Analyzing SiriusXM Holdings: A Stock Market Perspective

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing SiriusXM Holdings: A Stock Market Perspective

SiriusXM Holdings Inc. (SIRI), a dominant player in the satellite radio industry, has consistently captured investor attention. But is it a worthwhile investment? This in-depth analysis explores SiriusXM's current market position, financial performance, and future prospects, offering a comprehensive perspective for potential investors.

SiriusXM's Current Market Dominance:

SiriusXM boasts a substantial subscriber base, solidifying its position as the leading provider of satellite radio in North America. This market dominance provides a strong foundation for revenue generation and profitability. However, the increasing popularity of streaming services presents a significant challenge. The company's ability to adapt and integrate streaming capabilities into its offerings will be crucial for sustained growth. This includes integrating its content with popular smart devices and platforms, a strategy already underway.

Financial Performance and Key Metrics:

Analyzing SiriusXM's financial health requires a close look at several key metrics. Revenue growth, subscriber acquisition costs, churn rate, and operating margins all provide valuable insights into the company's performance. Recent quarterly reports reveal a mixed bag. While subscriber growth has been relatively stable, increasing competition and the cost of acquiring new subscribers remain key concerns. Investors should scrutinize the company's financial statements for evidence of improved efficiency and cost-cutting measures.

Growth Strategies and Future Outlook:

SiriusXM's future success hinges on its ability to innovate and adapt to the evolving media landscape. The company is investing heavily in expanding its content library, including partnerships with popular artists and exclusive programming. Diversification into adjacent markets, such as podcasting and connected car services, is also a key component of their growth strategy. This diversification mitigates risk and opens up new revenue streams. However, the success of these strategies will depend on execution and market acceptance.

Competitive Landscape and Challenges:

The satellite radio market isn't without its challenges. The rise of streaming music services like Spotify and Apple Music poses a significant threat to SiriusXM's subscriber base. Competition from other audio entertainment platforms, including podcasts and audiobooks, also adds pressure. SiriusXM's response to this competitive landscape will be vital in determining its long-term viability. Understanding the competitive landscape is crucial for any investor considering a position in SIRI.

Investment Considerations and Risks:

Investing in SiriusXM, like any stock, carries inherent risks. Economic downturns can impact consumer spending, potentially affecting subscriber numbers. Technological advancements could render satellite radio obsolete, although SiriusXM’s diversification efforts are designed to mitigate this risk. Investors should carefully weigh the potential rewards against the risks before making any investment decisions. A thorough due diligence process, including consulting with a financial advisor, is recommended.

Conclusion: A Balanced Perspective on SiriusXM Holdings

SiriusXM Holdings presents a complex investment opportunity. While its market dominance and diversification efforts are positive signs, the challenges posed by streaming services and the competitive landscape cannot be ignored. A balanced perspective, considering both the strengths and weaknesses of the company, is crucial for making informed investment decisions. Monitoring key metrics and staying updated on industry trends will be vital for investors tracking SiriusXM's performance. Remember to always conduct your own research and seek professional financial advice before investing.

Further Research:

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing SiriusXM Holdings: A Stock Market Perspective. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Official 2025 Social Security Payment Dates June Schedule

May 28, 2025

Official 2025 Social Security Payment Dates June Schedule

May 28, 2025 -

King Charles Iiis Impactful Canadian Tour Overshadowed By Trumps 51st State Bid

May 28, 2025

King Charles Iiis Impactful Canadian Tour Overshadowed By Trumps 51st State Bid

May 28, 2025 -

Nyse Bac Update Birmingham Capital Managements Recent Transaction And Market Implications

May 28, 2025

Nyse Bac Update Birmingham Capital Managements Recent Transaction And Market Implications

May 28, 2025 -

Understanding The Proposed 15 Reduction In Social Security Payments For 2025

May 28, 2025

Understanding The Proposed 15 Reduction In Social Security Payments For 2025

May 28, 2025 -

Update On Michael Gaine Disappearance Remains Identified In County Kerry

May 28, 2025

Update On Michael Gaine Disappearance Remains Identified In County Kerry

May 28, 2025

Latest Posts

-

Transportation Secretary Offers Plan To Address Newark Airports Air Traffic Delays

May 31, 2025

Transportation Secretary Offers Plan To Address Newark Airports Air Traffic Delays

May 31, 2025 -

Housing Market Shift Sellers Dominate As Buyer Numbers Dip To 12 Year Low

May 31, 2025

Housing Market Shift Sellers Dominate As Buyer Numbers Dip To 12 Year Low

May 31, 2025 -

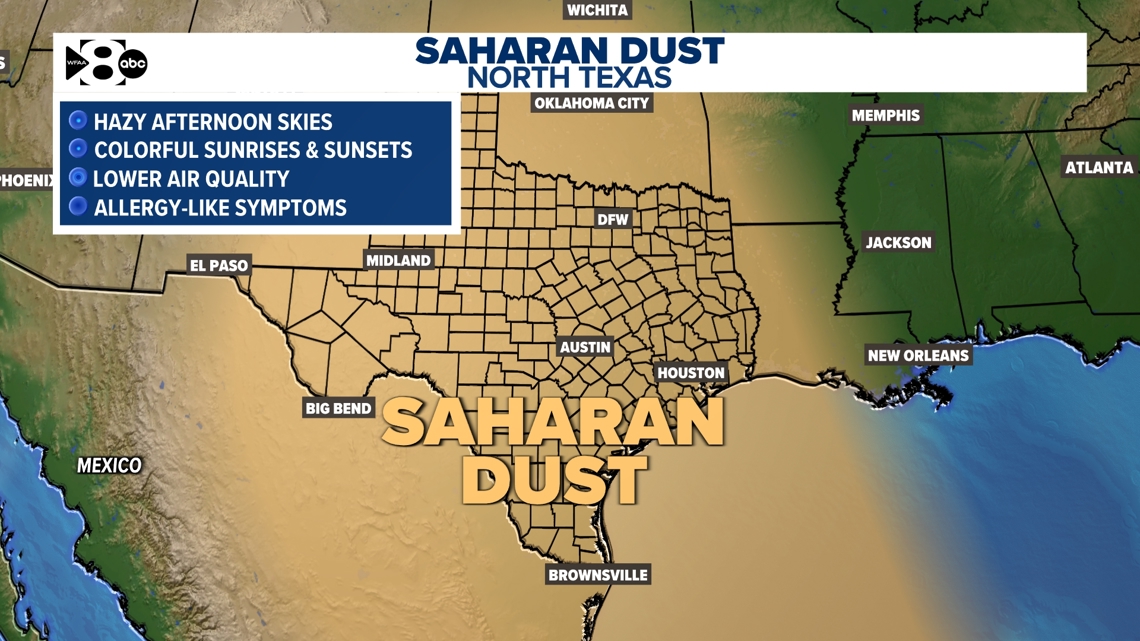

North Texas Weather Alert Saharan Dust Impacts And Health Concerns

May 31, 2025

North Texas Weather Alert Saharan Dust Impacts And Health Concerns

May 31, 2025 -

Longer Delays Anticipated For Newark Airport Air Traffic Control Modernization

May 31, 2025

Longer Delays Anticipated For Newark Airport Air Traffic Control Modernization

May 31, 2025 -

Aep Rate Hike Explained Years Of Factors Leading To Higher Costs

May 31, 2025

Aep Rate Hike Explained Years Of Factors Leading To Higher Costs

May 31, 2025