial for a full understanding of the situation and will be analyzed further as more data becomes available.

- Lower Tax Revenue: Lower-than-expected tax receipts may also have played a significant role. Factors such as inflation impacting consumer spending and potential tax avoidance could be contributing factors to this decrease. A deeper dive into the tax revenue data is necessary to pinpoint the exact reasons.

What Does This Mean for the UK Economy?

The higher-than-expected borrowing figures have raised concerns amongst experts. This development could potentially:

- Increase National Debt: Persistent high levels of borrowing contribute to the accumulation of national debt, increasing the burden on future generations and potentially impacting the UK's credit rating.

- Impact Interest Rates: Higher government borrowing could put upward pressure on interest rates, potentially impacting mortgage rates and borrowing costs for businesses and consumers.

- Restrict Government Spending: The government may need to reassess its spending plans and potentially implement austerity measures to manage the rising debt levels. This could lead to cuts in public services.

Expert Opinions and Future Outlook

Economists are divided on the long-term implications. Some believe this is a temporary blip caused by external factors, while others warn of a potentially more serious trend reflecting underlying economic weaknesses. The government's response and any subsequent policy changes will be crucial in shaping the future economic outlook. Further analysis of economic indicators and government responses will be essential to form a clearer picture.

The upcoming budget will be keenly observed for any policy adjustments the government might implement in response to this concerning development.

Calls for Transparency and Accountability

Increased transparency surrounding government spending and revenue is crucial for building public trust and informing future fiscal policy decisions. Regular updates and detailed breakdowns of the government's finances are essential for holding the government accountable for its spending commitments. Citizens have a right to understand how their tax contributions are being allocated.

This unexpected surge in government borrowing warrants close monitoring. The situation necessitates further detailed analysis to fully comprehend the implications and develop effective strategies for addressing the growing fiscal challenges. We will continue to update this article as more information becomes available. Stay informed and check back for further analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Government Borrowing Higher Than Expected In April. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Townsends Road To Recovery Following Concussion Incident

May 23, 2025

Townsends Road To Recovery Following Concussion Incident

May 23, 2025 -

Paramount Lands South Park The Future Of The Shows Streaming Availability

May 23, 2025

Paramount Lands South Park The Future Of The Shows Streaming Availability

May 23, 2025 -

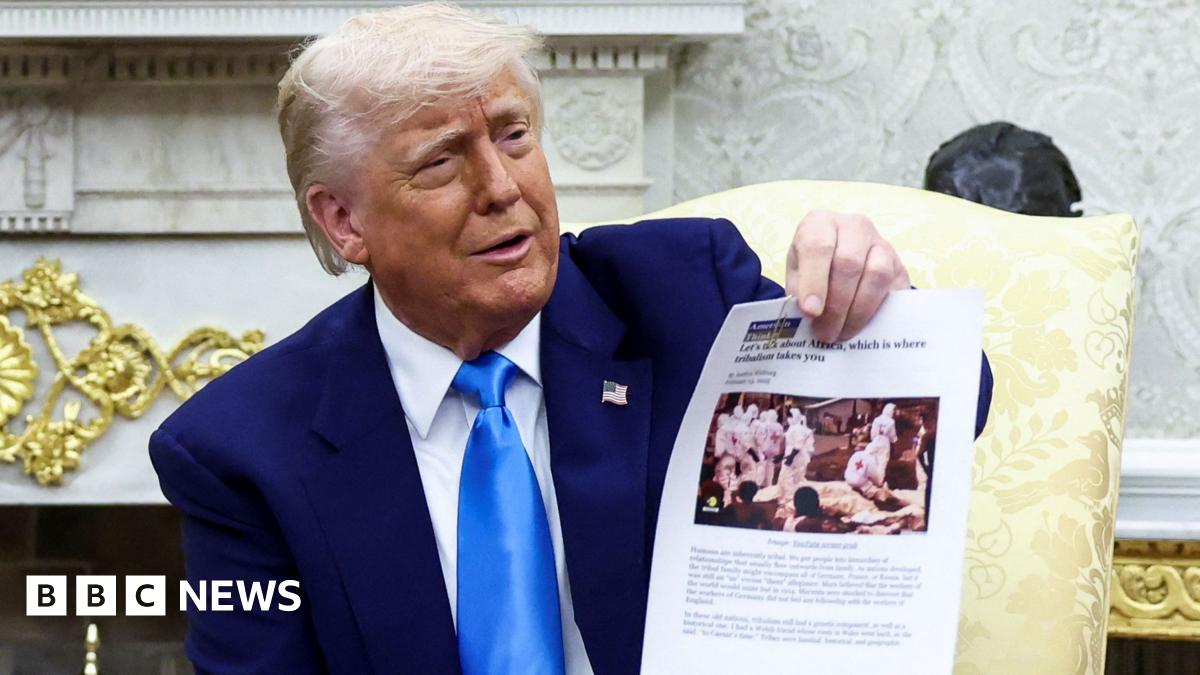

Trumps Onslaught Ramaphosa Remains Unfazed

May 23, 2025

Trumps Onslaught Ramaphosa Remains Unfazed

May 23, 2025 -

Melania Trumps Ai Assisted Memoir A New Chapter In Presidential Literature

May 23, 2025

Melania Trumps Ai Assisted Memoir A New Chapter In Presidential Literature

May 23, 2025 -

Fda Expands Warning On Rare Heart Inflammation Risk For Covid 19 Vaccines

May 23, 2025

Fda Expands Warning On Rare Heart Inflammation Risk For Covid 19 Vaccines

May 23, 2025

Latest Posts

-

Advocates Demand Enhanced Breast Cancer Screening For Women With Dense Breasts Via Nhs

May 23, 2025

Advocates Demand Enhanced Breast Cancer Screening For Women With Dense Breasts Via Nhs

May 23, 2025 -

Chagos Islands Deal Halted Legal Challenge Delays Decolonization

May 23, 2025

Chagos Islands Deal Halted Legal Challenge Delays Decolonization

May 23, 2025 -

Is Paramount Censoring South Park Fans React By Buying Dvds

May 23, 2025

Is Paramount Censoring South Park Fans React By Buying Dvds

May 23, 2025 -

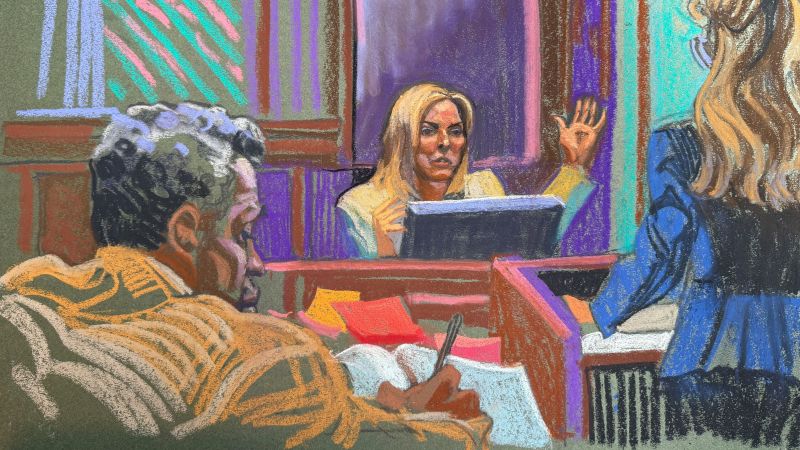

Cassie Venturas Abuse Allegations Expert Testimony In Diddys Trial

May 23, 2025

Cassie Venturas Abuse Allegations Expert Testimony In Diddys Trial

May 23, 2025 -

New Plans Could Free Violent Criminals Early For Good Behavior

May 23, 2025

New Plans Could Free Violent Criminals Early For Good Behavior

May 23, 2025