Analyst Downgrade: Northwestern Energy (NWE) Receives Hold Rating

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyst Downgrade: Northwestern Energy (NWE) Receives Hold Rating - What Investors Need to Know

Northwestern Energy (NWE), a prominent player in the utility sector, recently faced a downgrade from analysts at KeyCorp, shifting their rating from "Buy" to "Hold." This move sent ripples through the market, prompting investors to reassess their positions in the company. This article delves into the details of the downgrade, exploring the reasoning behind the analysts' decision and its potential implications for NWE shareholders.

KeyCorp's Rationale for the Downgrade:

KeyCorp cited several factors contributing to their decision to downgrade Northwestern Energy. These include concerns about:

-

Regulatory Headwinds: The utility sector is heavily regulated, and changes in regulatory environments can significantly impact profitability. KeyCorp likely identified potential regulatory hurdles that could constrain NWE's future earnings growth. This is a common concern among utility companies, as regulatory bodies often scrutinize rate increases and investment projects.

-

Increased Competition: The energy landscape is evolving rapidly, with increasing competition from renewable energy sources and new technologies. This competitive pressure might affect NWE's market share and pricing power. Investors should consider the impact of decentralized energy generation and the growing adoption of solar and wind power on NWE's long-term prospects.

-

Economic Uncertainty: Broader macroeconomic factors, such as inflation and potential recessionary pressures, also play a role. These uncertainties can impact consumer spending and affect demand for electricity, directly impacting NWE's revenue streams. Understanding the overall economic climate is crucial when assessing the performance of utility stocks like NWE.

-

Debt Levels: High levels of debt can constrain a company's financial flexibility. KeyCorp's analysis may have flagged concerns about NWE's debt-to-equity ratio or its ability to manage its debt obligations effectively in the current economic environment. Analyzing a company's financial statements, including its balance sheet, is key to understanding its financial health.

What Does This Mean for NWE Investors?

The "Hold" rating doesn't necessarily signal an immediate sell-off. However, it suggests that KeyCorp analysts believe the potential for significant upside in NWE's stock price is currently limited. Investors should:

-

Review their own investment thesis: Consider whether the factors cited by KeyCorp align with your own assessment of NWE's risks and opportunities. Do your own due diligence before making any investment decisions.

-

Monitor future developments: Keep an eye on NWE's financial performance, regulatory updates, and any further analyst commentary. The situation could change based on future events.

-

Diversify your portfolio: Reducing your concentration in any single stock, including NWE, is a prudent risk management strategy. A diversified portfolio can help mitigate losses if one investment underperforms.

Looking Ahead for Northwestern Energy:

Northwestern Energy remains a significant player in its region, providing essential services. However, the analyst downgrade highlights the challenges facing utility companies in a changing energy market. Investors need to carefully consider the long-term prospects of NWE in light of these challenges and the broader macroeconomic environment. Further research and monitoring of the company's performance are crucial for informed decision-making.

Disclaimer: This article provides information for educational purposes only and is not financial advice. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyst Downgrade: Northwestern Energy (NWE) Receives Hold Rating. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tom Daleys Movie Why He Wants Tom Holland As The Lead

Jun 04, 2025

Tom Daleys Movie Why He Wants Tom Holland As The Lead

Jun 04, 2025 -

Noise Complaint Ends All American Rejects College Town Performance

Jun 04, 2025

Noise Complaint Ends All American Rejects College Town Performance

Jun 04, 2025 -

Tom Daleys Biopic Choice Why He Wants Tom Holland To Star

Jun 04, 2025

Tom Daleys Biopic Choice Why He Wants Tom Holland To Star

Jun 04, 2025 -

Mets Call Up Ronny Mauricio Is He The Next Big Thing

Jun 04, 2025

Mets Call Up Ronny Mauricio Is He The Next Big Thing

Jun 04, 2025 -

Binge Worthy And Hilarious This New Netflix Comedy Is Taking Over

Jun 04, 2025

Binge Worthy And Hilarious This New Netflix Comedy Is Taking Over

Jun 04, 2025

Latest Posts

-

The Robinhood Investment Case Pros Cons And Future Outlook

Jun 06, 2025

The Robinhood Investment Case Pros Cons And Future Outlook

Jun 06, 2025 -

Search Ends Body Recovered In Portugal Missing Stag Party Attendee Confirmed

Jun 06, 2025

Search Ends Body Recovered In Portugal Missing Stag Party Attendee Confirmed

Jun 06, 2025 -

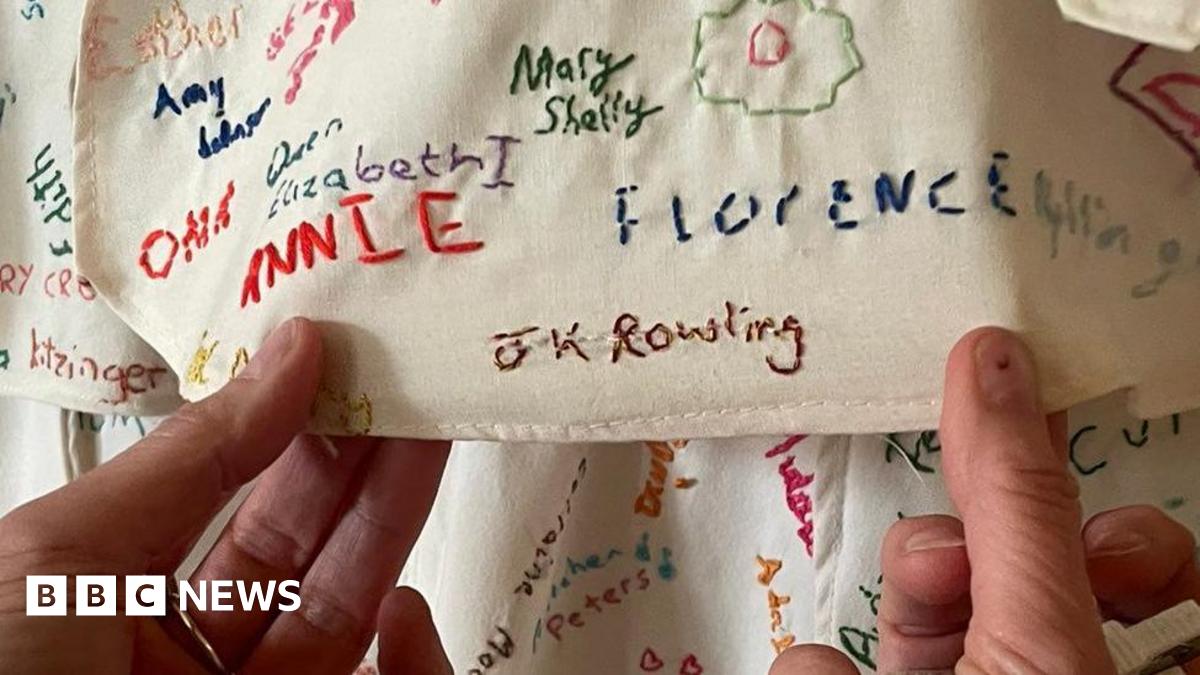

Derbyshire National Trust Property Hides Damaged J K Rowling Related Artwork

Jun 06, 2025

Derbyshire National Trust Property Hides Damaged J K Rowling Related Artwork

Jun 06, 2025 -

Heart Operation Deaths At Nhs Hospital Lead To Major Police Inquiry

Jun 06, 2025

Heart Operation Deaths At Nhs Hospital Lead To Major Police Inquiry

Jun 06, 2025 -

Summer House Star Paige De Sorbo Announces Departure After Seven Years

Jun 06, 2025

Summer House Star Paige De Sorbo Announces Departure After Seven Years

Jun 06, 2025