Analysis: Republican Retirement Plan Changes And Their Impact On 30-Year-Olds

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: How Republican Retirement Plan Changes Could Impact 30-Year-Olds

Are proposed Republican retirement plan changes good or bad news for millennials nearing midlife? Let's break down the potential impact.

The Republican party has put forth several proposals aimed at reforming retirement savings plans in the United States. While proponents argue these changes will boost economic growth and individual savings, the impact on specific demographics, particularly 30-year-olds, remains a complex and hotly debated issue. This analysis will delve into the key changes and explore their potential implications for this crucial generation.

Key Proposed Changes and Their Potential Impact on 30-Year-Olds:

Many Republican proposals focus on altering existing retirement plans like 401(k)s and IRAs. Here's a breakdown of potential changes and their likely impact on 30-year-olds:

-

Increased Contribution Limits: Some proposals suggest increasing contribution limits for 401(k)s and IRAs. This could be positive for 30-year-olds, allowing them to save more aggressively and potentially accelerate their path to retirement. However, this benefit is primarily felt by higher earners who can afford to maximize contributions.

-

Changes to Tax Treatment: Alterations to tax deductions or credits associated with retirement contributions are a key area of debate. Reducing tax benefits could significantly impact the savings potential of 30-year-olds, especially those in lower tax brackets. Conversely, increased tax advantages could incentivize higher contributions. The precise impact depends heavily on the specifics of the proposed changes.

-

Streamlining Regulations: Republicans often advocate for reducing regulations surrounding retirement plans. While this could potentially lower administrative costs for plan providers, the impact on individual 30-year-olds is less direct. It’s crucial to examine whether reduced oversight could lead to unintended consequences regarding investor protection.

-

Emphasis on Personal Responsibility: Many Republican proposals emphasize individual responsibility for retirement planning, often advocating for less government involvement in retirement security. While promoting personal savings is generally positive, this approach could disproportionately impact 30-year-olds facing challenges like student loan debt, stagnant wages, and rising living costs. These factors can make saving for retirement more difficult, necessitating a nuanced approach beyond simply promoting personal responsibility.

The Bigger Picture: Economic and Social Context

It's vital to consider the broader economic and social context when evaluating these proposals. Factors such as inflation, wage growth, and the availability of affordable healthcare significantly impact a 30-year-old's ability to prioritize retirement savings. Any analysis must take these intertwined elements into account.

What 30-Year-Olds Should Do Now:

Regardless of political developments, proactive retirement planning remains crucial for 30-year-olds. Consider these steps:

- Maximize Employer Matching: Take full advantage of any employer matching contributions to your 401(k). This is essentially free money.

- Diversify Investments: Spread your investments across different asset classes to mitigate risk. Consult a financial advisor for personalized guidance.

- Review Your Budget: Identify areas where you can reduce expenses and allocate more funds towards retirement savings.

- Stay Informed: Keep abreast of proposed legislative changes and their potential impact on your retirement plan.

Conclusion:

The potential impact of Republican retirement plan changes on 30-year-olds is multifaceted and depends heavily on the specifics of the proposed legislation. While some changes could offer benefits, others could create significant challenges for this generation. Proactive financial planning and staying informed about political developments are crucial for navigating this complex landscape and securing a comfortable retirement. Further analysis and detailed legislative proposals are necessary for a more comprehensive understanding of the long-term implications. Consult with a financial advisor to discuss your specific circumstances and develop a personalized retirement strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Republican Retirement Plan Changes And Their Impact On 30-Year-Olds. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

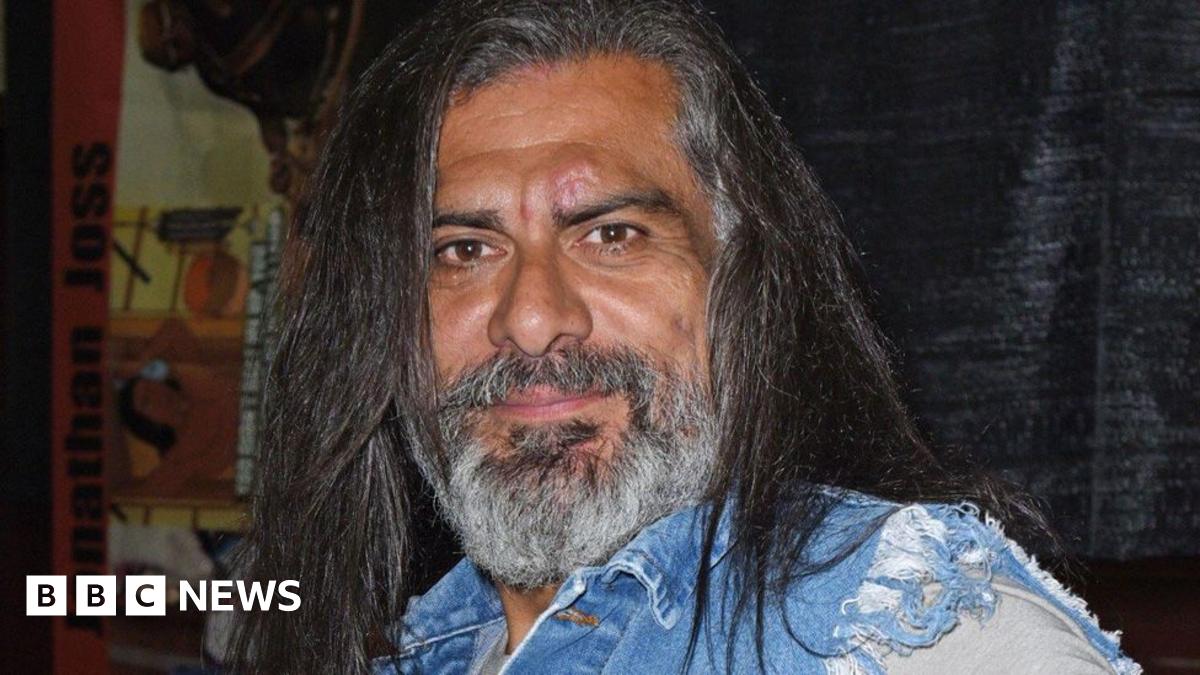

Actor Jonathan Joss King Of The Hills John Redcorn Shot And Killed

Jun 05, 2025

Actor Jonathan Joss King Of The Hills John Redcorn Shot And Killed

Jun 05, 2025 -

Resilient Us Job Market Aprils Unexpected Rise In Openings

Jun 05, 2025

Resilient Us Job Market Aprils Unexpected Rise In Openings

Jun 05, 2025 -

Jannik Sinner Opens Up About His Alcaraz Hurdle Before Potential Roland Garros Match

Jun 05, 2025

Jannik Sinner Opens Up About His Alcaraz Hurdle Before Potential Roland Garros Match

Jun 05, 2025 -

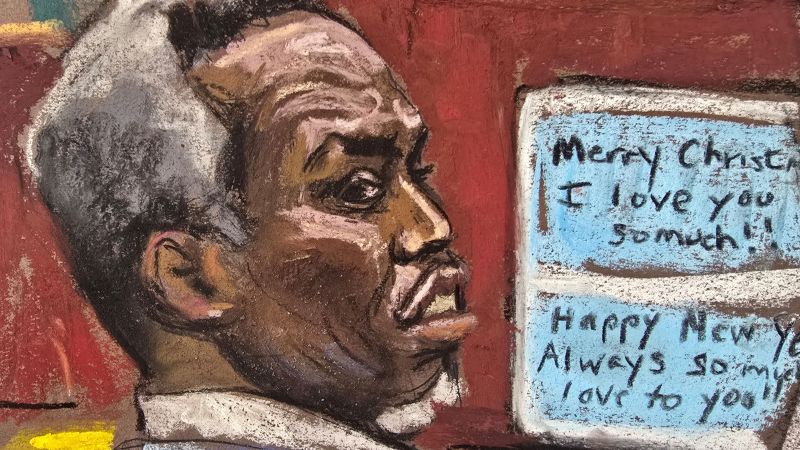

The Sean Diddy Combs Trial A Timeline Of Recent Events

Jun 05, 2025

The Sean Diddy Combs Trial A Timeline Of Recent Events

Jun 05, 2025 -

Where To Buy Halle Berrys Favorite Neck Firming Cream

Jun 05, 2025

Where To Buy Halle Berrys Favorite Neck Firming Cream

Jun 05, 2025

Latest Posts

-

The Beast In Me Netflix Premiere First Look At Claire Danes And Matthew Rhys

Aug 17, 2025

The Beast In Me Netflix Premiere First Look At Claire Danes And Matthew Rhys

Aug 17, 2025 -

Nba And Nbpa To Discuss Restrictions On Player Prop Bets

Aug 17, 2025

Nba And Nbpa To Discuss Restrictions On Player Prop Bets

Aug 17, 2025 -

Pasta Price Hike Why Italian Restaurants Are Furious

Aug 17, 2025

Pasta Price Hike Why Italian Restaurants Are Furious

Aug 17, 2025 -

Rise In Reports Prompts Surrey Police Crackdown On Jogging Harassment And Catcalling

Aug 17, 2025

Rise In Reports Prompts Surrey Police Crackdown On Jogging Harassment And Catcalling

Aug 17, 2025 -

After A Decade Two Badlands Tracks Get The Music Video Treatment From Halsey

Aug 17, 2025

After A Decade Two Badlands Tracks Get The Music Video Treatment From Halsey

Aug 17, 2025