Analyst Rating Change: Northwestern Energy (NWE) Stock Outlook Shifts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyst Rating Change: Northwestern Energy (NWE) Stock Outlook Shifts

Northwestern Energy (NWE), a prominent player in the utility sector, has seen its stock outlook shift following a recent analyst rating change. This development has sent ripples through the investment community, prompting investors to reassess their positions and consider the implications for future performance. Understanding the reasons behind this shift is crucial for anyone holding or considering investing in NWE stock.

Key Rating Change and Market Reaction:

The recent downgrade (or upgrade – replace with the actual rating change and specify the brokerage firm) from [Brokerage Firm Name] has significantly impacted NWE's stock price. The change from [Previous Rating] to [New Rating] reflects a revised outlook on the company's prospects. While the immediate market reaction was [describe the market reaction - e.g., a dip in stock price, increased trading volume], the long-term implications are still unfolding. Investors are now carefully scrutinizing the company's financial statements and future projections to gauge the accuracy of this new assessment.

Reasons Behind the Analyst Rating Change:

The rationale behind the altered rating is multi-faceted and likely stems from a combination of factors. These might include:

- Changes in Regulatory Environment: The utility sector is heavily regulated, and any shifts in regulatory policies can significantly impact a company's profitability. Recent changes in [mention specific regulations, e.g., renewable energy mandates, rate adjustments] could be contributing to the analyst's revised outlook.

- Financial Performance: A decline in profitability, revenue growth, or an increase in debt could trigger a rating downgrade. Investors should examine NWE's latest financial reports (available on their investor relations page and through SEC filings) for a deeper understanding.

- Future Growth Prospects: Analysts often consider a company's future growth trajectory. Factors such as competition, technological advancements (e.g., the rise of renewable energy sources), and expansion plans all contribute to the long-term outlook. NWE's strategy regarding renewable energy integration and grid modernization will be key indicators for future growth.

- Macroeconomic Factors: Broader economic conditions, such as interest rate hikes or inflation, can also influence analyst ratings. These macro factors often impact the utility sector, as they affect both capital investment and consumer spending.

What This Means for Investors:

This analyst rating change serves as a crucial piece of information, but it shouldn't be the sole factor guiding investment decisions. Investors should conduct thorough due diligence, including:

- Reviewing NWE's financial statements: Analyze key performance indicators (KPIs) such as revenue, earnings per share (EPS), and debt levels.

- Understanding the company's long-term strategy: Assess NWE's plans for growth, including investments in renewable energy and grid modernization.

- Considering the broader market context: Evaluate the overall economic climate and its potential impact on the utility sector.

- Diversifying your portfolio: Never put all your eggs in one basket. Diversification is crucial for mitigating risk.

Conclusion:

The analyst rating change for Northwestern Energy (NWE) highlights the dynamic nature of the stock market and the importance of staying informed. While this change provides valuable insight, investors should conduct comprehensive research before making any investment decisions. Remember to consult with a financial advisor for personalized guidance tailored to your investment goals and risk tolerance. Stay tuned for further updates on NWE's performance and future developments.

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyst Rating Change: Northwestern Energy (NWE) Stock Outlook Shifts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Volcanic Eruption Mount Etnas Powerful Blast Sends Ash Plume Into The Air

Jun 03, 2025

Volcanic Eruption Mount Etnas Powerful Blast Sends Ash Plume Into The Air

Jun 03, 2025 -

The Price Of Patience Furniture Crafted Over A Decade

Jun 03, 2025

The Price Of Patience Furniture Crafted Over A Decade

Jun 03, 2025 -

Look Whos Back Analyzing The Implications Of A Political Resurgence

Jun 03, 2025

Look Whos Back Analyzing The Implications Of A Political Resurgence

Jun 03, 2025 -

Impressive Showing Eight Americans Progress In French Open

Jun 03, 2025

Impressive Showing Eight Americans Progress In French Open

Jun 03, 2025 -

Deadly Clashes Erupt In Paris Two Dead 500 Detained After Psg Triumph

Jun 03, 2025

Deadly Clashes Erupt In Paris Two Dead 500 Detained After Psg Triumph

Jun 03, 2025

Latest Posts

-

Analyzing Cyberpunk 2077s Potential On Switch 2 An Xbox Series S Comparison

Aug 03, 2025

Analyzing Cyberpunk 2077s Potential On Switch 2 An Xbox Series S Comparison

Aug 03, 2025 -

Enduring Legacy Remembering Nypd Officer Didarul Islam

Aug 03, 2025

Enduring Legacy Remembering Nypd Officer Didarul Islam

Aug 03, 2025 -

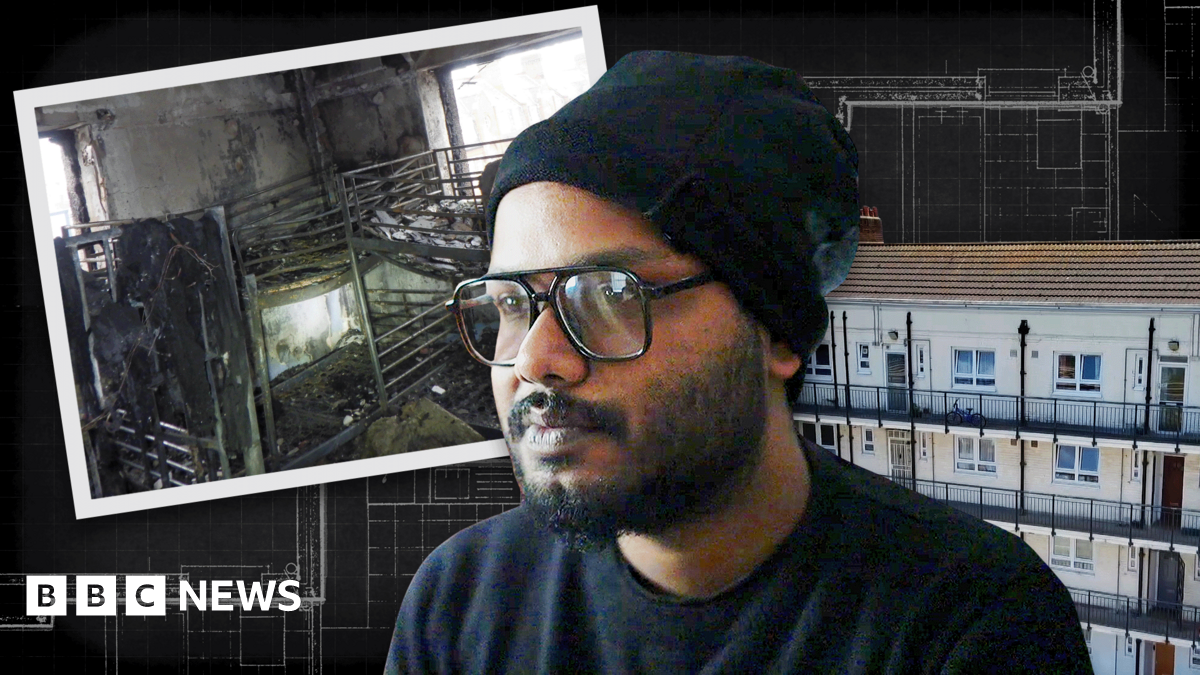

Illegal House Shares A Dangerous Mix Of Rats Mold And Overcrowding

Aug 03, 2025

Illegal House Shares A Dangerous Mix Of Rats Mold And Overcrowding

Aug 03, 2025 -

El Salvador Reeleccion Presidencial Indefinida Y Extension Del Periodo A 6 Anos Analisis Politico

Aug 03, 2025

El Salvador Reeleccion Presidencial Indefinida Y Extension Del Periodo A 6 Anos Analisis Politico

Aug 03, 2025 -

Dexters Return Analyzing The Performance Anxiety In Resurrection

Aug 03, 2025

Dexters Return Analyzing The Performance Anxiety In Resurrection

Aug 03, 2025