Analyzing Coca-Cola (KO): Should Investors Buy, Sell, Or Hold?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Coca-Cola (KO): Should Investors Buy, Sell, or Hold?

Coca-Cola (KO), a global beverage giant, has long been a staple in many investors' portfolios. But with fluctuating market conditions and evolving consumer preferences, the question remains: is now the right time to buy, sell, or hold KO stock? This in-depth analysis examines the company's performance, future prospects, and potential risks to help you make an informed investment decision.

Coca-Cola's Recent Performance: A Mixed Bag

Coca-Cola's Q2 2024 earnings report revealed a complex picture. While revenue growth exceeded expectations, driven by strong pricing and a recovery in away-from-home consumption, profit margins faced pressure due to increased input costs. This highlights a key challenge for the company: balancing price increases with maintaining consumer demand in an inflationary environment. Analyzing the company's financials, including its revenue growth, EPS (earnings per share), and P/E ratio, is crucial for understanding its current valuation. [Link to reliable financial news source with KO's Q2 results].

Growth Strategies and Future Outlook

Coca-Cola is actively diversifying its portfolio beyond its flagship cola. The company is investing heavily in:

- Healthier beverage options: Recognizing shifting consumer preferences towards healthier choices, Coca-Cola is expanding its range of zero-sugar and low-calorie drinks, as well as exploring new categories like functional beverages. This strategic move aims to capture a larger share of the growing health-conscious market.

- Strategic partnerships and acquisitions: Acquisitions and collaborations allow Coca-Cola to expand its reach into new markets and tap into innovative product lines. By partnering with other established brands and startups, Coca-Cola can leverage their expertise and accelerate its expansion.

- Sustainable practices: Increasingly, consumers are prioritizing environmentally responsible companies. Coca-Cola's commitment to sustainability, including reducing its carbon footprint and promoting responsible water management, can be a significant factor in attracting environmentally conscious investors.

However, challenges remain. Competition in the beverage industry is fierce, with both established players and emerging brands vying for market share. Geopolitical instability and fluctuating currency exchange rates also pose risks to Coca-Cola's global operations.

Risks to Consider:

- Inflationary pressures: Rising input costs, including sugar and packaging materials, continue to squeeze profit margins. Coca-Cola's ability to effectively manage these costs will be critical for maintaining profitability.

- Changing consumer preferences: The shift towards healthier beverages represents both an opportunity and a challenge. Coca-Cola needs to successfully navigate this change to maintain its market leadership.

- Geopolitical risks: International operations expose Coca-Cola to geopolitical risks, including trade wars, political instability, and currency fluctuations.

Should You Buy, Sell, or Hold?

The decision to buy, sell, or hold Coca-Cola stock depends on your individual investment goals and risk tolerance. While Coca-Cola boasts a strong brand recognition, a diversified portfolio, and a history of dividend payments, the current economic climate presents certain challenges. Investors should carefully weigh the company's strengths and weaknesses, considering the potential risks and rewards before making any investment decisions. Conduct thorough due diligence, including reviewing financial statements and industry analyses, before making any investment decisions. Consulting a financial advisor is also recommended.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Coca-Cola (KO): Should Investors Buy, Sell, Or Hold?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

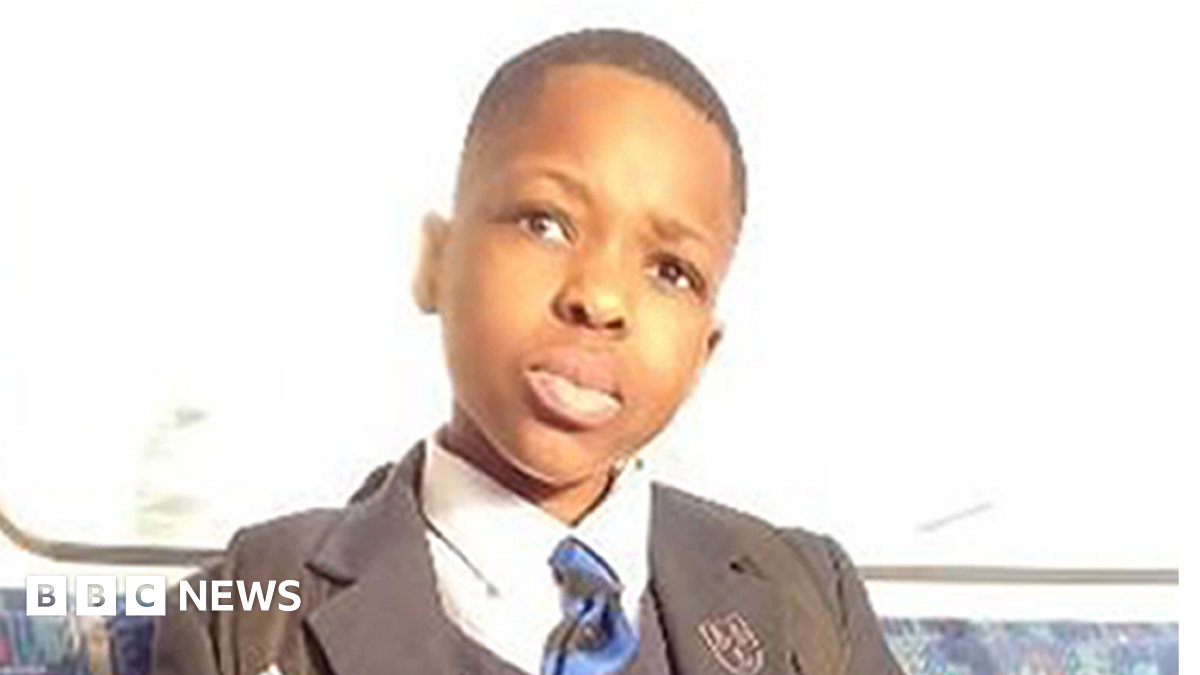

Murder Trial Witness Testifies On Monzos Intent To Kill Anjorin

Jun 06, 2025

Murder Trial Witness Testifies On Monzos Intent To Kill Anjorin

Jun 06, 2025 -

Supreme Court Ruling Heterosexual Plaintiff Prevails In Reverse Discrimination Dispute

Jun 06, 2025

Supreme Court Ruling Heterosexual Plaintiff Prevails In Reverse Discrimination Dispute

Jun 06, 2025 -

Steve Guttenberg On His New Thriller Kidnapped By A Killer

Jun 06, 2025

Steve Guttenberg On His New Thriller Kidnapped By A Killer

Jun 06, 2025 -

Camila Cabellos Former Partner Announces Baby News

Jun 06, 2025

Camila Cabellos Former Partner Announces Baby News

Jun 06, 2025 -

Trump Launches Probe Into Bidens Actions And Autopen Use Citing Cognitive Decline Concerns

Jun 06, 2025

Trump Launches Probe Into Bidens Actions And Autopen Use Citing Cognitive Decline Concerns

Jun 06, 2025

Latest Posts

-

K9 Retirement The Fight For Pensions For Our Working Dog Heroes

Jun 07, 2025

K9 Retirement The Fight For Pensions For Our Working Dog Heroes

Jun 07, 2025 -

Aplds Hyperscale Ambitions A 5 Billion Expansion Plan

Jun 07, 2025

Aplds Hyperscale Ambitions A 5 Billion Expansion Plan

Jun 07, 2025 -

Applied Digital Skyrockets 7 Billion Core Weave Ai Lease Fuels 48 Surge

Jun 07, 2025

Applied Digital Skyrockets 7 Billion Core Weave Ai Lease Fuels 48 Surge

Jun 07, 2025 -

The Importance Of The Scholz Trump Meeting Implications For Transatlantic Relations

Jun 07, 2025

The Importance Of The Scholz Trump Meeting Implications For Transatlantic Relations

Jun 07, 2025 -

Cognitive Decline Allegations Fuel Trumps Investigation Into Bidens Presidential Actions

Jun 07, 2025

Cognitive Decline Allegations Fuel Trumps Investigation Into Bidens Presidential Actions

Jun 07, 2025