Analysis: Proposed Republican Retirement Changes And Their Effect On Gen X And Millennials

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: Proposed Republican Retirement Changes and Their Impact on Gen X and Millennials

Introduction: The Republican party has recently proposed significant changes to retirement policies, sparking heated debate about their potential effects on various demographics. This analysis focuses specifically on how these proposed changes – which often center around adjustments to Social Security and 401(k) plans – would impact Gen X and Millennials, two generations already facing significant economic headwinds. Will these changes ease their path to retirement, or will they exacerbate existing challenges? Let's delve into the details.

Proposed Changes and Their Potential Impact:

The specific proposals vary, but many Republican plans involve some combination of the following:

- Raising the retirement age: This is a common strategy to address the projected shortfall in Social Security. For Gen X and Millennials, this translates to potentially working longer before accessing benefits, impacting their ability to enjoy retirement years and potentially reducing overall lifetime benefits.

- Reducing benefits: Some proposals suggest reducing the amount of Social Security benefits paid out to retirees. This would disproportionately affect younger generations who have contributed less to the system and are already facing higher costs of living.

- Changes to 401(k) regulations: While not always explicitly stated, some Republican plans indirectly influence 401(k)s through tax reforms. Changes impacting tax-advantaged accounts could impact the ability of Gen X and Millennials to save adequately for retirement.

- Privatization of Social Security: Although less commonly proposed, some Republican voices advocate for partial or full privatization of Social Security. The implications of such a move for younger generations are complex and uncertain, involving significant risks and potentially lower guaranteed returns.

Gen X: Facing a Retirement Cliff?

Generation X (born 1965-1980) is already facing a challenging retirement landscape. They've witnessed stagnant wage growth, rising healthcare costs, and increased student loan debt. Proposed changes to Social Security could push many Gen Xers towards a "retirement cliff," where they lack sufficient savings and face reduced benefits, forcing them to continue working well beyond their desired retirement age. The financial security many had hoped for during retirement may become a distant dream.

Millennials: A Bleak Retirement Outlook?

Millennials (born 1981-1996) are arguably in an even more precarious position. They've entered the workforce during a period of economic instability, saddled with significant student loan debt and facing a competitive housing market. The proposed changes, coupled with their generally lower savings rates compared to previous generations, could paint a bleak picture for their retirement future. Many may need to work significantly longer than previous generations to achieve a comfortable retirement.

Long-Term Consequences and Solutions:

The long-term consequences of these proposed changes could be significant, potentially leading to:

- Increased poverty among older adults: Reduced benefits and a longer working life could push more seniors into poverty.

- Strained healthcare system: Delayed retirement could increase the demand on the healthcare system, potentially leading to higher costs and longer wait times.

- Social unrest: A widening gap between the wealthy and the less fortunate could lead to social unrest and political instability.

Addressing these issues requires a multifaceted approach, including:

- Investing in retirement savings programs: Government initiatives should encourage and support increased savings through tax incentives and automatic enrollment programs.

- Addressing income inequality: Policies that promote fair wages and affordable housing are crucial to enabling younger generations to save adequately for retirement.

- Reforming Social Security: Comprehensive reforms are necessary to ensure the long-term viability of Social Security, but these reforms must be equitable and protect the interests of younger generations.

Conclusion:

The proposed Republican retirement changes present significant challenges for Gen X and Millennials. A thoughtful and comprehensive approach is needed to ensure that these generations have a secure and dignified retirement, rather than facing a future of financial hardship and insecurity. The current proposals, as they stand, may offer little in the way of relief and risk exacerbating existing inequalities. Open dialogue and collaborative solutions are crucial to navigate this critical issue. We need to move beyond partisan politics and focus on creating a fair and sustainable retirement system for all Americans.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Proposed Republican Retirement Changes And Their Effect On Gen X And Millennials. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Robinhood Hood Stock Performance A 6 46 Rise On June 3rd And What It Means

Jun 05, 2025

Robinhood Hood Stock Performance A 6 46 Rise On June 3rd And What It Means

Jun 05, 2025 -

Fact Check White House Vs Bbc On Gaza Reporting Accuracy

Jun 05, 2025

Fact Check White House Vs Bbc On Gaza Reporting Accuracy

Jun 05, 2025 -

Case Studies Understanding Why High Tech Projects Fail And How To Prevent It

Jun 05, 2025

Case Studies Understanding Why High Tech Projects Fail And How To Prevent It

Jun 05, 2025 -

Will The New Republican Retirement Plan Leave 30 Year Olds 420 000 Short

Jun 05, 2025

Will The New Republican Retirement Plan Leave 30 Year Olds 420 000 Short

Jun 05, 2025 -

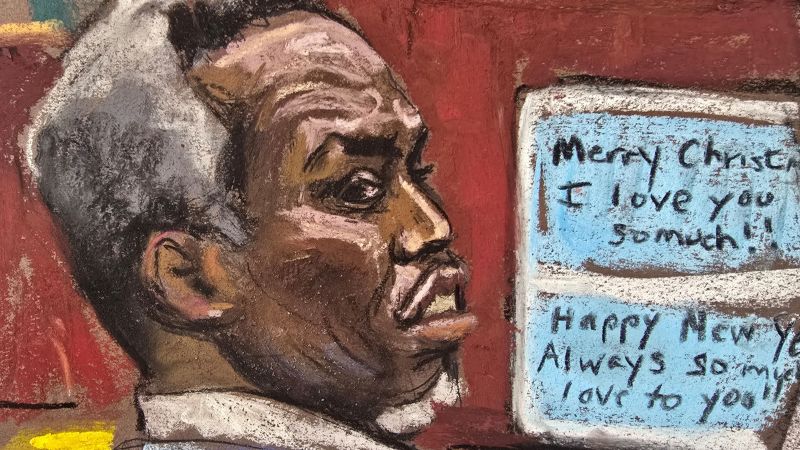

The Sean Diddy Combs Trial Timeline And Key Players

Jun 05, 2025

The Sean Diddy Combs Trial Timeline And Key Players

Jun 05, 2025

Latest Posts

-

Ryo Otas Grand Slam Extends Orixs Hope In Late Inning Comeback

Aug 17, 2025

Ryo Otas Grand Slam Extends Orixs Hope In Late Inning Comeback

Aug 17, 2025 -

Stalker 2 Roadmap Engine Upgrade Ps 5 And Potential Ps 5 Pro Release Date

Aug 17, 2025

Stalker 2 Roadmap Engine Upgrade Ps 5 And Potential Ps 5 Pro Release Date

Aug 17, 2025 -

Topshops Second Act Challenges And Opportunities In The Fashion Industry

Aug 17, 2025

Topshops Second Act Challenges And Opportunities In The Fashion Industry

Aug 17, 2025 -

Northwests Low Livability Score Sparks Debate

Aug 17, 2025

Northwests Low Livability Score Sparks Debate

Aug 17, 2025 -

Stalker 2 Update Unreal Engine 5 Upgrade And Next Gen Console Release Details

Aug 17, 2025

Stalker 2 Update Unreal Engine 5 Upgrade And Next Gen Console Release Details

Aug 17, 2025