Analyzing Coca-Cola's (KO) Financial Health And Investment Potential

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Coca-Cola's (KO) Financial Health and Investment Potential: A Deep Dive

Coca-Cola (KO), a name synonymous with refreshment and global reach, remains a compelling investment case for many, but is it the right choice for you? This in-depth analysis examines Coca-Cola's financial health, exploring its strengths and weaknesses to assess its current investment potential. We'll delve into key financial metrics, market position, and future growth prospects to provide a comprehensive overview.

Coca-Cola's Financial Strengths: A Solid Foundation

Coca-Cola boasts a robust financial profile characterized by several key strengths:

-

Strong Brand Recognition and Global Reach: The iconic Coca-Cola brand enjoys unparalleled global recognition, providing a significant competitive advantage. This brand loyalty translates into consistent demand, even during economic downturns. Their diverse portfolio, encompassing brands like Sprite, Fanta, and Minute Maid, further diversifies their revenue streams.

-

Consistent Dividend Payments: For income-focused investors, Coca-Cola’s history of consistent dividend payments is a major draw. The company has a long track record of increasing its dividend, making it attractive for those seeking regular income streams. [Link to a reputable financial site showing KO dividend history]

-

Efficient Operations and Cost Management: Coca-Cola has demonstrated a commitment to operational efficiency and cost management, allowing it to maintain profitability even in challenging market conditions. This focus on efficiency helps bolster their bottom line and supports their dividend payouts.

-

Strategic Acquisitions and Diversification: Coca-Cola's strategic acquisitions and expansion into various beverage categories have broadened its product portfolio and reduced reliance on its flagship cola. This diversification mitigates risks associated with changing consumer preferences.

Challenges and Risks Facing Coca-Cola

Despite its strengths, Coca-Cola faces several challenges:

-

Shifting Consumer Preferences: Growing health consciousness among consumers is pushing demand towards healthier beverages. This shift presents a challenge to Coca-Cola's traditionally sugar-laden product lineup, requiring strategic adaptation and innovation.

-

Competition in the Beverage Industry: The beverage industry is highly competitive, with both established players and new entrants vying for market share. Coca-Cola needs to continually innovate and adapt to maintain its leading position.

-

Supply Chain Disruptions and Inflationary Pressures: Like many companies, Coca-Cola has experienced challenges related to global supply chain disruptions and inflationary pressures, impacting production costs and profitability.

Analyzing Key Financial Metrics

To gauge Coca-Cola's financial health, let's examine some key metrics:

-

Revenue Growth: Analyze the year-over-year revenue growth to assess the company's ability to expand its market share and generate sales. [Link to a reputable financial site showing KO revenue data]

-

Profitability Margins: Examine the gross and net profit margins to understand the company's efficiency and profitability. [Link to a reputable financial site showing KO profit margin data]

-

Debt Levels: Assess the company's debt-to-equity ratio to understand its financial leverage and risk profile. [Link to a reputable financial site showing KO debt data]

Investment Potential: A Cautious Optimism

Coca-Cola's long history, strong brand recognition, and consistent dividend payments make it an attractive investment for many. However, the challenges posed by shifting consumer preferences and intense competition require careful consideration. Investors should conduct thorough due diligence and consider their own risk tolerance before investing in Coca-Cola stock.

Conclusion: A Long-Term Play?

Coca-Cola's future success depends on its ability to adapt to evolving consumer preferences and maintain its market leadership. While the company faces challenges, its strong brand, efficient operations, and consistent dividend payouts suggest a relatively stable outlook. However, investors should maintain a long-term perspective and carefully monitor the company's performance and strategic initiatives before making an investment decision. Remember to consult with a financial advisor before making any investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Coca-Cola's (KO) Financial Health And Investment Potential. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Paige De Sorbo Bids Farewell To Summer House After Seven Years

Jun 05, 2025

Paige De Sorbo Bids Farewell To Summer House After Seven Years

Jun 05, 2025 -

Police Raid Backyard Concert All American Rejects Surprise Gig Cut Short

Jun 05, 2025

Police Raid Backyard Concert All American Rejects Surprise Gig Cut Short

Jun 05, 2025 -

2026 Patriot League Football Lineup Villanovas Addition Announced

Jun 05, 2025

2026 Patriot League Football Lineup Villanovas Addition Announced

Jun 05, 2025 -

Jack Draper Vs Alcaraz And Sinner The 2025 French Open Showdown A Realistic Assessment

Jun 05, 2025

Jack Draper Vs Alcaraz And Sinner The 2025 French Open Showdown A Realistic Assessment

Jun 05, 2025 -

Halle Berrys Neck Tightening Cream Where To Buy It

Jun 05, 2025

Halle Berrys Neck Tightening Cream Where To Buy It

Jun 05, 2025

Latest Posts

-

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025 -

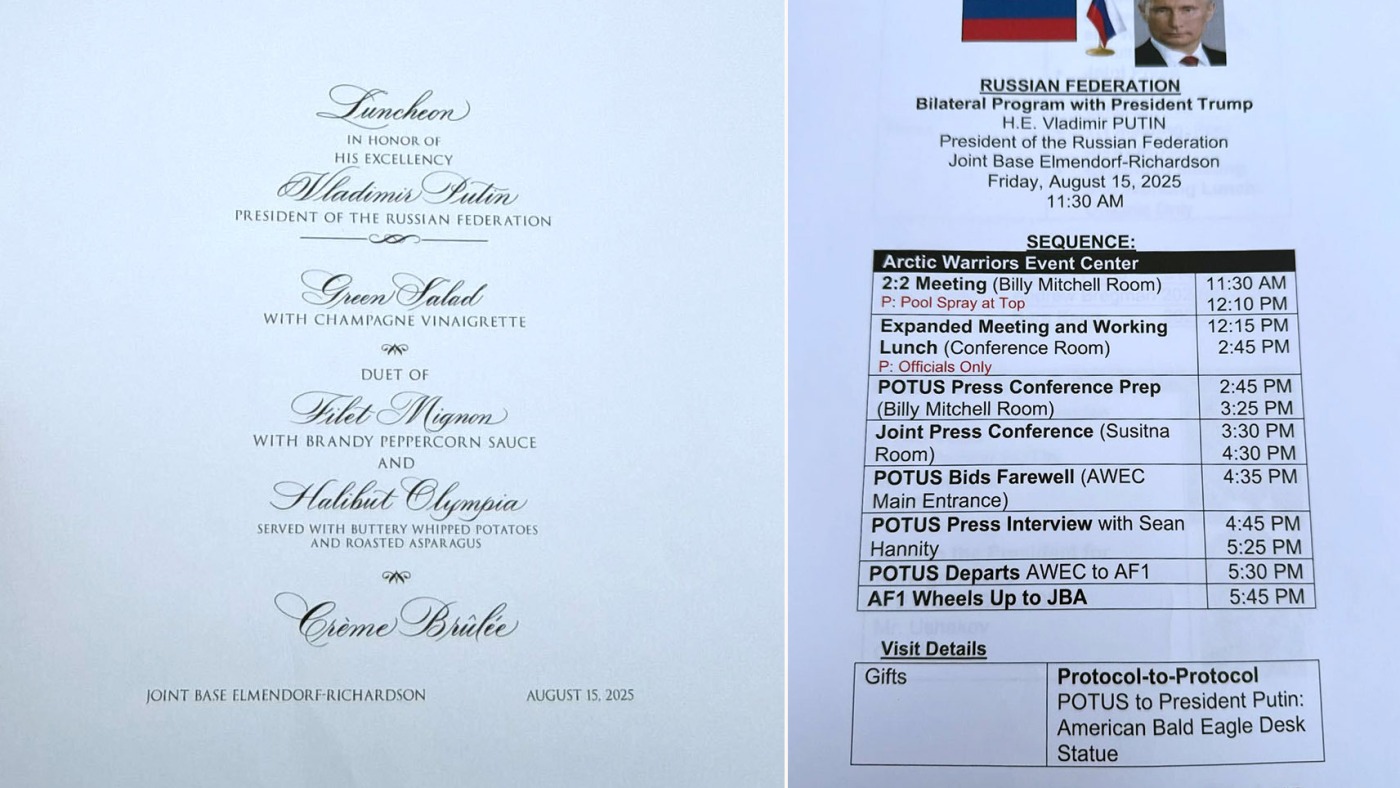

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025 -

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025 -

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025 -

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025