Analyst Downgrade: Northwestern Energy (NWE) Stock Now A Hold

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyst Downgrade: Northwestern Energy (NWE) Stock Now a Hold – What Investors Need to Know

Northwestern Energy (NWE), a prominent player in the utility sector, has received a significant downgrade from a leading financial analyst, shifting the stock's outlook from a buy to a hold. This decision sends ripples through the investment community, prompting investors to reassess their positions in the company. This article delves into the reasons behind the downgrade, its potential implications for NWE stock, and what this means for current and prospective shareholders.

The Downgrade: A Closer Look

The downgrade, issued by [Analyst Firm Name – replace with actual firm name], cites [Specific reason 1 – e.g., concerns about regulatory hurdles] and [Specific reason 2 – e.g., increased competition in the renewable energy market] as the primary factors influencing their decision. The analysts lowered their price target for NWE from [Previous Price Target] to [New Price Target], reflecting a more cautious outlook on the company's future performance. This isn't the first time NWE has faced analyst scrutiny; however, this particular downgrade carries significant weight due to [Analyst Firm Name]'s reputation and influence within the market.

Understanding the Implications for NWE Investors

This shift from a "buy" to a "hold" recommendation doesn't necessarily signal an impending disaster for NWE. However, it does suggest a period of uncertainty and potentially slower growth compared to previous projections. Investors should consider several key factors:

- Regulatory Uncertainty: The utility sector is heavily regulated, and changes in regulations can significantly impact profitability. NWE's exposure to potential regulatory challenges warrants careful consideration.

- Competitive Landscape: The increasing adoption of renewable energy sources introduces new competitors into the market, potentially putting pressure on NWE's traditional energy business.

- Long-Term Growth Potential: While the short-term outlook might be less optimistic, investors need to assess NWE's long-term growth prospects. This requires examining their strategic initiatives and their ability to adapt to the evolving energy landscape.

What Should Investors Do?

The decision to buy, hold, or sell NWE stock depends entirely on individual investment strategies and risk tolerance. However, the analyst downgrade serves as a crucial data point to consider. Here are some steps investors might take:

- Review your investment strategy: Re-evaluate your portfolio allocation and determine if NWE still aligns with your long-term financial goals.

- Conduct thorough due diligence: Independently research NWE's financial statements, recent news, and future projections.

- Seek professional advice: Consult with a qualified financial advisor to discuss your options and tailor a strategy that best suits your needs.

Beyond the Downgrade: Looking Ahead for Northwestern Energy

While this downgrade is undoubtedly a setback, it's crucial to avoid knee-jerk reactions. Northwestern Energy remains a significant player in the utility sector, and its long-term prospects depend heavily on its ability to navigate regulatory hurdles, adapt to market changes, and embrace sustainable energy solutions. Keeping a close eye on the company's performance, strategic decisions, and upcoming regulatory announcements is vital for all investors.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial professional before making any investment decisions.

Keywords: Northwestern Energy, NWE, stock, analyst downgrade, hold, buy, sell, utility sector, renewable energy, regulatory hurdles, investment, financial advice, stock market, price target, investor, portfolio, due diligence.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyst Downgrade: Northwestern Energy (NWE) Stock Now A Hold. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Semi Automatic Weapon Bans Supreme Court Allows State Restrictions

Jun 03, 2025

Semi Automatic Weapon Bans Supreme Court Allows State Restrictions

Jun 03, 2025 -

Critics And Fans Agree This Netflix Comedy Is A Must Watch

Jun 03, 2025

Critics And Fans Agree This Netflix Comedy Is A Must Watch

Jun 03, 2025 -

Drone Warfare In Ukraine Assessing The Impact On Russia And The West

Jun 03, 2025

Drone Warfare In Ukraine Assessing The Impact On Russia And The West

Jun 03, 2025 -

Nuclear Capable Jets And Political Implications Deciphering Recent News

Jun 03, 2025

Nuclear Capable Jets And Political Implications Deciphering Recent News

Jun 03, 2025 -

Reglement Roland Garros Baptiste Et Son Equipementier

Jun 03, 2025

Reglement Roland Garros Baptiste Et Son Equipementier

Jun 03, 2025

Latest Posts

-

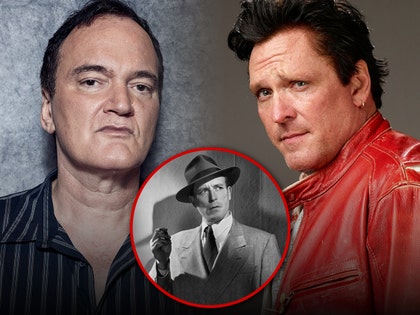

Actor Michael Madsen On Lawrence Tierneys Dismissal From Tarantino Film

Aug 02, 2025

Actor Michael Madsen On Lawrence Tierneys Dismissal From Tarantino Film

Aug 02, 2025 -

Michael Madsen Remembered Tarantino Speaks Out At Star Studded Funeral

Aug 02, 2025

Michael Madsen Remembered Tarantino Speaks Out At Star Studded Funeral

Aug 02, 2025 -

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025 -

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025 -

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025