Analyst Downgrade: Ladenburg Thalmann Cuts Northwestern Energy (NWE) Rating

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyst Downgrade Shakes Northwestern Energy (NWE): Ladenburg Thalmann Cuts Rating

Northwestern Energy (NWE), a major player in the utility sector, experienced a significant market shake-up today following a rating downgrade from Ladenburg Thalmann. The analyst firm lowered its rating on NWE, sending ripples through the energy investment landscape and prompting investors to re-evaluate their positions. This unexpected move highlights growing concerns within the financial community regarding the company's future performance. Understanding the reasons behind this downgrade is crucial for anyone holding NWE stock or considering an investment.

Ladenburg Thalmann's Rationale: A Closer Look

Ladenburg Thalmann cited several key factors contributing to their decision to downgrade Northwestern Energy. While the specific details haven't been fully disclosed publicly, preliminary reports suggest concerns about:

-

Regulatory Uncertainty: The utility sector is heavily regulated, and changes in regulations can significantly impact profitability. Recent legislative developments at both the state and federal levels might be influencing Ladenburg Thalmann's assessment of NWE's future earnings potential. This regulatory uncertainty is a common concern among investors in the energy sector.

-

Competition and Market Dynamics: Increased competition within the energy market, particularly from renewable energy sources, could be impacting NWE's market share and pricing power. The shift towards cleaner energy is forcing traditional utilities to adapt, and Ladenburg Thalmann may believe NWE's response isn't robust enough.

-

Long-Term Growth Prospects: The analyst firm's downgrade likely reflects a reassessment of NWE's long-term growth trajectory. This might involve considerations of capital expenditures, infrastructure upgrades, and the overall potential for sustainable revenue growth in the coming years. Investors are always keenly interested in a company's long-term prospects.

NWE Stock Performance: Immediate Impact and Future Outlook

The announcement of the downgrade immediately impacted NWE's stock price, resulting in a noticeable drop. The severity of the decline will depend on investor reaction and the overall market sentiment. It's important to note that stock prices are volatile, and short-term fluctuations don't necessarily reflect the company's long-term value.

However, this downgrade serves as a cautionary signal for investors. It's crucial to conduct thorough due diligence before making any investment decisions, especially following a negative analyst report. Understanding the full details of Ladenburg Thalmann's analysis will be critical for informed decision-making.

What Investors Should Do Next:

Investors currently holding NWE stock should carefully review their investment strategy in light of this news. Consider consulting with a financial advisor to discuss the implications of the downgrade and potential adjustments to your portfolio. Those considering investing in NWE should thoroughly research the company's financials and future prospects before committing capital. Staying informed about industry trends and regulatory changes is also essential for navigating the complexities of the energy sector.

Further Reading:

For more in-depth analysis of the utility sector and related investment opportunities, we recommend exploring resources such as [link to relevant financial news website] and [link to SEC filings for NWE].

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyst Downgrade: Ladenburg Thalmann Cuts Northwestern Energy (NWE) Rating. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sustainable Luxury Furniture Crafted Over A Decade Priced Accordingly

Jun 03, 2025

Sustainable Luxury Furniture Crafted Over A Decade Priced Accordingly

Jun 03, 2025 -

Draper Defeats Monfils In French Open Thriller Djokovic Sinner Victorious

Jun 03, 2025

Draper Defeats Monfils In French Open Thriller Djokovic Sinner Victorious

Jun 03, 2025 -

Baptistes Winning Formula The Power Of The Tiafoe Connection

Jun 03, 2025

Baptistes Winning Formula The Power Of The Tiafoe Connection

Jun 03, 2025 -

Musetti Upsets Rune Earns First Top 10 Masters Win

Jun 03, 2025

Musetti Upsets Rune Earns First Top 10 Masters Win

Jun 03, 2025 -

Nyt Spelling Bee Hints Spangram And Answers For June 3rd

Jun 03, 2025

Nyt Spelling Bee Hints Spangram And Answers For June 3rd

Jun 03, 2025

Latest Posts

-

Urgent Aid Needed Gaza Faces Humanitarian Catastrophe After Workers Death

Aug 03, 2025

Urgent Aid Needed Gaza Faces Humanitarian Catastrophe After Workers Death

Aug 03, 2025 -

Catch Up Top Entertainment Stories From Fox News Flash This Week

Aug 03, 2025

Catch Up Top Entertainment Stories From Fox News Flash This Week

Aug 03, 2025 -

Fox News Flash Top Entertainment Headlines This Week

Aug 03, 2025

Fox News Flash Top Entertainment Headlines This Week

Aug 03, 2025 -

How Did The Manhattan Shooter Obtain A Gun Despite Past Psychiatric Holds

Aug 03, 2025

How Did The Manhattan Shooter Obtain A Gun Despite Past Psychiatric Holds

Aug 03, 2025 -

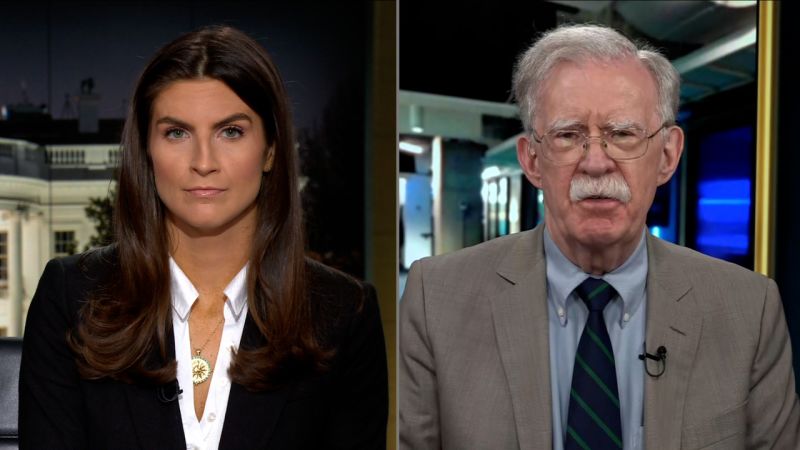

Very Risky Business Bolton Criticizes Trumps Controversial Nuclear Submarine Plan

Aug 03, 2025

Very Risky Business Bolton Criticizes Trumps Controversial Nuclear Submarine Plan

Aug 03, 2025