Analysis: Jon Stewart's Take On Trump's "Big, Beautiful Bill" And Its Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: Jon Stewart's Take on Trump's "Big, Beautiful Bill" and its Impact

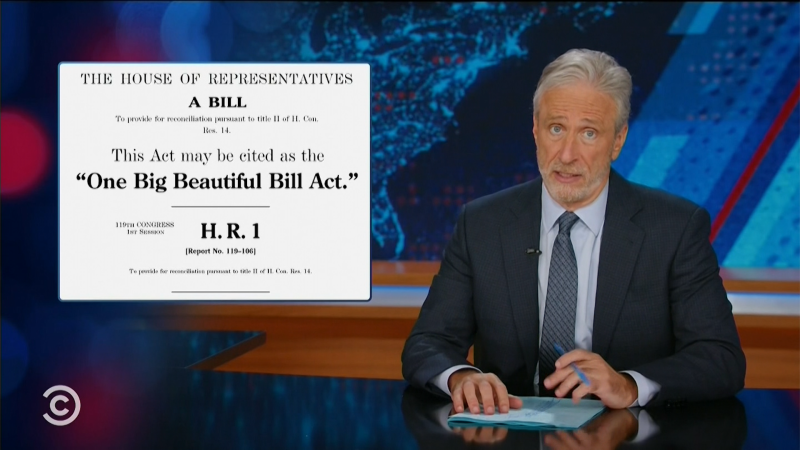

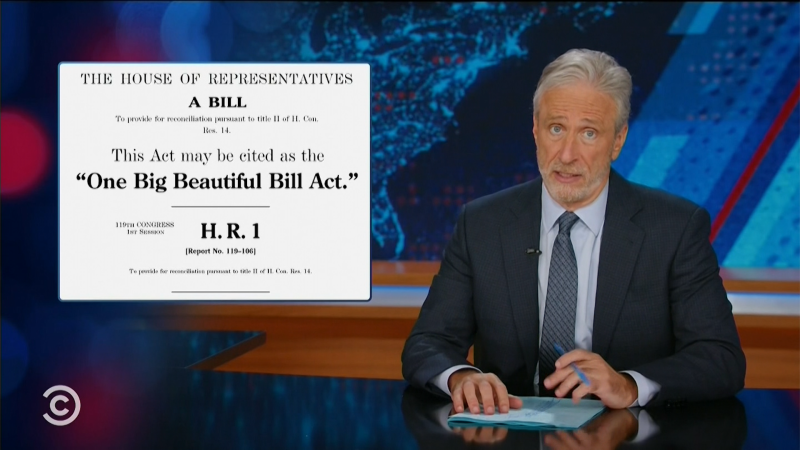

Jon Stewart, the sharp-tongued comedian and political commentator, rarely shies away from dissecting complex political issues with his signature blend of humor and incisive analysis. His recent commentary on Donald Trump's often-referenced "big, beautiful bill" – referring primarily to the 2017 Tax Cuts and Jobs Act – provides a compelling lens through which to examine the legislation's lasting impact. While the bill’s proponents touted economic growth, Stewart's critique highlighted potential long-term consequences often overlooked in the initial fanfare. This analysis delves into Stewart's perspective and examines the actual effects of the tax cuts.

Stewart's Critique: Beyond the Headlines

Stewart's criticism wasn't simply a partisan attack. Instead, he focused on the inherent contradictions and potential pitfalls of the legislation, pointing out the discrepancies between promised economic benefits and the reality on the ground. He cleverly exposed the narrative surrounding the bill, highlighting how the focus on immediate tax breaks overshadowed the potential for long-term economic instability. His comedic timing allowed him to deliver serious criticisms in a digestible and engaging format, reaching a broader audience than traditional political analysis might. Many viewers found his commentary more accessible and relatable than dense policy papers.

Many of Stewart's points resonated with those concerned about increasing national debt and the disproportionate benefits accruing to the wealthy. His analysis wasn't just about the numbers; it was about the narrative surrounding the bill and its impact on everyday Americans. He effectively challenged the celebratory rhetoric that often accompanied the bill's passage.

The 2017 Tax Cuts and Jobs Act: A Retrospective

The Tax Cuts and Jobs Act of 2017 significantly lowered corporate and individual income tax rates. Proponents argued that this would stimulate economic growth through increased investment and job creation. However, the long-term effects have been a subject of ongoing debate amongst economists.

Key Provisions and Claimed Impacts:

- Corporate Tax Rate Reduction: The corporate tax rate was slashed from 35% to 21%, a measure touted to boost corporate profits and investment.

- Individual Tax Rate Reductions: Individual income tax rates were also lowered across the board, with significant reductions for higher-income earners.

- Standard Deduction Increase: The standard deduction was significantly increased, benefiting many middle- and lower-income taxpayers.

Criticisms and Actual Outcomes:

- Increased National Debt: Critics argued, and subsequent data largely supports, the claim that the tax cuts dramatically increased the national debt without generating commensurate economic growth. [Link to relevant government data on national debt].

- Inequality Concerns: The disproportionate benefits to high-income earners fueled concerns about increased income inequality. [Link to study on income inequality post-2017 tax cuts].

- Limited Job Growth: While some job growth occurred, it's difficult to definitively attribute this solely to the tax cuts, and the projected economic boom failed to materialize to the extent promised.

The Lasting Legacy: Stewart's Point Proven?

Jon Stewart's commentary, while delivered with his trademark humor, served as a prescient warning about the potential downsides of the 2017 tax cuts. While it’s impossible to definitively say his analysis was entirely predictive, many of his concerns – particularly regarding the national debt and the unequal distribution of benefits – have been borne out by subsequent economic data. His ability to cut through the political noise and present a clear, concise critique of the bill's impact remains a significant contribution to the ongoing discussion surrounding its legacy.

Ultimately, Stewart's take on Trump's "big, beautiful bill" serves as a reminder of the importance of critical analysis and long-term perspective when evaluating complex economic legislation. It highlights the need to look beyond the immediate headlines and consider the broader social and economic consequences of such policies. Further research and continued debate are crucial to fully understand the long-term implications of the 2017 Tax Cuts and Jobs Act.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Jon Stewart's Take On Trump's "Big, Beautiful Bill" And Its Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

How To Watch Jannik Sinner Vs Ben Shelton Wimbledon Quarterfinal Online

Jul 10, 2025

How To Watch Jannik Sinner Vs Ben Shelton Wimbledon Quarterfinal Online

Jul 10, 2025 -

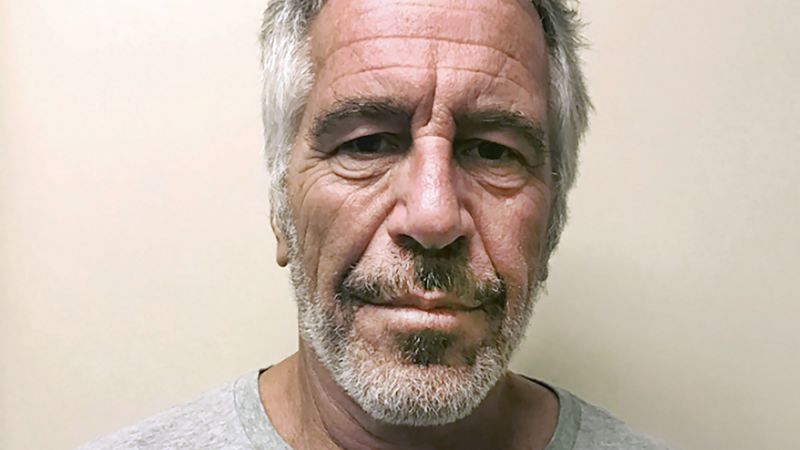

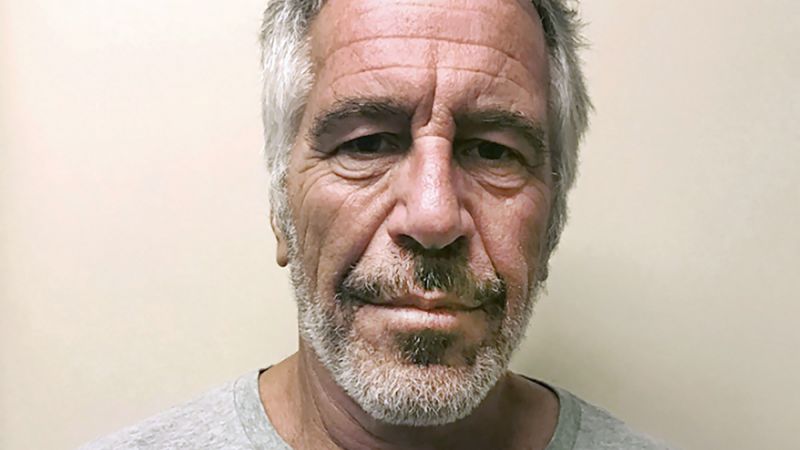

No Client List Suicide Confirmed The Jeffrey Epstein Case Officially Closed By Doj

Jul 10, 2025

No Client List Suicide Confirmed The Jeffrey Epstein Case Officially Closed By Doj

Jul 10, 2025 -

Official Confirmation Jeffrey Epstein Died By Suicide No Client List Exists

Jul 10, 2025

Official Confirmation Jeffrey Epstein Died By Suicide No Client List Exists

Jul 10, 2025 -

Van Der Poel Vs Pogacar Deciphering The Tour De Frances Yellow Jersey Allocation

Jul 10, 2025

Van Der Poel Vs Pogacar Deciphering The Tour De Frances Yellow Jersey Allocation

Jul 10, 2025 -

Space X Starlink Mission 28 Satellites Launching Live From Florida

Jul 10, 2025

Space X Starlink Mission 28 Satellites Launching Live From Florida

Jul 10, 2025

Latest Posts

-

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025 -

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

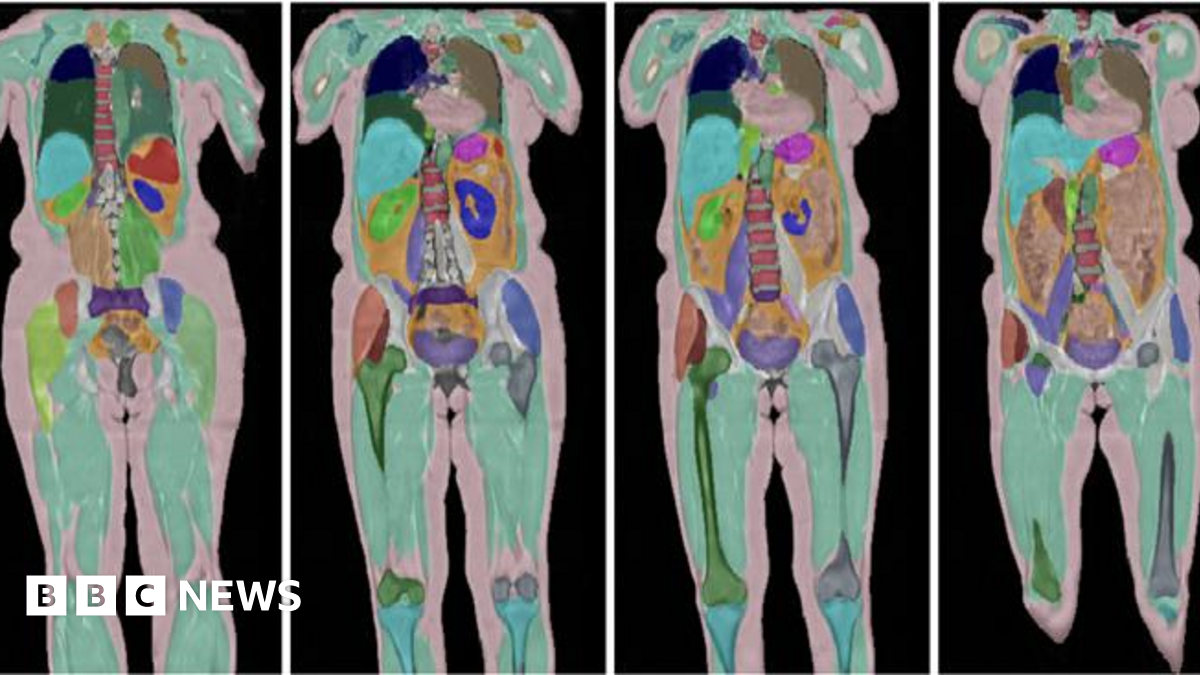

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025