Analysis: Warren Buffett's Strategic Shift Away From Bank Of America Towards A Booming Consumer Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: Warren Buffett's Strategic Shift Away from Bank of America Towards a Booming Consumer Stock

The Oracle of Omaha makes a move, signaling a potential shift in market sentiment. Warren Buffett's Berkshire Hathaway recently trimmed its stake in Bank of America, a long-held position, while simultaneously increasing its investment in a burgeoning consumer goods company. This strategic shift has sent ripples through the financial world, prompting analysts to dissect the implications for both companies and the broader market. What does this move reveal about Buffett's outlook on the banking sector and the future of consumer spending?

Buffett's Bank of America Bet: A Calculated Retreat?

For years, Bank of America (BAC) has been a cornerstone of Berkshire Hathaway's portfolio. Buffett's significant investment reflected confidence in the bank's recovery and growth potential following the 2008 financial crisis. However, recent regulatory changes, increasing interest rate uncertainty, and potential economic slowdowns may have prompted a reassessment of this position. The reduction in Berkshire's stake, while still substantial, suggests a strategic recalibration rather than a complete abandonment of the financial sector. This could indicate Buffett’s belief that other opportunities offer better short-term returns, or a cautious approach to navigating potential headwinds in the banking industry. [Link to a relevant Bank of America financial news article]

The Allure of the Consumer Sector: A Growth Play?

The counterpoint to the Bank of America adjustment is Berkshire's increased investment in [Insert Name of Consumer Stock Here - e.g., a specific consumer staples company like Costco or a technology company with a strong consumer base like Apple]. This move highlights Buffett's unwavering belief in the enduring power of consumer spending, even amidst economic uncertainty. This company [again, insert specific company name] demonstrates robust growth in [mention key metrics like revenue, market share, or specific product lines]. Its strong brand recognition, loyal customer base, and proven ability to adapt to evolving consumer preferences likely attracted Buffett's attention. The investment underscores a bullish outlook on the resilience of consumer demand and the potential for long-term growth within this specific sector. [Link to a relevant article about the chosen consumer stock].

What Does This Mean for Investors?

Buffett's actions rarely go unnoticed. His strategic shift away from a major banking player and towards a thriving consumer stock provides valuable insight into his market analysis. For individual investors, this move serves as a reminder to:

- Diversify your portfolio: Don't put all your eggs in one basket. Buffett himself demonstrates the importance of strategic allocation across different sectors.

- Stay informed about macroeconomic trends: Understanding the broader economic landscape is crucial for making informed investment decisions. Factors like interest rate changes and potential economic slowdowns significantly impact various sectors.

- Analyze company fundamentals: Focus on a company's financial health, growth potential, and competitive advantages before investing.

This strategic shift by Warren Buffett isn't just a simple portfolio adjustment; it's a commentary on the current economic climate and a prediction about future growth. While it's impossible to definitively predict market movements, Buffett's actions offer valuable food for thought for both seasoned and novice investors alike. What are your thoughts on this significant market movement? Share your analysis in the comments below.

Keywords: Warren Buffett, Berkshire Hathaway, Bank of America, BAC, Consumer Stocks, Investment Strategy, Stock Market Analysis, Economic Outlook, [Insert Name of Consumer Stock Here], Investing, Portfolio Diversification, Financial News.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Warren Buffett's Strategic Shift Away From Bank Of America Towards A Booming Consumer Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lively Vs Baldoni Actress Withdraws Two Claims

Jun 05, 2025

Lively Vs Baldoni Actress Withdraws Two Claims

Jun 05, 2025 -

Hood Stock Surge Robinhood Shares Climb 6 46 June 3rd Whats Behind The Rise

Jun 05, 2025

Hood Stock Surge Robinhood Shares Climb 6 46 June 3rd Whats Behind The Rise

Jun 05, 2025 -

Patriot League Welcomes Villanova As Football Associate Member 2026 Season And Beyond

Jun 05, 2025

Patriot League Welcomes Villanova As Football Associate Member 2026 Season And Beyond

Jun 05, 2025 -

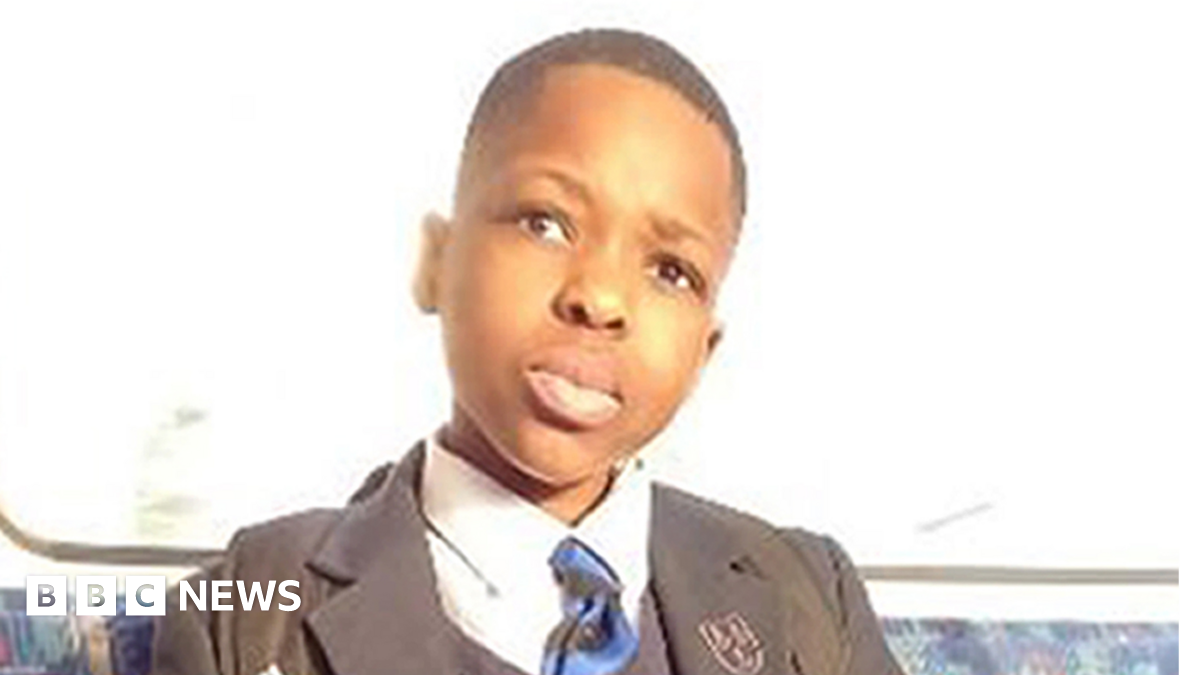

Court Testimony Reveals Marcus Monzos Intent To Kill Daniel Anjorin

Jun 05, 2025

Court Testimony Reveals Marcus Monzos Intent To Kill Daniel Anjorin

Jun 05, 2025 -

6 46 Gain For Robinhood Hood On June 3rd Investor Sentiment And Future Outlook

Jun 05, 2025

6 46 Gain For Robinhood Hood On June 3rd Investor Sentiment And Future Outlook

Jun 05, 2025

Latest Posts

-

Us Military Reinforces Latin America Deployment 4 000 Troops In Anti Cartel Operation

Aug 17, 2025

Us Military Reinforces Latin America Deployment 4 000 Troops In Anti Cartel Operation

Aug 17, 2025 -

Donny Schatz Secures Ride In Upcoming World Of Outlaws Races

Aug 17, 2025

Donny Schatz Secures Ride In Upcoming World Of Outlaws Races

Aug 17, 2025 -

Topshops Return Will The Brands Comeback Be Successful

Aug 17, 2025

Topshops Return Will The Brands Comeback Be Successful

Aug 17, 2025 -

Over 4 000 Additional Us Troops Deployed To Latin American Waters Combating Drug Cartels

Aug 17, 2025

Over 4 000 Additional Us Troops Deployed To Latin American Waters Combating Drug Cartels

Aug 17, 2025 -

Ryo Otas Grand Slam Extends Orixs Hope In Late Inning Comeback

Aug 17, 2025

Ryo Otas Grand Slam Extends Orixs Hope In Late Inning Comeback

Aug 17, 2025