Analysis: Warren Buffett's Recent US Investment Sell-Off

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: Warren Buffett's Recent US Investment Sell-Off – A Sign of Market Caution?

The Oracle of Omaha's recent moves have sent ripples through the financial world. Warren Buffett's Berkshire Hathaway has significantly reduced its holdings in several major US companies, sparking intense speculation about the future of the American market. This sell-off, while not unprecedented, warrants close examination, particularly given Buffett's reputation for long-term investment strategies. Is this a sign of impending market downturn, a strategic repositioning, or something else entirely?

What Did Buffett Sell?

Berkshire Hathaway's 13F filings revealed substantial decreases in stakes across several key sectors. While the exact motivations remain undisclosed (as is typical with Buffett's investment decisions), the scale of the sell-off is noteworthy. Significant reductions were seen in holdings of companies like [insert specific company examples here with links to relevant financial news sources]. These divestments encompass various sectors, indicating a potentially broad-based reassessment of the market landscape, rather than a sector-specific concern.

Possible Explanations for the Sell-Off:

Several theories are circulating to explain Buffett's actions. These include:

-

Market Overvaluation: Some analysts believe Buffett may perceive the current market as overvalued, prompting him to secure profits before a potential correction. This aligns with historical instances where Buffett has trimmed holdings in anticipation of market volatility. [Link to an article discussing market valuation concerns].

-

Strategic Portfolio Restructuring: Another interpretation suggests that the sell-off is part of a larger strategic portfolio restructuring. Berkshire Hathaway may be reallocating capital towards other promising investment opportunities, perhaps in sectors experiencing faster growth or exhibiting lower risk profiles. This is a common practice for long-term investors seeking optimal portfolio diversification.

-

Sector-Specific Concerns: While a broad market sell-off is a possibility, there could also be underlying concerns specific to certain sectors. Further analysis is needed to determine if these sell-offs represent targeted adjustments based on individual company performance or industry-specific risks.

What Does This Mean for Investors?

Buffett's actions are rarely inconsequential. While it's crucial to avoid blindly following any single investor's moves, his decisions often serve as a significant market indicator. The recent sell-off certainly warrants caution. However, it's vital to avoid panic-selling. Instead, investors should conduct thorough due diligence and review their own portfolios in light of these developments. This includes:

-

Re-evaluating Risk Tolerance: Consider your personal risk tolerance and adjust your investment strategy accordingly. A more conservative approach might be prudent given the current uncertainty.

-

Diversification is Key: Maintain a well-diversified portfolio across different asset classes to mitigate risk.

-

Long-Term Perspective: Remember that market fluctuations are normal. Maintaining a long-term investment horizon is crucial for weathering short-term volatility.

Conclusion:

The recent sell-off by Warren Buffett remains shrouded in some mystery. While no single explanation fully captures the complexity of the situation, it's clear that this development demands careful attention from investors. Further analysis, including official statements from Berkshire Hathaway (if any), will be needed to fully understand the implications of this significant market event. For now, a cautious, well-informed approach to investment strategies is highly recommended. Stay informed and consult with a financial advisor before making significant investment decisions.

Keywords: Warren Buffett, Berkshire Hathaway, investment sell-off, US market, stock market, portfolio restructuring, market valuation, investment strategy, financial news, Oracle of Omaha, 13F filings.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Warren Buffett's Recent US Investment Sell-Off. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Supreme Court Upholds Workplace Discrimination Claim Ohio Woman Prevails

Jun 05, 2025

Supreme Court Upholds Workplace Discrimination Claim Ohio Woman Prevails

Jun 05, 2025 -

Impact Of Villanovas Departure On Caa Football Key Questions Answered

Jun 05, 2025

Impact Of Villanovas Departure On Caa Football Key Questions Answered

Jun 05, 2025 -

Winter Fuel Payment U Turn What The Chancellors Decision Means For You

Jun 05, 2025

Winter Fuel Payment U Turn What The Chancellors Decision Means For You

Jun 05, 2025 -

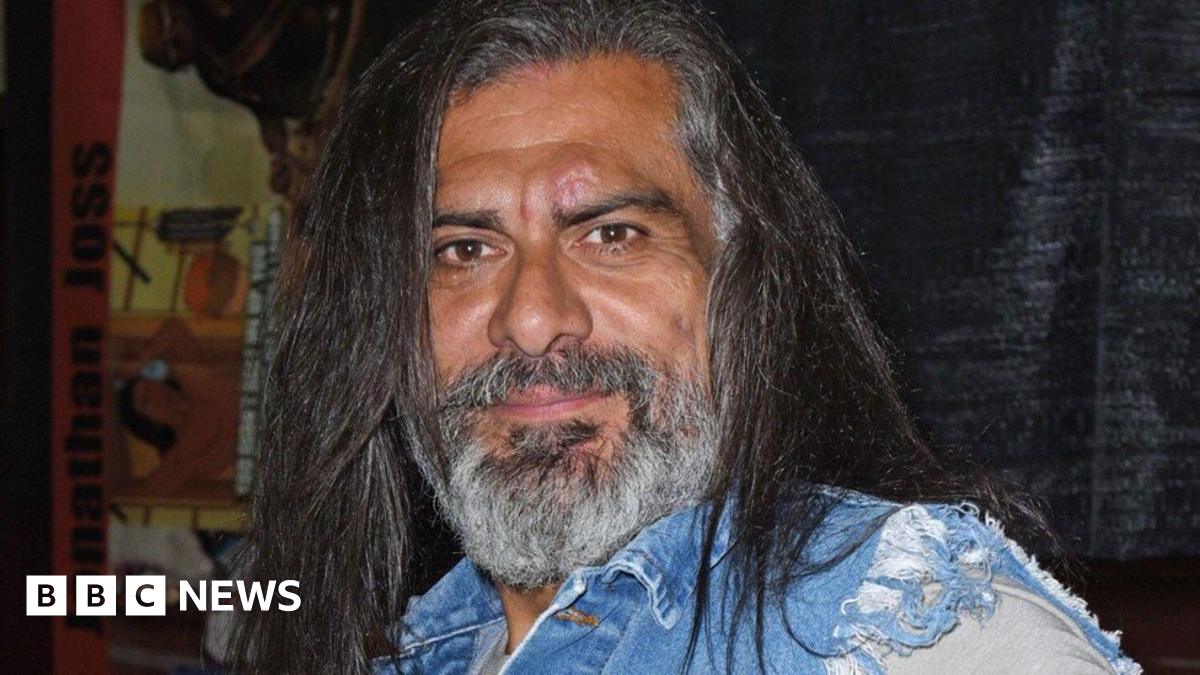

Tragedy Strikes Jonathan Joss King Of The Hill Actor Dies In Shooting

Jun 05, 2025

Tragedy Strikes Jonathan Joss King Of The Hill Actor Dies In Shooting

Jun 05, 2025 -

Another Portland Energy Firm Battles For Survival

Jun 05, 2025

Another Portland Energy Firm Battles For Survival

Jun 05, 2025

Latest Posts

-

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025 -

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025 -

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025 -

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025 -

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025