Analyzing SiriusXM Holdings: A Stock For Long-Term Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing SiriusXM Holdings: A Stock for Long-Term Growth?

SiriusXM Holdings (SIRI) has carved a niche for itself in the entertainment industry, dominating satellite radio. But is it a solid pick for long-term investors? This in-depth analysis explores the company's strengths, weaknesses, and future prospects, helping you decide if SiriusXM deserves a place in your portfolio.

SiriusXM's Strengths: A Dominant Player in Satellite Radio

SiriusXM boasts a substantial subscriber base, making it the undisputed leader in satellite radio. This dominance translates into consistent revenue streams, a key factor for long-term growth. The company’s diverse programming, ranging from music to sports talk and comedy, caters to a wide audience, ensuring a loyal subscriber base. This strong foundation has allowed SiriusXM to consistently generate positive cash flow, a crucial element for any investment strategy focused on long-term gains.

Furthermore, SiriusXM's strategic partnerships and acquisitions have expanded its reach and content library. These moves demonstrate a proactive approach to maintaining market leadership and adapting to evolving consumer preferences. The company's efforts in developing its digital platforms, including Pandora, further solidify its position in the broader audio entertainment market.

Challenges and Weaknesses: Navigating the Changing Media Landscape

While SiriusXM enjoys market dominance, it faces significant challenges. The rise of streaming services like Spotify and Apple Music presents stiff competition, particularly among younger demographics. Maintaining subscriber growth in the face of these digital disruptors will be crucial for SiriusXM's long-term success.

Another potential weakness lies in the company's dependence on the automotive industry. A downturn in car sales could directly impact SiriusXM's subscriber acquisition rates. Diversifying revenue streams beyond automotive partnerships will be vital to mitigating this risk. Moreover, the increasing popularity of podcasts and other audio content presents a challenge to SiriusXM's core business model.

Future Prospects: Growth Strategies and Potential

SiriusXM's future hinges on its ability to adapt to the changing media landscape. The company's investment in its digital platforms, like Pandora, is a key strategy to attract and retain younger subscribers. Success in this area will be paramount to long-term growth.

Furthermore, exploring strategic partnerships and acquisitions within the podcasting industry could provide a significant boost to its content offerings. This would diversify its content portfolio and broaden its appeal to a wider audience. Continued innovation in its programming and leveraging its strong brand recognition will also play crucial roles.

Is SiriusXM a Buy for Long-Term Investors?

The answer isn't straightforward. SiriusXM's strong market position and consistent cash flow are attractive to long-term investors. However, the competitive landscape and dependence on the automotive industry present significant challenges.

Investors should carefully consider the risks and rewards before investing in SiriusXM. Thorough due diligence, including analyzing financial statements and considering market trends, is essential. Consider diversifying your portfolio to mitigate risks associated with any single stock.

Further Research:

Before making any investment decisions, conduct thorough research using reputable financial resources. Consult with a qualified financial advisor for personalized advice tailored to your investment goals and risk tolerance. Remember, past performance is not indicative of future results.

Call to Action: Stay informed about market trends and company news to make well-informed investment decisions. What are your thoughts on SiriusXM's long-term prospects? Share your opinions in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing SiriusXM Holdings: A Stock For Long-Term Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Financial Avengers Portfolio Bank Of America Bac Secures 8th Largest Holding

May 27, 2025

Financial Avengers Portfolio Bank Of America Bac Secures 8th Largest Holding

May 27, 2025 -

Before And After The Breakout How 7 Allegedly Helped Escaped Inmates In New Orleans

May 27, 2025

Before And After The Breakout How 7 Allegedly Helped Escaped Inmates In New Orleans

May 27, 2025 -

A 560 Amazon Return My Rationale For Not Selling

May 27, 2025

A 560 Amazon Return My Rationale For Not Selling

May 27, 2025 -

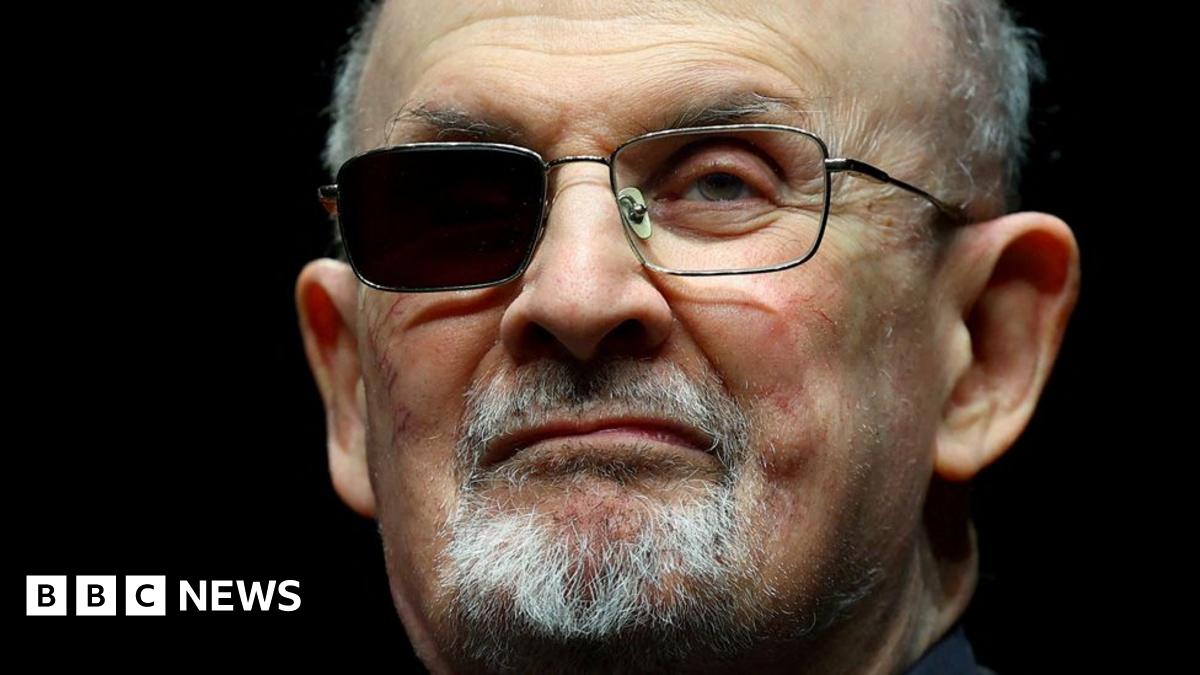

Sir Salman Rushdie Satisfaction Expressed After Attackers Conviction

May 27, 2025

Sir Salman Rushdie Satisfaction Expressed After Attackers Conviction

May 27, 2025 -

The Andriy Portnov Murder Investigating A Death Shrouded In Mystery

May 27, 2025

The Andriy Portnov Murder Investigating A Death Shrouded In Mystery

May 27, 2025

Latest Posts

-

Viral Video Passengers Unexpected Encounter With Birds On A Delta Flight

May 30, 2025

Viral Video Passengers Unexpected Encounter With Birds On A Delta Flight

May 30, 2025 -

Musica Comida E Traje Os Elementos Essenciais De Uma Festa Portuguesa

May 30, 2025

Musica Comida E Traje Os Elementos Essenciais De Uma Festa Portuguesa

May 30, 2025 -

French Media Censorship Macrons Marital Ad Disappears

May 30, 2025

French Media Censorship Macrons Marital Ad Disappears

May 30, 2025 -

Musician Rick Derringer Dead At 77 His Collaborations And Impact

May 30, 2025

Musician Rick Derringer Dead At 77 His Collaborations And Impact

May 30, 2025 -

High Profile Jailbreaks Fuel Renewed Debate On Us Prison Security

May 30, 2025

High Profile Jailbreaks Fuel Renewed Debate On Us Prison Security

May 30, 2025