Analysis: Trump's Plan For National School Vouchers And Its Tax Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: Trump's Proposed National School Voucher Plan and its Complex Tax Implications

Introduction: Donald Trump's proposed national school voucher program, a cornerstone of his education platform, has ignited a fiery debate. While proponents champion increased school choice and parental autonomy, critics raise concerns about funding mechanisms, constitutional challenges, and the significant tax implications for both individuals and the federal government. This analysis delves into the intricacies of Trump's plan, exploring its potential impact on the tax landscape.

Understanding the Proposed Voucher System: Trump's plan envisions a substantial federal investment in a national school voucher program. The exact details remain somewhat fluid, but the core concept involves providing federal funds to families to use towards private school tuition, homeschooling expenses, or other approved educational options. This differs significantly from existing state-level voucher programs, which often have more limited scope and funding sources. The scale of a national program would be unprecedented.

Tax Implications for Families: The immediate impact on families would depend heavily on the specific design of the voucher program. If vouchers are considered tax-free grants, families wouldn't see a direct tax benefit beyond the reduced cost of private schooling. However, if vouchers are structured as tax credits, this could lead to significant tax savings for participating families, potentially reducing their overall tax burden. The complexity arises in how these credits would interact with other existing tax deductions and credits, a factor requiring further analysis.

Tax Implications for the Federal Government: The massive cost of a national school voucher program presents a significant challenge for the federal budget. The funding mechanism would require substantial increases in federal spending, potentially necessitating tax increases elsewhere to offset the cost. This could impact various tax brackets and potentially lead to debates surrounding income tax rates, corporate tax rates, or the introduction of new taxes entirely. Moreover, the program's financial sustainability remains questionable given the potential for escalating costs over time.

Constitutional Concerns and Legal Challenges: The legality of a national school voucher program is another significant area of concern. Past legal challenges to voucher programs have focused on issues of church-state separation, as vouchers could potentially fund religious schools. The Supreme Court's stance on this matter is not entirely settled, and a national program would undoubtedly face significant legal hurdles. These legal battles would further complicate the tax implications, creating uncertainty around the program's long-term feasibility and the associated tax burdens.

Economic Impacts Beyond Taxation: The economic ramifications extend beyond direct tax implications. A shift towards private schooling could impact public school funding, potentially leading to cuts in public education budgets. The potential consequences for teachers, school districts, and the overall educational landscape require careful consideration. Furthermore, the impact on the economy as a whole – job creation, economic growth, and potential disparities in educational access across different socioeconomic groups – needs further scrutiny.

H3: Key Questions Remain Unanswered:

- What will be the specific funding mechanism for the national voucher program?

- How will the program address the issue of religious schools and constitutional concerns?

- What safeguards will be in place to ensure equitable access for low-income families?

- What is the long-term cost projection for the program, and how will it be financed?

Conclusion: Trump's proposed national school voucher program presents a complex and multifaceted issue with far-reaching tax implications. While offering the potential for increased school choice, the plan raises significant concerns about its financial sustainability, its potential impact on the federal budget, and its legal challenges. Further analysis and detailed policy proposals are necessary to fully understand the long-term consequences of this ambitious plan and its effect on the American tax system. This requires a thorough examination beyond the immediate tax implications, encompassing the broader economic and social impact on the nation's educational landscape.

Call to Action: Stay informed on the evolving debate surrounding school vouchers and their tax implications by following reputable news sources and engaging in informed discussions with elected officials.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Trump's Plan For National School Vouchers And Its Tax Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Kepa Arrizabalaga Transfer Arsenal In Advanced Talks

Jun 08, 2025

Kepa Arrizabalaga Transfer Arsenal In Advanced Talks

Jun 08, 2025 -

Investigation Launched American Airlines Pilot Takes Wrong 787 To Italy

Jun 08, 2025

Investigation Launched American Airlines Pilot Takes Wrong 787 To Italy

Jun 08, 2025 -

M And S Data Breach Ceo Targeted With Ransomware And Online Harassment

Jun 08, 2025

M And S Data Breach Ceo Targeted With Ransomware And Online Harassment

Jun 08, 2025 -

Luigi Mangiones Diary New Evidence In United Healthcare Ceo Murder Case

Jun 08, 2025

Luigi Mangiones Diary New Evidence In United Healthcare Ceo Murder Case

Jun 08, 2025 -

Israeli Gunfire Alleged In Gaza Aid Site Attack Expert Analysis And Witness Accounts

Jun 08, 2025

Israeli Gunfire Alleged In Gaza Aid Site Attack Expert Analysis And Witness Accounts

Jun 08, 2025

Latest Posts

-

Suspect In Charlie Kirks Killing Arrested After Confession To Father

Sep 14, 2025

Suspect In Charlie Kirks Killing Arrested After Confession To Father

Sep 14, 2025 -

In Memoriam Charlie Kirk Erika Kirks Vow To Preserve His Voice

Sep 14, 2025

In Memoriam Charlie Kirk Erika Kirks Vow To Preserve His Voice

Sep 14, 2025 -

Iva Jovic Jugara La Final Del Gdl Open Akron 2025 Contra Emiliana Arango

Sep 14, 2025

Iva Jovic Jugara La Final Del Gdl Open Akron 2025 Contra Emiliana Arango

Sep 14, 2025 -

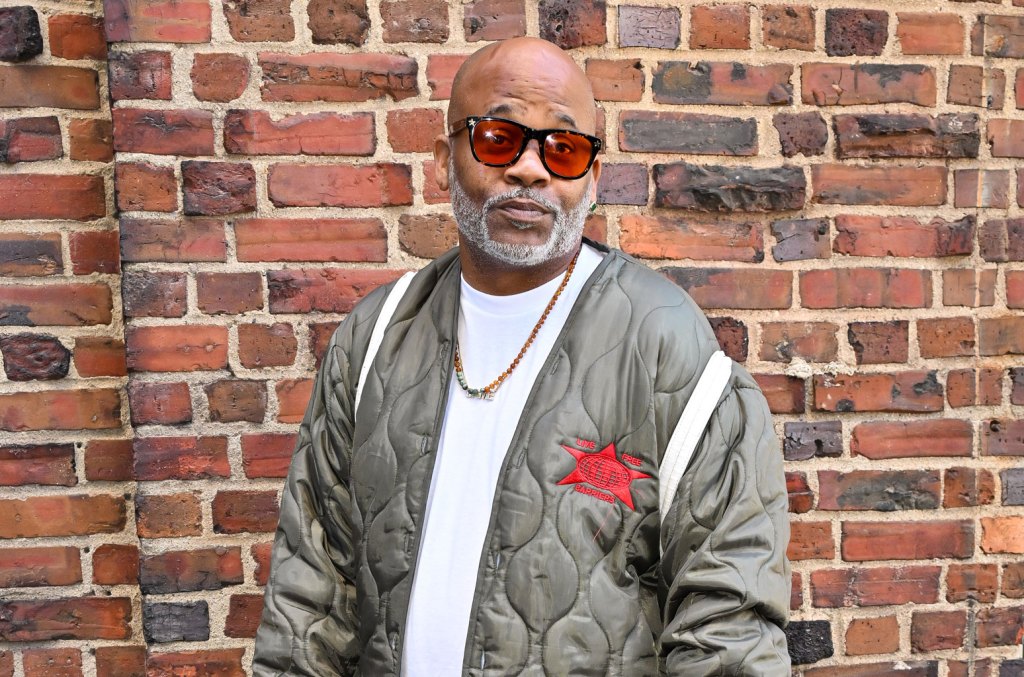

Cam Ron And 50 Cents Paid In Full Dame Dashs Heated Response

Sep 14, 2025

Cam Ron And 50 Cents Paid In Full Dame Dashs Heated Response

Sep 14, 2025 -

Snl Season 51 Cast Announced Bowen Yang Chloe Fineman And More Return

Sep 14, 2025

Snl Season 51 Cast Announced Bowen Yang Chloe Fineman And More Return

Sep 14, 2025