Analysis Of Financial Avengers Inc.'s Portfolio: Focus On Bank Of America's Role

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis of Financial Avengers Inc.'s Portfolio: A Deep Dive into Bank of America's Influence

Financial Avengers Inc. (FAI), a prominent investment firm known for its aggressive yet shrewd strategies, has once again captured the attention of market analysts. This time, the focus is on the significant role Bank of America (BAC) plays within FAI's meticulously crafted portfolio. This in-depth analysis explores FAI's investment in BAC, examining its implications for both the firm and the broader financial landscape.

FAI's Strategic Investment in Bank of America:

FAI's stake in Bank of America is not insignificant. Reports suggest a substantial holding, representing a considerable portion of their overall portfolio. This strategic move raises several key questions: Why Bank of America? What are the anticipated returns? And what risks are involved?

To understand FAI's decision, we must consider Bank of America's current market position. BAC is a financial behemoth, a systemically important bank with a vast network and diverse range of services, including:

- Retail Banking: Serving millions of individual customers across the United States.

- Investment Banking: A major player in mergers and acquisitions, underwriting, and trading.

- Wealth Management: Managing substantial assets for high-net-worth individuals and institutions.

- Global Markets: Operating in various international markets, exposing them to diverse economic conditions.

These diverse revenue streams provide a degree of resilience, making BAC an attractive investment even amidst market volatility. However, it's crucial to acknowledge the inherent risks associated with such a large financial institution. Regulatory changes, economic downturns, and cybersecurity threats all pose potential challenges.

Analyzing the Risk-Reward Profile:

FAI's investment likely reflects a calculated risk-reward assessment. The potential for significant returns from BAC's growth is undeniable, especially considering its ongoing digital transformation and expansion into new financial technologies. However, the potential downsides necessitate a thorough examination.

The Macroeconomic Context:

The current macroeconomic environment plays a critical role in assessing the success of FAI's strategy. Rising interest rates, inflation, and geopolitical uncertainty all impact the performance of financial institutions like Bank of America. FAI's decision likely factored in these macroeconomic factors, suggesting a long-term perspective rather than short-term gains.

Expert Opinions and Future Outlook:

Several financial analysts have weighed in on FAI's move, with opinions varying. Some applaud the strategic foresight, highlighting the long-term potential of BAC. Others express caution, emphasizing the inherent risks associated with such a significant investment in a single entity. The future performance of FAI's portfolio, and consequently their investment in Bank of America, will be largely dependent on macroeconomic conditions and BAC's ability to navigate the evolving financial landscape. The coming months will be crucial in determining the success of this bold strategy.

Conclusion:

FAI's investment in Bank of America is a complex and multifaceted decision. It's a high-stakes gamble with potentially significant rewards, but it also carries substantial risk. The success of this strategy will be closely watched by market analysts and investors alike, offering valuable insights into future investment trends in the financial sector. Further analysis will be needed to fully understand the long-term implications of this strategic move. Stay tuned for future updates and deeper dives into FAI’s portfolio holdings.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis Of Financial Avengers Inc.'s Portfolio: Focus On Bank Of America's Role. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Important Social Security News Expect Checks Up To 5 108 This Week

May 27, 2025

Important Social Security News Expect Checks Up To 5 108 This Week

May 27, 2025 -

Beach Town Chaos 73 Arrests Following Memorial Day Weekend Stabbings

May 27, 2025

Beach Town Chaos 73 Arrests Following Memorial Day Weekend Stabbings

May 27, 2025 -

Apple Ends Support For I Os 18 4 1 Downgrade Restrictions Explained

May 27, 2025

Apple Ends Support For I Os 18 4 1 Downgrade Restrictions Explained

May 27, 2025 -

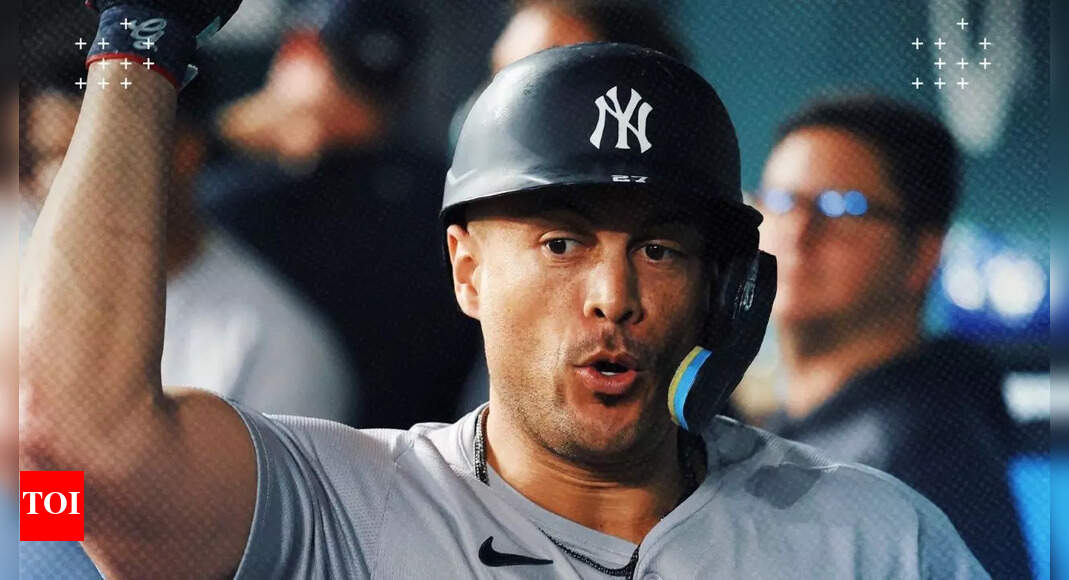

Yankees Release Giancarlo Stantons Potential Mariners Move

May 27, 2025

Yankees Release Giancarlo Stantons Potential Mariners Move

May 27, 2025 -

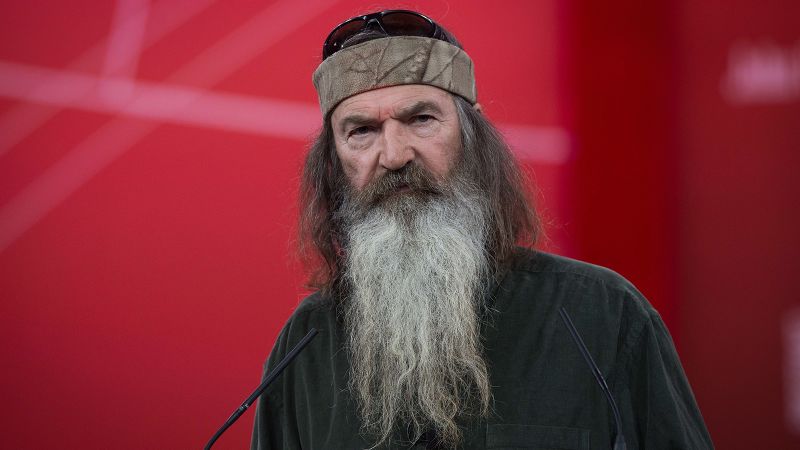

Tributes Pour In After Death Of Duck Dynastys Phil Robertson At 79

May 27, 2025

Tributes Pour In After Death Of Duck Dynastys Phil Robertson At 79

May 27, 2025

Latest Posts

-

Nancy Astors Tiara Auction Details And Expected Price At Bonhams

Jun 01, 2025

Nancy Astors Tiara Auction Details And Expected Price At Bonhams

Jun 01, 2025 -

Psc Argues Georgia Power Overestimated Future Energy Demand

Jun 01, 2025

Psc Argues Georgia Power Overestimated Future Energy Demand

Jun 01, 2025 -

Are Georgia Powers Predictions Accurate Data Center Growth Tests Grid Capacity

Jun 01, 2025

Are Georgia Powers Predictions Accurate Data Center Growth Tests Grid Capacity

Jun 01, 2025 -

A Falconer Provides A Forever Home For A Flamstead Hawk

Jun 01, 2025

A Falconer Provides A Forever Home For A Flamstead Hawk

Jun 01, 2025 -

Analysis Trumps Pardon Power And Its Impact On Convicted Republican Congresspeople

Jun 01, 2025

Analysis Trumps Pardon Power And Its Impact On Convicted Republican Congresspeople

Jun 01, 2025