Analysis: Why Warren Buffett Sold These Two Prominent US Investments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analysis: Why Warren Buffett Sold These Two Prominent US Investments

The Oracle of Omaha's recent portfolio adjustments have sent shockwaves through the investment world. Warren Buffett's Berkshire Hathaway offloaded significant stakes in two major US companies, leaving many wondering: what prompted these strategic moves? This analysis delves into the reasons behind Berkshire Hathaway's divestment of shares in these prominent companies, examining market trends, company performance, and Buffett's long-term investment philosophy.

Buffett's investment decisions are rarely arbitrary. They are meticulously researched and reflect a deep understanding of both macroeconomic factors and the specific dynamics of individual companies. His recent moves, therefore, warrant careful scrutiny. Understanding his rationale can offer valuable insights for investors of all levels.

The Companies in Question: While specific details vary depending on the reporting period, the divestment of significant holdings in companies like [Insert Company Name 1 - e.g., Activision Blizzard] and [Insert Company Name 2 - e.g., Verizon] have dominated headlines. This is particularly interesting given Berkshire Hathaway's long-term association with both entities.

Analyzing the Activision Blizzard Sale: Beyond the Gaming Sector

Berkshire Hathaway's sale of Activision Blizzard shares, following Microsoft's acquisition bid, sparked considerable debate. While some speculate that the sale was simply a profit-taking opportunity following the surge in Activision's share price, a deeper analysis suggests a more nuanced perspective.

- Regulatory Uncertainty: The Microsoft acquisition faced significant regulatory hurdles, creating uncertainty around the deal's ultimate success. Buffett, known for his aversion to risk and preference for predictable returns, may have deemed the uncertainty too great to warrant continued investment.

- Shifting Investment Strategy: Berkshire Hathaway's portfolio has increasingly focused on stable, dividend-paying companies in recent years. The gaming sector, while lucrative, is known for its volatility. This divestment could reflect a strategic shift away from high-growth, high-risk sectors.

- Alternative Opportunities: Buffett's philosophy involves constantly seeking better investment opportunities. The sale might indicate the identification of more promising ventures offering superior returns and lower risk profiles.

Verizon's Divestment: A Telecom Sector Reassessment?

The reduction of Berkshire Hathaway's stake in Verizon also raises important questions about the future of the telecom sector. This decision wasn't as dramatic as the Activision sale, but it still signals a potential reassessment of the company's long-term prospects by the legendary investor.

- Competitive Landscape: The increasingly competitive telecom landscape, with the rise of new technologies and aggressive competitors, presents challenges for established players like Verizon. Buffett's decision might reflect a concern about Verizon's ability to maintain its market share and profitability.

- 5G Rollout Costs: The substantial investment required for 5G infrastructure rollout could impact Verizon's short-term profitability. Buffett's decision may indicate a cautious approach to companies facing significant capital expenditure demands.

- Diversification Strategy: Even for a company as large and diversified as Berkshire Hathaway, managing risk is paramount. Reducing exposure to a specific sector allows for greater diversification across various industries.

Conclusion: Warren Buffett's investment decisions, while sometimes perplexing at first glance, invariably reflect a deep understanding of market dynamics and a long-term perspective. The sales of Activision Blizzard and Verizon shares highlight his adaptability and unwavering commitment to risk management and value investing. For aspiring investors, studying these decisions provides invaluable lessons in strategic portfolio management and understanding market trends. By analyzing these moves, investors can gain insights into current market sentiment and refine their own investment strategies. What are your thoughts on Buffett’s recent moves? Share your analysis in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analysis: Why Warren Buffett Sold These Two Prominent US Investments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Self Directed Gold Iras A Retirement Planning Guide

Jun 05, 2025

Self Directed Gold Iras A Retirement Planning Guide

Jun 05, 2025 -

Glastonbury 2025 Official Lineup Stage Times And Performance Schedule

Jun 05, 2025

Glastonbury 2025 Official Lineup Stage Times And Performance Schedule

Jun 05, 2025 -

Lost Grace Potter Recordings Emerge Opening The Vault Project Explored

Jun 05, 2025

Lost Grace Potter Recordings Emerge Opening The Vault Project Explored

Jun 05, 2025 -

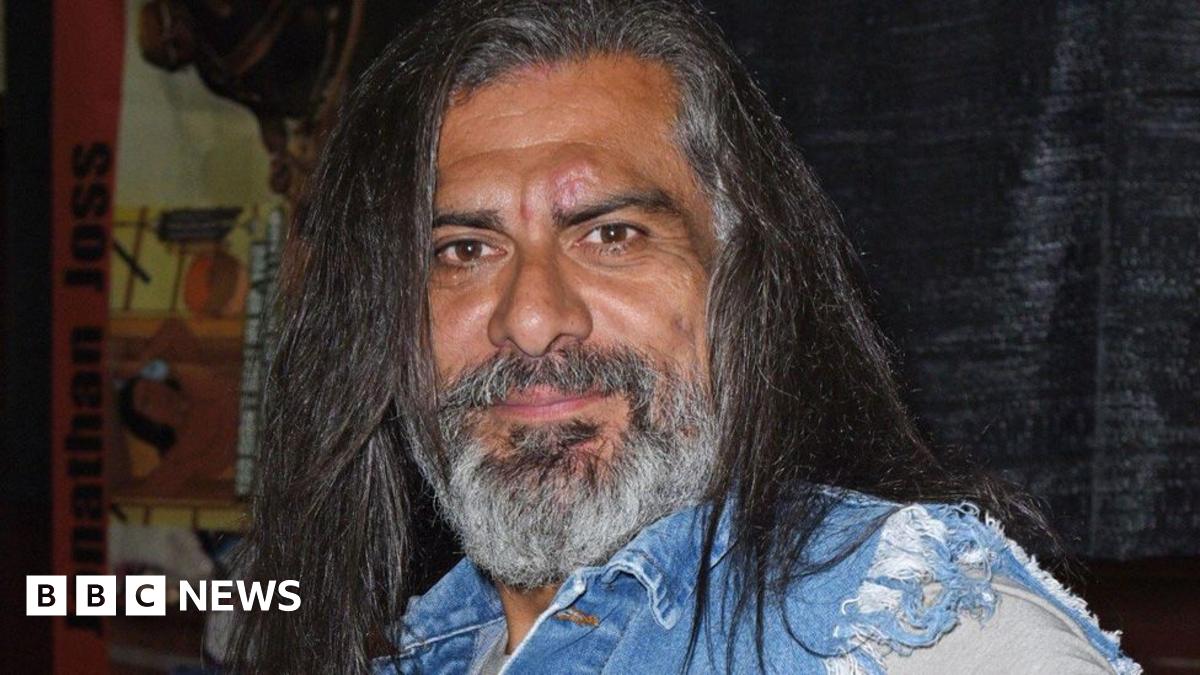

Actor Jonathan Joss King Of The Hills John Redcorn Fatally Shot

Jun 05, 2025

Actor Jonathan Joss King Of The Hills John Redcorn Fatally Shot

Jun 05, 2025 -

Warren Buffetts Stock Portfolio Shakeup Two Major Us Holdings Sold

Jun 05, 2025

Warren Buffetts Stock Portfolio Shakeup Two Major Us Holdings Sold

Jun 05, 2025

Latest Posts

-

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025 -

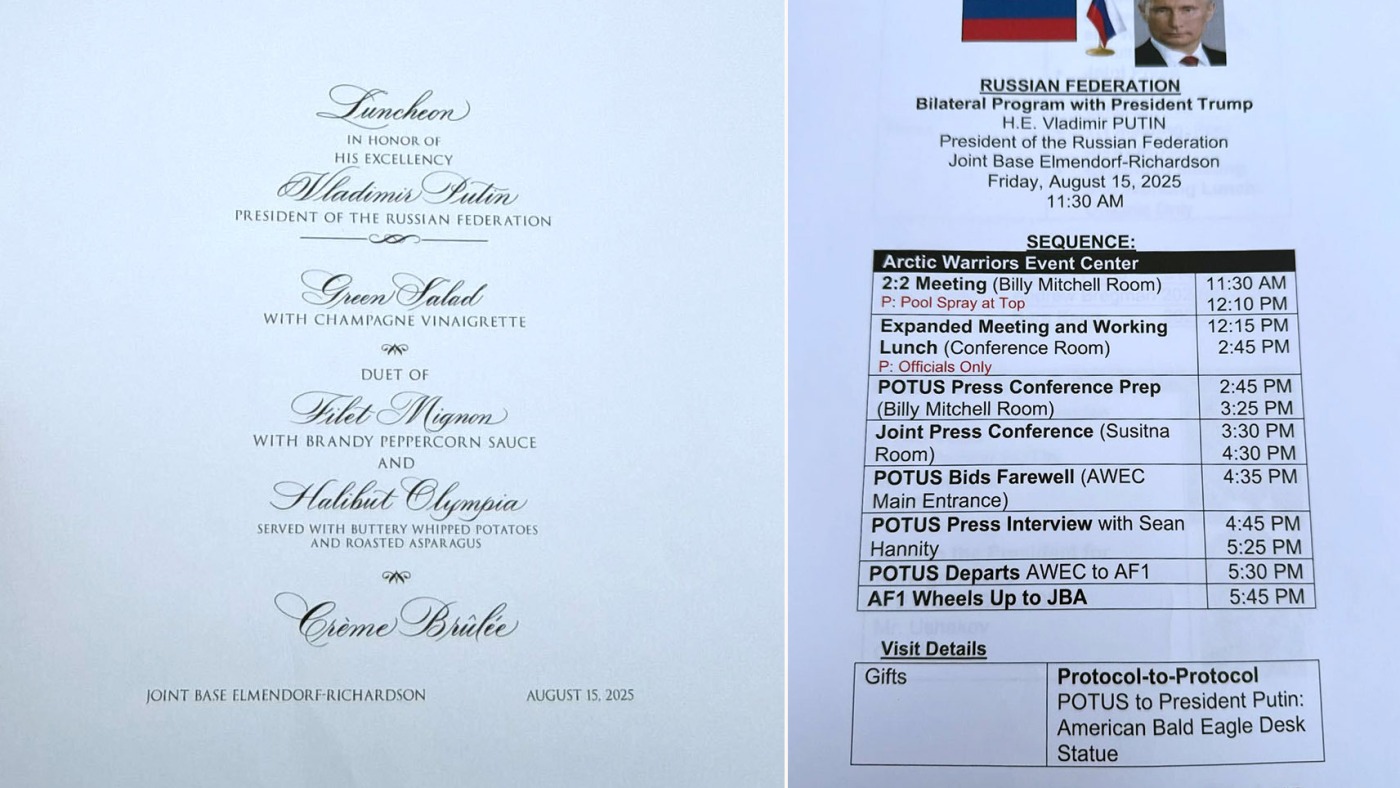

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025 -

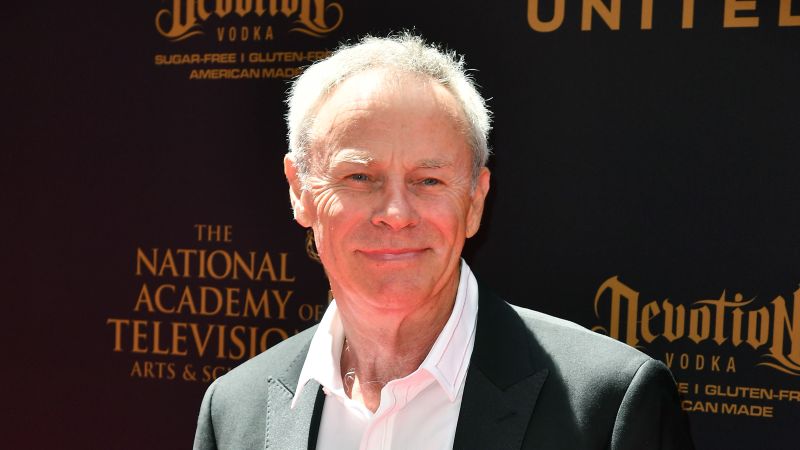

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025 -

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025 -

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025