Analysis Of Trump's Unprecedented Tax Credit For A National School Voucher Program

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Proposed National School Voucher Program: An Unprecedented Tax Credit Analyzed

Donald Trump's proposed national school voucher program, a cornerstone of his education platform, has sparked intense debate. The plan centers around a significant tax credit, offering unprecedented financial support to parents choosing private schools over public institutions. This article delves into a comprehensive analysis of this proposal, examining its potential impact, economic feasibility, and constitutional implications.

The Core of the Proposal:

The core of Trump's plan revolves around a substantial federal tax credit, allowing parents to divert a portion of their federal taxes towards private school tuition. While the exact figures have fluctuated throughout different iterations of the proposal, the scale suggests a considerable financial commitment, potentially reaching billions of dollars annually. This differs significantly from existing voucher programs, many of which are state-funded and operate on a smaller, more localized scale. The sheer magnitude of a national program funded through a tax credit presents unique challenges and opportunities.

Potential Impacts:

The potential impacts of such a sweeping initiative are multifaceted and far-reaching. Proponents argue that it would:

- Increase school choice: Parents would have greater freedom to select educational environments best suited to their children's needs, regardless of socioeconomic background.

- Boost competition: Private schools would face increased competition, potentially leading to improved quality and innovation within the education sector.

- Empower parents: Parents would gain greater control over their children's education, aligning with the philosophy of parental rights championed by many conservatives.

However, critics raise several concerns:

- Funding disparities: The program's reliance on tax credits could exacerbate existing inequalities, potentially benefiting wealthier families more than those with lower incomes.

- Accountability and oversight: Private schools receiving funding through the program may lack the same level of accountability and transparency as public schools. Ensuring quality control and preventing fraud becomes a significant challenge.

- Constitutional issues: The legality of using federal funds to support religious schools remains a contentious issue, potentially facing legal challenges under the Establishment Clause of the First Amendment. [Link to relevant Supreme Court case: e.g., Zelman v. Simmons-Harris]

Economic Feasibility and Budgetary Implications:

The economic feasibility of such a large-scale tax credit program is a significant point of contention. Estimating the program's cost requires complex modeling, taking into account factors like participation rates, average tuition costs, and tax bracket distributions. A thorough cost-benefit analysis is crucial to assess its long-term economic impact on the federal budget and the broader economy. Independent studies on similar programs in other states could provide valuable insights into potential cost overruns or unexpected consequences.

Comparison with Existing Voucher Programs:

To understand the potential implications of Trump's proposal, comparing it to existing voucher programs is vital. Analyzing the successes and failures of these programs – for example, the Milwaukee Parental Choice Program or the Florida Tax Credit Scholarship Program – provides valuable data for predicting the potential outcomes of a national program. These comparisons should examine factors such as student achievement, school choice expansion, and program costs. [Link to relevant research on existing voucher programs]

Conclusion:

Trump's proposed national school voucher program, facilitated by an unprecedented tax credit, presents both significant opportunities and substantial challenges. A thorough understanding of its potential impacts, economic feasibility, and constitutional implications is crucial for informed discussion and policymaking. Further research and analysis, focusing on detailed cost projections, comparative studies, and legal precedents, are essential to fully evaluate the merits and drawbacks of this ambitious proposal. The long-term consequences for the American education system hinge on careful consideration of these factors.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis Of Trump's Unprecedented Tax Credit For A National School Voucher Program. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Louisville Cardinals Vs Miami Hurricanes Ncaa Baseball Super Regional Game Updates

Jun 08, 2025

Louisville Cardinals Vs Miami Hurricanes Ncaa Baseball Super Regional Game Updates

Jun 08, 2025 -

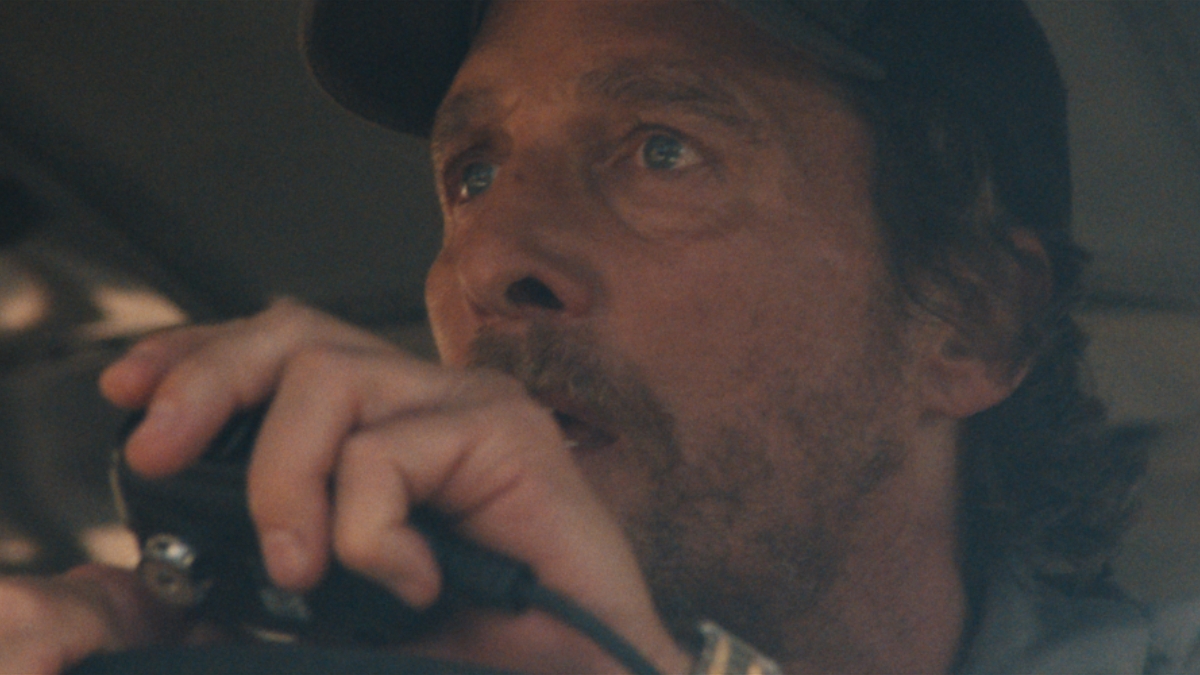

The Lost Bus Teaser Apple Tv Series With Mc Conaughey And Ferrera

Jun 08, 2025

The Lost Bus Teaser Apple Tv Series With Mc Conaughey And Ferrera

Jun 08, 2025 -

The Hamilton By Election Why Reform Party Emerged Victorious

Jun 08, 2025

The Hamilton By Election Why Reform Party Emerged Victorious

Jun 08, 2025 -

Hunter Dobbins Red Sox Loyalty Trumps Yankees Offer Retirement A Real Possibility

Jun 08, 2025

Hunter Dobbins Red Sox Loyalty Trumps Yankees Offer Retirement A Real Possibility

Jun 08, 2025 -

Syrias Damascus President Trumps Image On City Billboards

Jun 08, 2025

Syrias Damascus President Trumps Image On City Billboards

Jun 08, 2025

Yankees Shortstop Situation Volpes Performance Under Daily Scrutiny

Yankees Shortstop Situation Volpes Performance Under Daily Scrutiny

Democrats Fail To Block Gop Nominee Push Senate Rules Altered

Democrats Fail To Block Gop Nominee Push Senate Rules Altered

Mealtime Struggles Expert Tips For Dealing With Fussy Eaters

Mealtime Struggles Expert Tips For Dealing With Fussy Eaters