Analyzing Spencer's Slump: Causes And Potential Recovery

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Spencer's Slump: Causes and Potential Recovery

Spencer, once a shining star in the [Industry Name - e.g., retail, tech, sports] sector, has recently experienced a significant downturn. This article delves into the potential causes of Spencer's slump and explores strategies for a potential recovery. Understanding the factors contributing to this decline is crucial not only for Spencer's stakeholders but also for gaining insights into broader industry trends.

The Fall from Grace: Identifying the Key Factors

Spencer's recent struggles haven't emerged overnight. A confluence of factors has likely contributed to this downturn. These include:

-

Increased Competition: The [Industry Name] market is increasingly competitive. New entrants with innovative products and aggressive pricing strategies have eroded Spencer's market share. This highlights the importance of staying ahead of the curve in a rapidly evolving landscape. Understanding competitive analysis and adopting proactive strategies is vital for survival in such markets.

-

Changing Consumer Preferences: Consumer behavior is dynamic, and Spencer may have failed to adapt to these shifts. A failure to understand evolving consumer preferences, particularly concerning [mention specific examples relevant to Spencer's industry, e.g., sustainability, online shopping, specific product features], can lead to a loss of market relevance. Market research and customer feedback are critical in identifying and responding to these changes.

-

Internal Operational Inefficiencies: Internal challenges, such as supply chain disruptions, inefficient production processes, or poor internal communication, can significantly impact profitability. These internal factors often go unnoticed until they have a substantial impact on the company’s performance. A thorough review of internal operations and implementation of lean management principles might be necessary.

-

Economic Downturn: The broader economic climate has also played a significant role. [Mention specific economic factors affecting the industry, e.g., inflation, recession, increased interest rates]. These macroeconomic factors can severely impact consumer spending and business performance across many sectors.

Charting a Course to Recovery: Potential Strategies

Spencer's recovery will require a multi-pronged approach focusing on both internal restructuring and external market adaptation. Here are some potential strategies:

-

Revamping Marketing and Branding: A refreshed brand identity and targeted marketing campaigns can help Spencer reconnect with its customer base. This might involve a stronger focus on digital marketing, social media engagement, and personalized customer experiences. Consider exploring influencer marketing and content marketing to reach new audiences.

-

Product Innovation and Diversification: Introducing new products or services catering to evolving consumer demands is crucial. This diversification can mitigate risks associated with relying on a single product line. Investing in research and development is paramount for future success.

-

Strengthening Supply Chain Resilience: A more robust and diversified supply chain can help mitigate disruptions and ensure product availability. This includes exploring alternative suppliers and implementing inventory management strategies to optimize stock levels.

-

Cost Optimization and Efficiency Improvements: Identifying and eliminating operational inefficiencies is essential for improving profitability. This might involve streamlining processes, adopting new technologies, and negotiating better deals with suppliers. A detailed cost-benefit analysis is critical in identifying areas for improvement.

The Road Ahead: A Cautious Outlook

Spencer's recovery will require significant effort, strategic planning, and a commitment to adaptation. While the challenges are substantial, the potential for recovery is real. By addressing the underlying causes of the slump and implementing the strategies outlined above, Spencer can potentially regain its position as a leader in the [Industry Name] market. The next few quarters will be crucial in determining the success of these initiatives. This situation serves as a reminder of the dynamic nature of the business world and the importance of constant adaptation and innovation for long-term success.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Spencer's Slump: Causes And Potential Recovery. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Gusty Winds Fuel Oregon Wildfire Forcing Widespread Evacuations

Jun 14, 2025

Gusty Winds Fuel Oregon Wildfire Forcing Widespread Evacuations

Jun 14, 2025 -

Evacuation Lifted Following Successful Carlsbad Brush Fire Response

Jun 14, 2025

Evacuation Lifted Following Successful Carlsbad Brush Fire Response

Jun 14, 2025 -

Would I Lie To You Nazi Salute Bbc Responds To David Walliams Actions

Jun 14, 2025

Would I Lie To You Nazi Salute Bbc Responds To David Walliams Actions

Jun 14, 2025 -

U S Open Generational Golf Clash At Location Course Name

Jun 14, 2025

U S Open Generational Golf Clash At Location Course Name

Jun 14, 2025 -

Sole Survivor British Passenger From Seat 11 A Recounts India Air Disaster

Jun 14, 2025

Sole Survivor British Passenger From Seat 11 A Recounts India Air Disaster

Jun 14, 2025

Latest Posts

-

Tensions Rise The Implications Of The Israeli Attack On Iran

Jun 15, 2025

Tensions Rise The Implications Of The Israeli Attack On Iran

Jun 15, 2025 -

Blenheim Palace Gold Toilet Theft Inside The 4 8m Crime And Subsequent Conviction

Jun 15, 2025

Blenheim Palace Gold Toilet Theft Inside The 4 8m Crime And Subsequent Conviction

Jun 15, 2025 -

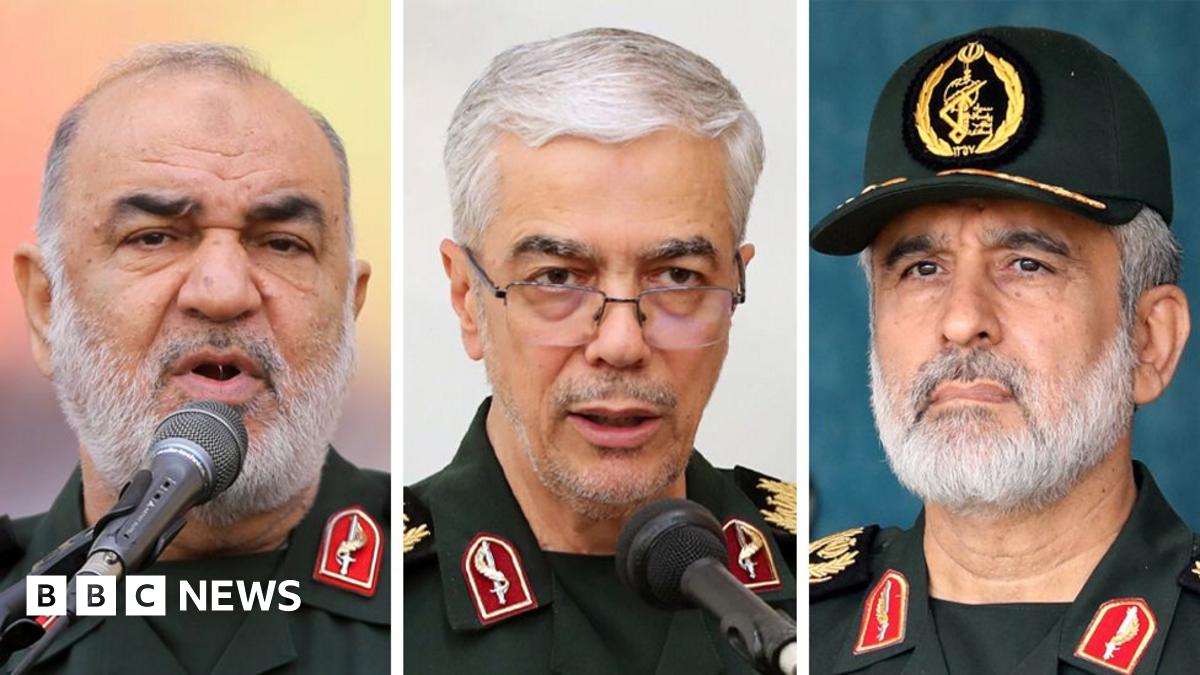

Key Iranian Military Figures Killed In Recent Israeli Attack

Jun 15, 2025

Key Iranian Military Figures Killed In Recent Israeli Attack

Jun 15, 2025 -

Post Iran Attack Republican Party Discord Challenges Trumps Leadership

Jun 15, 2025

Post Iran Attack Republican Party Discord Challenges Trumps Leadership

Jun 15, 2025 -

Visualizing The Israeli Strike On Iran Maps Images And Analysis

Jun 15, 2025

Visualizing The Israeli Strike On Iran Maps Images And Analysis

Jun 15, 2025