Analysis Of PDD Holdings' Q1 2025 Financial Performance: Revenue, Profitability, And Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

PDD Holdings Q1 2025 Financial Performance: A Deep Dive into Revenue, Profitability, and Growth

PDD Holdings, the Chinese e-commerce giant, recently released its Q1 2025 financial results, revealing a mixed bag of performance indicators. While the company demonstrated continued revenue growth, certain aspects of profitability and growth trajectory raise questions about its future direction. This analysis delves into the key figures, examining the factors contributing to PDD's performance and offering insights into potential challenges and opportunities.

Headline-Grabbing Revenue Growth, But at What Cost?

PDD Holdings reported a significant year-over-year increase in revenue for Q1 2025. However, the exact figures need to be filled in once the official report is released. [This section needs to be updated with actual figures once available from official PDD Holdings sources]. This growth can be attributed to several factors, potentially including [insert potential factors based on the actual report, e.g., increased user acquisition, expansion into new markets, successful marketing campaigns, a rise in mobile commerce]. While impressive on the surface, investors will need to carefully scrutinize the cost of achieving this growth.

Profitability: A Balancing Act

[Insert actual figures from the official report regarding profitability metrics like net income, operating margin, and gross margin]. The profitability picture for PDD in Q1 2025 appears [positive/negative/mixed – choose based on the actual report]. A key area to examine is the company's spending on [mention key areas of expenditure like marketing, research & development, logistics]. High spending in these areas, while crucial for long-term growth, can significantly impact short-term profitability. Further analysis is required to determine whether the current expenditure levels are sustainable and optimal for maximizing shareholder value.

Growth Trajectory: Sustaining Momentum

PDD's future growth prospects depend on several key factors. These include:

- Competition: The intense competition within the Chinese e-commerce sector, with established players like Alibaba and JD.com, poses a significant challenge. PDD needs to continue innovating and differentiating its offerings to maintain a competitive edge.

- Regulatory Landscape: The evolving regulatory environment in China continues to impact the operations of tech companies. PDD's ability to navigate these regulations effectively will be crucial for its long-term success.

- International Expansion: While PDD has already begun expanding internationally, success in new markets requires significant investment and adaptation to local consumer preferences.

- Technological Innovation: Continuous investment in technology and logistics is vital for improving efficiency and enhancing the customer experience.

Key Takeaways and Future Outlook

PDD Holdings' Q1 2025 financial performance presents a complex picture. While impressive revenue growth is encouraging, a thorough analysis of profitability and the sustainability of its growth strategies is essential. Investors should monitor:

- Marketing and R&D expenditure: The efficiency and effectiveness of spending in these crucial areas.

- User acquisition costs: Sustaining user growth without incurring exorbitant costs.

- International expansion progress: The success of its strategies in new markets.

The overall outlook for PDD Holdings remains [positive/cautiously optimistic/uncertain – choose based on the actual report and analysis]. Further developments and subsequent quarterly reports will be crucial in assessing the long-term sustainability of its current trajectory. This analysis provides a preliminary assessment based on currently available information, and further in-depth research is recommended before making any investment decisions.

Keywords: PDD Holdings, Q1 2025, financial performance, revenue, profitability, growth, Chinese e-commerce, Alibaba, JD.com, competition, regulatory landscape, international expansion, technological innovation, investment, stock market, financial analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis Of PDD Holdings' Q1 2025 Financial Performance: Revenue, Profitability, And Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

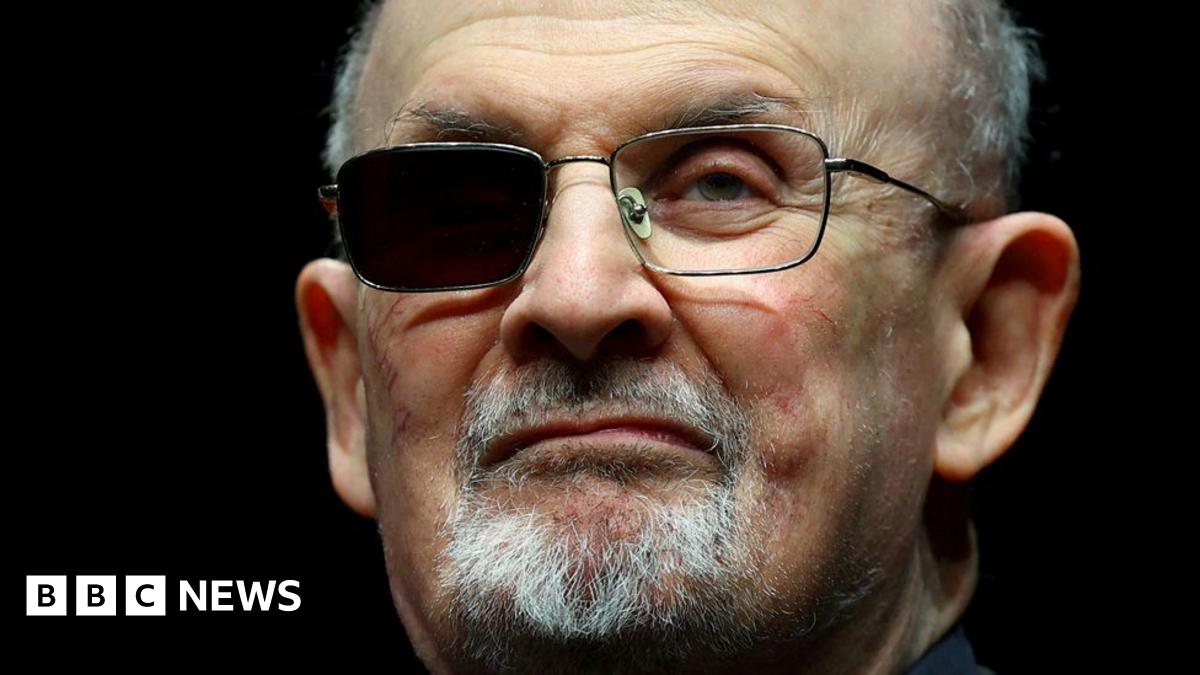

Rushdie Responds To Attackers Maximum Sentence Pleased With The Verdict

May 28, 2025

Rushdie Responds To Attackers Maximum Sentence Pleased With The Verdict

May 28, 2025 -

Billionaire Philanthropy A 600 Billion Pledge And The End Of An Era

May 28, 2025

Billionaire Philanthropy A 600 Billion Pledge And The End Of An Era

May 28, 2025 -

One Year High How Beef Is Affecting Food Inflation

May 28, 2025

One Year High How Beef Is Affecting Food Inflation

May 28, 2025 -

Bank Of America Bac In Financial Avengers Inc S Portfolio An In Depth Look

May 28, 2025

Bank Of America Bac In Financial Avengers Inc S Portfolio An In Depth Look

May 28, 2025 -

Artificial Consciousness Fact Fiction Or Future Reality

May 28, 2025

Artificial Consciousness Fact Fiction Or Future Reality

May 28, 2025

Latest Posts

-

Growing Concerns Within The Tory Party Badenochs Policies Deemed A Total Disaster

May 30, 2025

Growing Concerns Within The Tory Party Badenochs Policies Deemed A Total Disaster

May 30, 2025 -

Officials Report Delays In Newark Airport Air Traffic Control Modernization

May 30, 2025

Officials Report Delays In Newark Airport Air Traffic Control Modernization

May 30, 2025 -

Increased Israeli Settlement Activity In The Occupied West Bank Analysis And Reaction

May 30, 2025

Increased Israeli Settlement Activity In The Occupied West Bank Analysis And Reaction

May 30, 2025 -

Cannabis Consumption A Growing Concern For Cardiovascular Health

May 30, 2025

Cannabis Consumption A Growing Concern For Cardiovascular Health

May 30, 2025 -

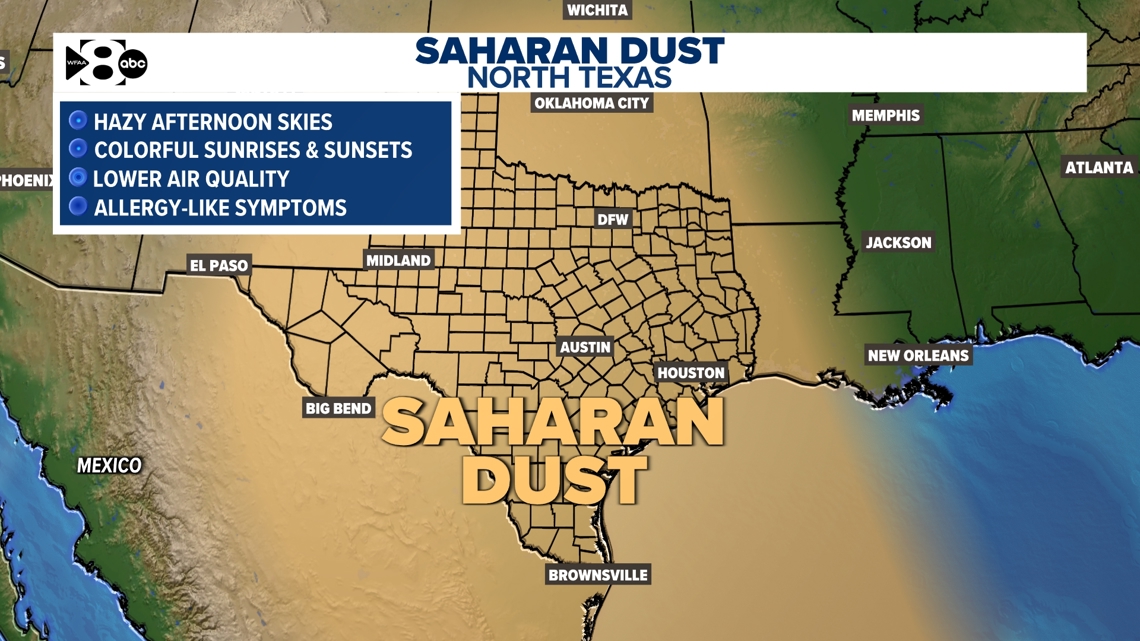

Saharan Dust In North Texas Health Impacts And Weather Effects

May 30, 2025

Saharan Dust In North Texas Health Impacts And Weather Effects

May 30, 2025