Analysis Of PDD Holdings' Q1 2025 Earnings: A Deep Dive Into E-commerce Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis of PDD Holdings' Q1 2025 Earnings: A Deep Dive into E-commerce Performance

PDD Holdings, the parent company of Pinduoduo, a leading e-commerce platform in China, recently released its Q1 2025 earnings report, revealing a mixed bag of results that have sparked considerable discussion amongst analysts and investors. While the company showcased impressive growth in certain areas, others raised concerns about the sustainability of its current trajectory. This in-depth analysis delves into the key takeaways from the report, examining the factors contributing to PDD Holdings' performance and exploring the potential implications for the future.

Headline-Grabbing Growth, Yet Underlying Concerns

PDD Holdings reported a significant year-over-year increase in revenue, driven primarily by robust growth in its core e-commerce business. This surge was fueled by several factors, including increased user engagement, expansion into new product categories, and successful marketing campaigns. However, the report also highlighted rising operational expenses and a slightly lower-than-expected net income, prompting questions about profitability in the long term.

Key Highlights from PDD Holdings' Q1 2025 Earnings:

-

Revenue Growth: A substantial increase in revenue compared to Q1 2024, exceeding analyst expectations in the initial stages. This growth is a testament to PDD Holdings' strong market position and its ability to attract and retain customers. However, a closer look at the individual revenue streams is crucial for a complete understanding.

-

Active User Base: The number of active users on the Pinduoduo platform continued to grow, demonstrating the platform's enduring appeal. This is a positive indicator of the company's ability to attract and retain users in a competitive market. Understanding user demographics and engagement patterns will be key to further growth strategies.

-

Operational Expenses: A notable increase in operational expenses, particularly in marketing and technology, raised concerns about profitability. This increase needs to be analyzed in relation to revenue growth to determine the overall impact on profit margins. Further, a detailed breakdown of the expenditure is needed for investors to assess the efficacy of the company's spending.

-

Gross Merchandise Volume (GMV): Analysis of the GMV, a key indicator of e-commerce platform health, needs to be compared with the previous quarters and industry benchmarks to assess its overall significance. Fluctuations in GMV often reflect broader economic trends and consumer spending habits.

-

Competitive Landscape: The increasing competition in the Chinese e-commerce market, with giants like Alibaba and JD.com, remains a significant challenge. PDD Holdings' ability to differentiate itself and maintain its market share will be a critical factor in determining its future success.

Looking Ahead: Challenges and Opportunities

PDD Holdings faces several challenges, including intensifying competition, regulatory changes in China's tech sector, and maintaining profitability amidst rising operational costs. However, the company also possesses significant opportunities, such as expanding into new markets, leveraging its strong user base for further growth, and exploring new revenue streams through diversification.

Strategic Implications and Investor Sentiment:

The Q1 2025 earnings report has sparked a mixed reaction among investors. While some remain optimistic about PDD Holdings' long-term potential, others are expressing concerns about profitability and the sustainability of its growth trajectory. Further analysis of the report's finer details will be crucial for investors to make informed decisions. This includes a deeper understanding of the company's long-term strategic goals, technological advancements, and plans to manage operational costs effectively.

Conclusion:

PDD Holdings' Q1 2025 earnings report presents a complex picture. While the company has demonstrated significant revenue growth and maintained a strong user base, concerns remain about rising operational costs and the competitive landscape. A thorough analysis of the report's finer points, coupled with an understanding of the broader macroeconomic factors impacting the Chinese e-commerce market, is crucial for evaluating the company’s future prospects. Further insights will be crucial in shaping investor sentiment and the company's overall trajectory. Stay tuned for further updates and in-depth analysis as more information becomes available.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis Of PDD Holdings' Q1 2025 Earnings: A Deep Dive Into E-commerce Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

King Charles Iiis Impactful Canada Trip Overshadowed By Trumps 51st State Claim

May 28, 2025

King Charles Iiis Impactful Canada Trip Overshadowed By Trumps 51st State Claim

May 28, 2025 -

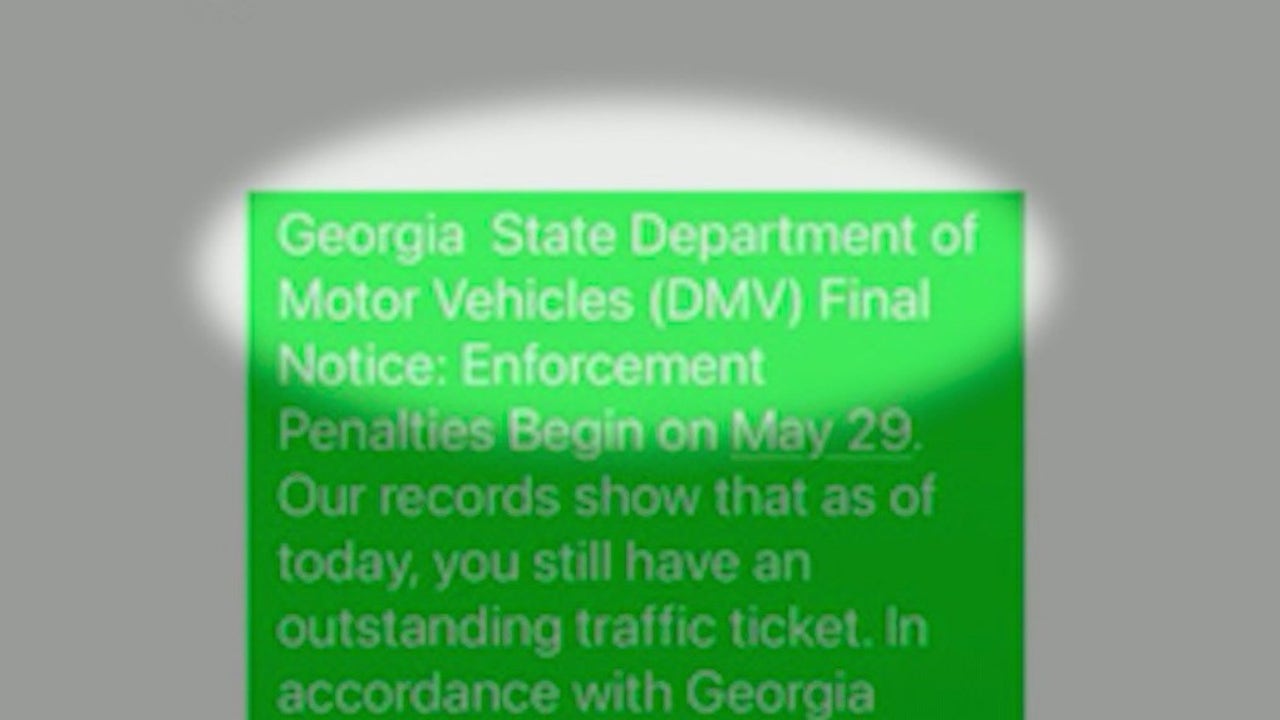

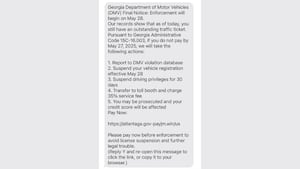

Georgia Residents Targeted New Text Message Scam Mimics Traffic Citations

May 28, 2025

Georgia Residents Targeted New Text Message Scam Mimics Traffic Citations

May 28, 2025 -

Social Security Benefit Increase 5 108 Payments Issued This Week

May 28, 2025

Social Security Benefit Increase 5 108 Payments Issued This Week

May 28, 2025 -

Chinese Chemical Plant Explosion Casualties Reported Rescue Operation Launched

May 28, 2025

Chinese Chemical Plant Explosion Casualties Reported Rescue Operation Launched

May 28, 2025 -

The Trump Harvard Controversy Unraveling The Deception Behind The Fury

May 28, 2025

The Trump Harvard Controversy Unraveling The Deception Behind The Fury

May 28, 2025

Latest Posts

-

Georgia Dds Scam Text What To Do If You Received It

May 29, 2025

Georgia Dds Scam Text What To Do If You Received It

May 29, 2025 -

Royal Tour And Political Controversy King Charles In Canada As Trump Pushes For Statehood

May 29, 2025

Royal Tour And Political Controversy King Charles In Canada As Trump Pushes For Statehood

May 29, 2025 -

Trumps Harvard Outburst A Deeper Dive Into The Maga Fundraising Controversy

May 29, 2025

Trumps Harvard Outburst A Deeper Dive Into The Maga Fundraising Controversy

May 29, 2025 -

Unlocking Value 2025 Memorial Tournament Sleeper Picks And Odds

May 29, 2025

Unlocking Value 2025 Memorial Tournament Sleeper Picks And Odds

May 29, 2025 -

Local Authorities Fight Back Against Rising Georgia Dmv Imposter Scams

May 29, 2025

Local Authorities Fight Back Against Rising Georgia Dmv Imposter Scams

May 29, 2025