Analyst Cuts Northwestern Energy (NWE) Rating To Hold; What's Next?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyst Cuts Northwestern Energy (NWE) Rating to Hold; What's Next?

Northwestern Energy (NWE), a major player in the utility sector, saw its stock rating downgraded by analysts at KeyCorp, sending ripples through the investment community. The move from "Buy" to "Hold" raises important questions about the future trajectory of NWE and its implications for investors. This article delves into the details of the downgrade, explores potential reasons behind the decision, and examines what investors can expect next from Northwestern Energy.

KeyCorp's Rationale: A Deeper Dive

KeyCorp's decision to lower the rating wasn't made lightly. While the specific reasoning hasn't been publicly detailed in excruciating depth, industry analysts point to several potential contributing factors. These include:

-

Regulatory Uncertainty: The utility sector is heavily regulated, and changes in regulations can significantly impact profitability. Recent shifts in environmental policies and potential changes to rate structures could be influencing analyst sentiment. Uncertainty surrounding these regulatory hurdles could be a key factor in the downgrade.

-

Increased Competition: The energy market is becoming increasingly competitive, with the rise of renewable energy sources and new players entering the field. Northwestern Energy may be facing increased pressure on pricing and market share, affecting its projected growth.

-

Economic Headwinds: Broader macroeconomic factors, such as inflation and potential economic slowdowns, can impact consumer spending and, consequently, utility demand. Analysts may be factoring in a more cautious economic outlook for the coming quarters.

-

Debt Levels: High levels of debt can constrain a company's ability to invest in growth and weather economic downturns. KeyCorp may have concerns about NWE's debt burden and its impact on future performance.

What This Means for Investors

The downgrade to "Hold" doesn't necessarily signal an impending crash for NWE. It suggests a more cautious approach, advising investors to hold their current positions rather than actively buying more stock at this time. However, it does raise questions about the potential for significant short-term gains.

Investors should carefully consider their individual risk tolerance and investment strategies. Those with a longer-term outlook might remain invested, viewing the current situation as a temporary setback. However, those seeking higher growth potential might consider diversifying their portfolio.

Analyzing the Future: Potential Scenarios

Several scenarios could unfold following this rating downgrade:

-

NWE Executes Strategic Initiatives: Northwestern Energy might respond by implementing strategic initiatives to improve profitability and address the concerns raised by KeyCorp. This could involve focusing on cost reduction, investing in renewable energy projects, or seeking further regulatory clarity. Successful execution of these initiatives could lead to a reassessment of the stock rating.

-

Market Reaction and Volatility: The stock market's reaction to the downgrade will be crucial. Increased volatility is possible in the short term, presenting both risks and opportunities for investors. Careful monitoring of market trends is recommended.

-

Further Analyst Reviews: Other analysts may follow suit, issuing their own ratings and reports. A convergence of negative opinions could put further downward pressure on the stock price. Conversely, dissenting opinions offering a more optimistic perspective could provide a counterbalance.

Call to Action: Stay informed by following reputable financial news sources and consulting with a qualified financial advisor to determine the best course of action for your investment portfolio based on your individual circumstances and risk tolerance. Thorough due diligence is paramount before making any significant investment decisions.

Keywords: Northwestern Energy, NWE, Stock Rating Downgrade, KeyCorp, Utility Sector, Investment Strategy, Stock Market, Regulatory Uncertainty, Economic Headwinds, Renewable Energy, Financial Analysis, Investment Advice

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyst Cuts Northwestern Energy (NWE) Rating To Hold; What's Next?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Buffetts Billionaire Move Bank Of America Sell Off Fuels Consumer Brand Investment

Jun 04, 2025

Buffetts Billionaire Move Bank Of America Sell Off Fuels Consumer Brand Investment

Jun 04, 2025 -

All American Rejects Concert Shut Down By Police College Town Show Cancelled

Jun 04, 2025

All American Rejects Concert Shut Down By Police College Town Show Cancelled

Jun 04, 2025 -

Tiafoe Continues U S Open Success Musettis Top 10 Breakthrough

Jun 04, 2025

Tiafoe Continues U S Open Success Musettis Top 10 Breakthrough

Jun 04, 2025 -

Etna Volcano Spews Lava Tourist Evacuation Captured On Video

Jun 04, 2025

Etna Volcano Spews Lava Tourist Evacuation Captured On Video

Jun 04, 2025 -

American Tennis Triumph Tiafoes Historic Roland Garros Victory

Jun 04, 2025

American Tennis Triumph Tiafoes Historic Roland Garros Victory

Jun 04, 2025

Latest Posts

-

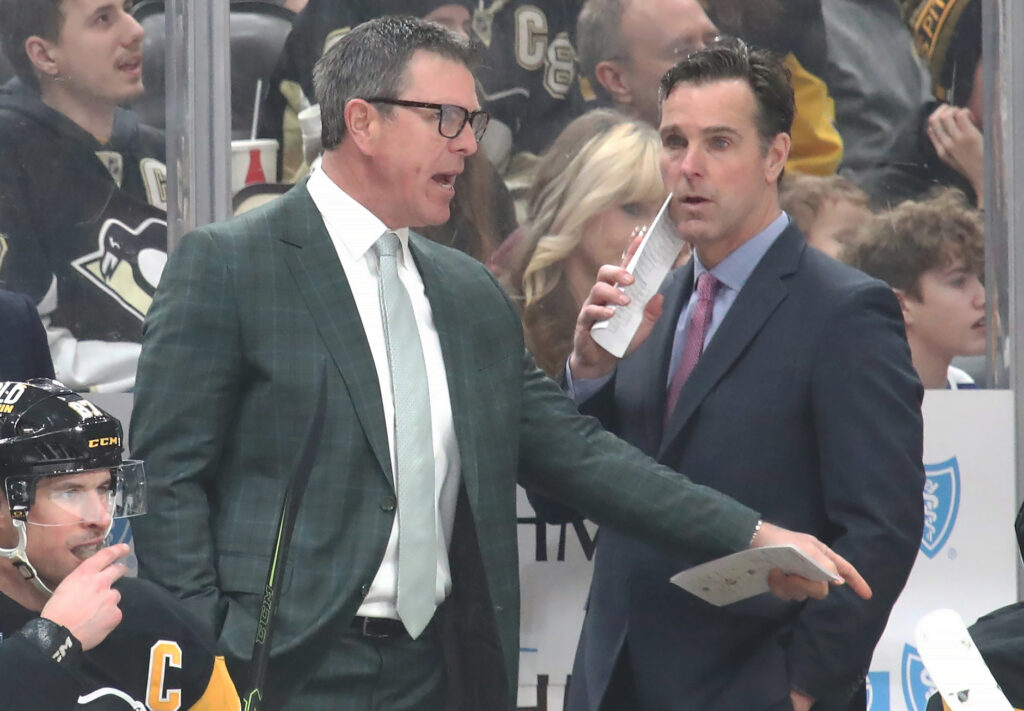

David Quinn And Joe Sacco Join Rangers Coaching Team

Jun 06, 2025

David Quinn And Joe Sacco Join Rangers Coaching Team

Jun 06, 2025 -

Harry Enten Deconstructs Mike Lindells Business And Political Career On Cnn

Jun 06, 2025

Harry Enten Deconstructs Mike Lindells Business And Political Career On Cnn

Jun 06, 2025 -

The Unique Demands Of Clay Why Roland Garros Is Different

Jun 06, 2025

The Unique Demands Of Clay Why Roland Garros Is Different

Jun 06, 2025 -

Is Coca Cola Ko Stock A Buy Analyzing The Investment Potential

Jun 06, 2025

Is Coca Cola Ko Stock A Buy Analyzing The Investment Potential

Jun 06, 2025 -

Madeleine Mc Cann Case Still Unsolved After 18 Years

Jun 06, 2025

Madeleine Mc Cann Case Still Unsolved After 18 Years

Jun 06, 2025