Analyzing Robinhood Stock: Factors Driving Investor Confidence

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Robinhood Stock: Factors Driving Investor Confidence (And Concerns)

Robinhood, the commission-free trading app that exploded onto the scene, has seen its stock price fluctuate wildly since its IPO. While initial excitement fueled rapid growth, investors are now scrutinizing the company's performance, looking for signs of sustained growth and profitability. Understanding the factors driving (and potentially undermining) investor confidence is crucial for anyone considering investing in or following this volatile stock.

H2: The Rise and Fall (and Rise?) of Robinhood

Robinhood's meteoric rise was largely fueled by its disruptive business model – offering commission-free trading and a user-friendly interface that appealed to a younger generation of investors. The pandemic, with its accompanying market volatility and surge in retail investing, further boosted the platform's popularity. However, the subsequent market correction, coupled with regulatory scrutiny and increased competition, led to a significant drop in Robinhood's stock price.

H2: Key Factors Influencing Investor Confidence

Several factors are currently shaping investor sentiment towards Robinhood:

H3: Revenue Diversification and Growth:

- Subscription Services: Robinhood is actively expanding its revenue streams beyond transaction-based revenue. Its premium subscription service, Robinhood Gold, offers enhanced features, and the company is exploring other subscription models to increase recurring revenue. The success of these initiatives will be a key indicator of future growth.

- Cryptocurrency Trading: While the cryptocurrency market is notoriously volatile, it represents a significant opportunity for Robinhood. Its continued growth in this sector will be crucial for overall revenue diversification.

- Expansion into New Markets: Robinhood's international expansion plans could unlock significant growth potential, but these ventures also carry inherent risks associated with navigating new regulatory landscapes and market dynamics.

H3: Regulatory Landscape and Compliance:

Robinhood has faced significant regulatory scrutiny, including investigations and fines related to its trading practices. Maintaining compliance and building a strong reputation for regulatory adherence is paramount for restoring and maintaining investor trust. Any negative news on this front can significantly impact investor confidence.

H3: Competition and Market Saturation:

The online brokerage industry is increasingly competitive. Established players and new entrants are vying for market share, putting pressure on Robinhood to innovate and differentiate its offerings. Its ability to maintain its competitive edge will be crucial for long-term success.

H3: User Growth and Engagement:

While Robinhood boasts a large user base, maintaining user growth and engagement is vital. Attracting and retaining new customers, while also ensuring active engagement from existing users, will be crucial for driving transaction volume and revenue. Metrics like Monthly Active Users (MAU) are closely watched by investors.

H2: Concerns and Potential Risks

Despite positive developments, several concerns remain:

- Profitability: Robinhood is still striving for consistent profitability. Achieving sustainable profitability amidst increasing competition will be a major challenge.

- Market Volatility: The broader market's volatility directly impacts Robinhood's performance, making it a riskier investment for risk-averse investors.

- Dependence on Retail Investors: Robinhood's business model is heavily reliant on retail investors. Any significant shift in retail investor behavior could significantly impact its revenue.

H2: The Outlook for Robinhood Stock

The future of Robinhood stock remains uncertain. While the company is taking steps to diversify its revenue streams and improve its profitability, the challenges it faces are significant. Investors should carefully consider the risks before investing and conduct thorough due diligence before making any investment decisions. Staying informed about regulatory developments, competitive pressures, and the company’s financial performance is crucial for making informed choices.

Disclaimer: This article provides general information and analysis only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Robinhood Stock: Factors Driving Investor Confidence. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Will Karen Read Testify Defense Filing Hints At Decision

Jun 06, 2025

Will Karen Read Testify Defense Filing Hints At Decision

Jun 06, 2025 -

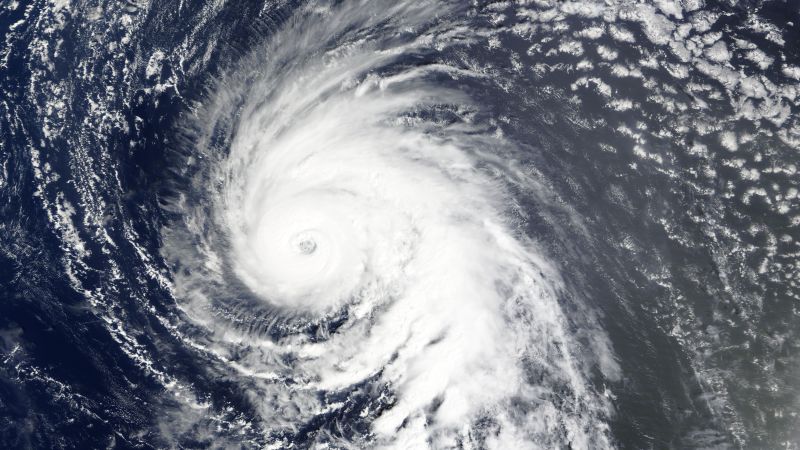

Ghost Hurricanes Forecasting Real Hurricanes More Accurately

Jun 06, 2025

Ghost Hurricanes Forecasting Real Hurricanes More Accurately

Jun 06, 2025 -

New Photos Meghan Shares Intimate Moments Celebrating Lilibets 4th Birthday

Jun 06, 2025

New Photos Meghan Shares Intimate Moments Celebrating Lilibets 4th Birthday

Jun 06, 2025 -

Coca Cola Ko Analyzing The Stocks Performance And Future Prospects

Jun 06, 2025

Coca Cola Ko Analyzing The Stocks Performance And Future Prospects

Jun 06, 2025 -

Gut Microbiome And Hospitalization Risk The Role Of Early Bacterial Exposure

Jun 06, 2025

Gut Microbiome And Hospitalization Risk The Role Of Early Bacterial Exposure

Jun 06, 2025

Latest Posts

-

Understanding Ghost Hurricanes Implications For Hurricane Prediction Models

Jun 06, 2025

Understanding Ghost Hurricanes Implications For Hurricane Prediction Models

Jun 06, 2025 -

Dallas Stars Post Season Disappointment Leads To De Boers Dismissal

Jun 06, 2025

Dallas Stars Post Season Disappointment Leads To De Boers Dismissal

Jun 06, 2025 -

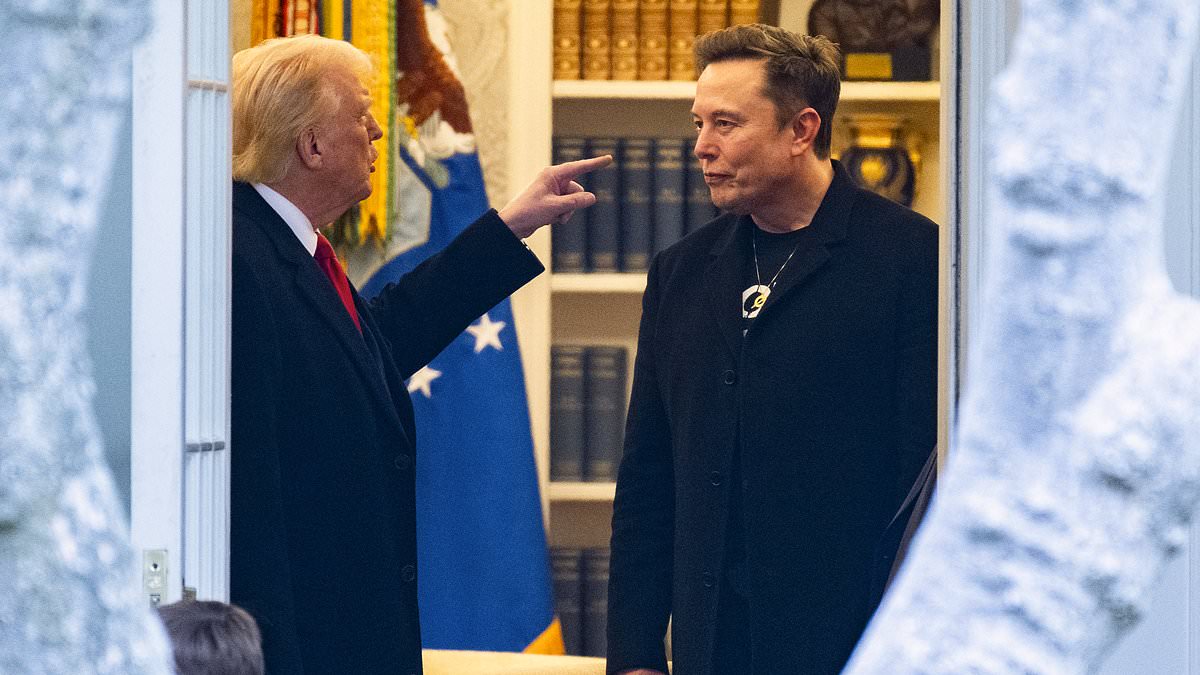

Trump Musk Fallout Uncovering The Advisors Pivotal Role

Jun 06, 2025

Trump Musk Fallout Uncovering The Advisors Pivotal Role

Jun 06, 2025 -

Applied Digital Shares Surge After 7 Billion Core Weave Ai Lease

Jun 06, 2025

Applied Digital Shares Surge After 7 Billion Core Weave Ai Lease

Jun 06, 2025 -

Actor Steve Guttenbergs Killer Role In Lifetimes Kidnapped By A Killer

Jun 06, 2025

Actor Steve Guttenbergs Killer Role In Lifetimes Kidnapped By A Killer

Jun 06, 2025