Analyzing SiriusXM Holdings: Is This Stock Still A Good Investment?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing SiriusXM Holdings: Is This Stock Still a Good Investment?

SiriusXM Holdings (SIRI) has been a source of both excitement and uncertainty for investors. While the satellite radio giant boasts a loyal subscriber base and a seemingly entrenched market position, recent market performance and evolving technological landscapes raise questions about its future prospects. Is SiriusXM still a smart investment in 2024? Let's delve into the details.

SiriusXM's Strengths: A Loyal Listener Base and Diversification

SiriusXM's core strength lies in its substantial subscriber base. Millions of drivers rely on its ad-free, high-quality audio programming, providing a predictable revenue stream. This loyalty translates into a relatively high churn rate, meaning subscribers are less likely to cancel their subscriptions compared to other streaming services. Furthermore, the company's strategic diversification beyond satellite radio, encompassing Pandora and other digital audio platforms, broadens its reach and mitigates reliance on a single revenue source. This diversification strategy is crucial in a rapidly evolving media landscape.

Challenges Facing SiriusXM: Competition and Technological Shifts

However, SiriusXM isn't without its challenges. The rise of streaming services like Spotify and Apple Music presents stiff competition. These platforms offer vast libraries of on-demand music, podcasts, and audiobooks at competitive prices, potentially attracting subscribers away from SiriusXM's primarily curated content. Moreover, the increasing integration of infotainment systems in modern vehicles poses a threat. Many new car models are pre-loaded with various streaming apps, potentially reducing the need for a separate SiriusXM subscription.

Financial Performance and Future Outlook: A Mixed Bag

Analyzing SiriusXM's recent financial performance provides a mixed picture. While the company has demonstrated consistent revenue growth, driven largely by its subscriber base, profit margins have faced pressure. Increased programming costs, competition, and investments in new technologies are all contributing factors. The future outlook for SiriusXM depends heavily on its ability to navigate these challenges effectively. This includes successfully integrating its various platforms, attracting and retaining subscribers in a crowded marketplace, and strategically investing in future technologies.

Is SiriusXM a Buy, Sell, or Hold?

Determining whether SiriusXM is a good investment in 2024 requires careful consideration of several factors. Investors should assess their risk tolerance, long-term investment goals, and the current market conditions. While the company’s loyal subscriber base and diversification efforts are positive indicators, the competitive landscape and evolving technological advancements present significant headwinds.

Key Factors to Consider:

- Subscription growth rate: Sustained subscriber growth is crucial for SiriusXM's long-term success.

- Competition from streaming services: The intensity of competition will significantly impact SiriusXM's market share.

- Technological advancements: SiriusXM's ability to adapt to evolving technologies will be key to its survival.

- Debt levels: High debt levels can constrain future growth and profitability.

Conclusion: A Cautious Approach

Ultimately, the decision of whether to invest in SiriusXM is a personal one. While the company possesses inherent strengths, several challenges need to be carefully considered. Investors should conduct thorough due diligence, consult with a financial advisor, and stay updated on the latest industry news and financial reports before making any investment decisions. A cautious approach, carefully weighing the potential risks and rewards, is advised. This isn't financial advice; always consult a professional before making investment choices.

Further Research: For more detailed financial information, refer to SiriusXM's investor relations website and SEC filings. You can also explore financial news websites and analyst reports for further insights.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing SiriusXM Holdings: Is This Stock Still A Good Investment?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

King Charles Iiis Impactful Canada Trip Overshadowed By Trumps 51st State Claim

May 28, 2025

King Charles Iiis Impactful Canada Trip Overshadowed By Trumps 51st State Claim

May 28, 2025 -

Has Sirius Xms Millionaire Making Run Ended A Look At Current Stock Performance

May 28, 2025

Has Sirius Xms Millionaire Making Run Ended A Look At Current Stock Performance

May 28, 2025 -

From Harvard Student To Critic My Perspective On Harvard Vs Trump

May 28, 2025

From Harvard Student To Critic My Perspective On Harvard Vs Trump

May 28, 2025 -

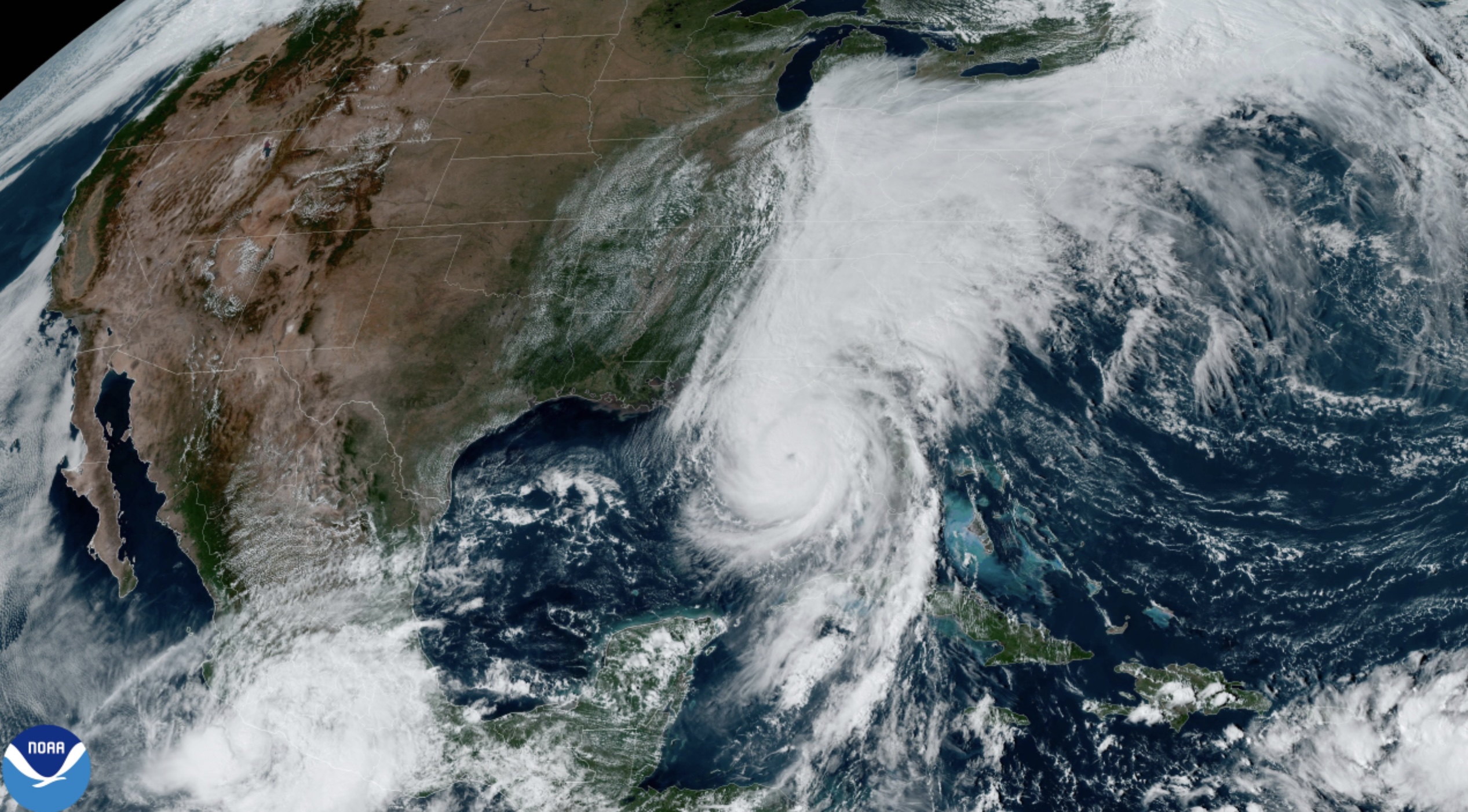

Us Summer Hurricane Outlook Above Normal Conditions Mean Increased Risk

May 28, 2025

Us Summer Hurricane Outlook Above Normal Conditions Mean Increased Risk

May 28, 2025 -

Portstewart Beach Sadly A Dead Minke Whale Washes Ashore

May 28, 2025

Portstewart Beach Sadly A Dead Minke Whale Washes Ashore

May 28, 2025

Latest Posts

-

Trumps Controversial Pardon Reality Show Duo Freed From Bank Fraud And Tax Convictions

May 29, 2025

Trumps Controversial Pardon Reality Show Duo Freed From Bank Fraud And Tax Convictions

May 29, 2025 -

Grief And Outrage Palestinian Ambassador On The Death Of 1300 Children

May 29, 2025

Grief And Outrage Palestinian Ambassador On The Death Of 1300 Children

May 29, 2025 -

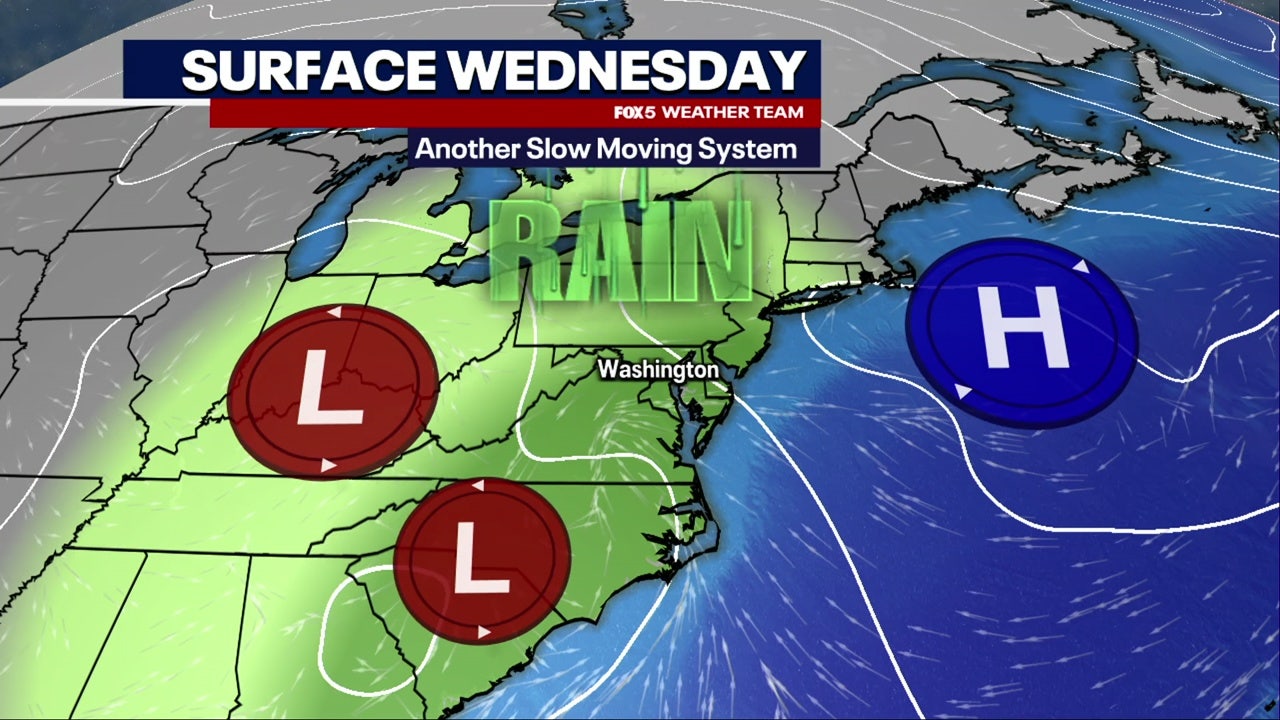

Dmv Weather Alert Heavy Rain And Thunderstorms Predicted For Wednesday

May 29, 2025

Dmv Weather Alert Heavy Rain And Thunderstorms Predicted For Wednesday

May 29, 2025 -

First Odi Jamie Smith Opens For England Against West Indies

May 29, 2025

First Odi Jamie Smith Opens For England Against West Indies

May 29, 2025 -

Birds On A Plane Passengers Hilarious Attempt To Catch Avian Stowaways On Delta Flight

May 29, 2025

Birds On A Plane Passengers Hilarious Attempt To Catch Avian Stowaways On Delta Flight

May 29, 2025