Analyzing The 1000% Surge: Understanding SBET's Stock Market Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing the 1000% Surge: Understanding SBET's Stock Market Performance

The stock market is a rollercoaster, and few rides have been as dramatic as SBET's recent performance. A staggering 1000% increase in stock value has left investors both awestruck and questioning: What fueled this meteoric rise, and is it sustainable? This in-depth analysis delves into the factors contributing to SBET's phenomenal growth and explores the potential risks and rewards moving forward.

The SBET Phenomenon: A 1000% Surge Explained

SBET's journey to becoming a market darling hasn't been overnight. Several key factors have converged to create this unprecedented surge:

-

Innovative Product Launch: The recent launch of [mention specific product or service, e.g., "their groundbreaking AI-powered platform"] has been a major catalyst. This new offering has disrupted the [mention industry, e.g., "online gaming sector"] and captured significant market share. The positive market reception and strong user adoption have directly translated into increased revenue and investor confidence.

-

Strategic Partnerships: SBET's strategic alliances with key players in the [mention relevant industry, e.g., "technology and entertainment"] sectors have provided access to wider markets and expanded their reach. These collaborations have not only boosted brand awareness but also solidified SBET's position as a leader in the industry.

-

Strong Financial Performance: Beyond the hype, SBET’s impressive financial reports have underpinned investor enthusiasm. Consistent growth in revenue, profitability, and positive cash flow have provided tangible evidence of the company's success. These robust financials have attracted both institutional and individual investors.

-

Positive Market Sentiment: Overall positive market sentiment, coupled with a growing interest in [mention relevant sector, e.g., "AI-driven technologies"], has contributed to the increased demand for SBET shares. This positive momentum has created a self-reinforcing cycle, further driving up the stock price.

Risks and Considerations: Is the Surge Sustainable?

While SBET's performance is undeniably impressive, it's crucial to consider potential risks:

-

Market Volatility: The stock market is inherently volatile. While SBET’s fundamentals appear strong, external factors, such as economic downturns or regulatory changes, could negatively impact its stock price.

-

Competition: Increased competition from established players and new entrants could erode SBET’s market share and hinder future growth. Maintaining its competitive edge will be critical for sustained success.

-

Overvaluation Concerns: The 1000% surge raises concerns about potential overvaluation. Investors should carefully analyze SBET’s valuation metrics to determine if the current stock price accurately reflects the company's long-term prospects.

Investing in SBET: A Calculated Risk?

The dramatic rise of SBET presents both exciting opportunities and significant risks. Investors interested in SBET should conduct thorough due diligence, considering the factors outlined above. It's crucial to remember that past performance is not indicative of future results. A diversified investment strategy is always recommended.

Further Research and Resources:

For more detailed information on SBET's financial performance, please refer to their official investor relations website: [Insert link to SBET's investor relations website]. You can also consult reputable financial news sources and analyst reports for additional insights. Remember to always consult with a qualified financial advisor before making any investment decisions.

Conclusion:

SBET's 1000% surge is a captivating market story, highlighting the potential for explosive growth in the [mention industry] sector. However, understanding the factors driving this growth, as well as the inherent risks, is crucial for informed investment decisions. Careful analysis and a balanced perspective are key to navigating the complexities of this dynamic market situation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing The 1000% Surge: Understanding SBET's Stock Market Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Harassment At Track Meets Transgender Athlete Speaks Out On The Impact Of Adult Hecklers

May 31, 2025

Harassment At Track Meets Transgender Athlete Speaks Out On The Impact Of Adult Hecklers

May 31, 2025 -

From Rescue To Recovery Flamstead Hawks New Life With A Falconer

May 31, 2025

From Rescue To Recovery Flamstead Hawks New Life With A Falconer

May 31, 2025 -

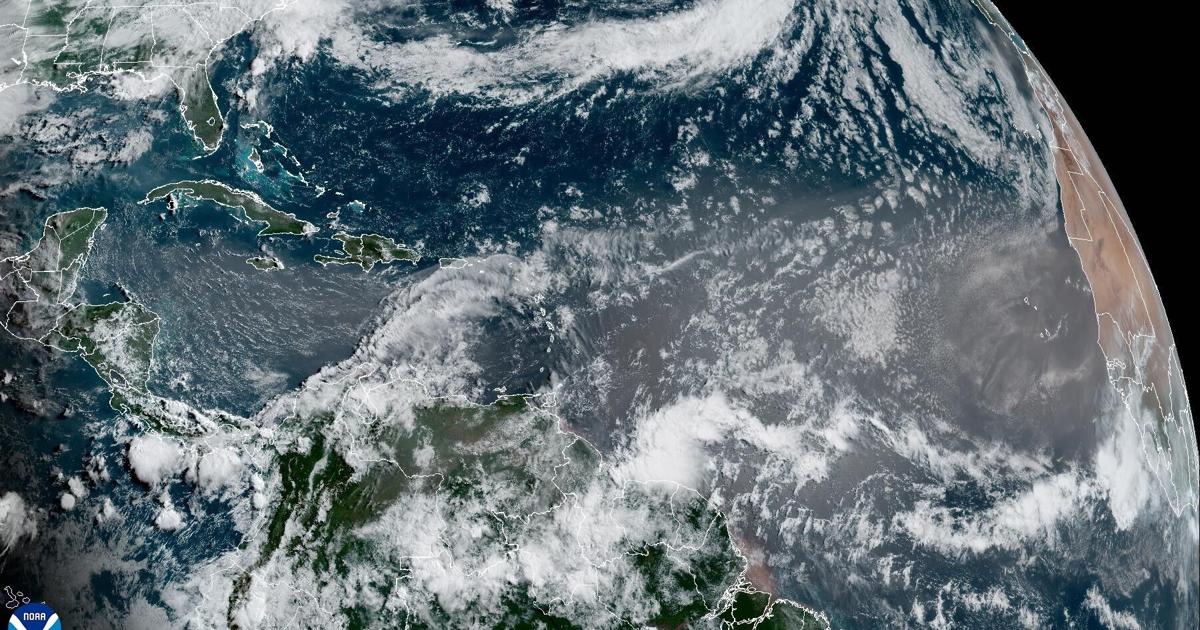

Saharan Dust Plume To Bring Stunning Louisiana Sunsets Timing And Forecast

May 31, 2025

Saharan Dust Plume To Bring Stunning Louisiana Sunsets Timing And Forecast

May 31, 2025 -

Tennis Star Sloane Stephens Upper Body Exhaustion And The Jell O Arm Struggle

May 31, 2025

Tennis Star Sloane Stephens Upper Body Exhaustion And The Jell O Arm Struggle

May 31, 2025 -

Anger And Anxiety China Condemns Us Crackdown On Student Visas

May 31, 2025

Anger And Anxiety China Condemns Us Crackdown On Student Visas

May 31, 2025

Latest Posts

-

Epping Asylum Hotel Government Challenges Court Ruling

Aug 23, 2025

Epping Asylum Hotel Government Challenges Court Ruling

Aug 23, 2025 -

Government Launches Appeal Against Epping Asylum Hotel Ruling

Aug 23, 2025

Government Launches Appeal Against Epping Asylum Hotel Ruling

Aug 23, 2025 -

Us Open 2025 Preview Comparing Sinner And Alcarazs Draw Challenges

Aug 23, 2025

Us Open 2025 Preview Comparing Sinner And Alcarazs Draw Challenges

Aug 23, 2025 -

Detroit Lions Vs Houston Texans Preseason Game Your Complete Viewing Guide

Aug 23, 2025

Detroit Lions Vs Houston Texans Preseason Game Your Complete Viewing Guide

Aug 23, 2025 -

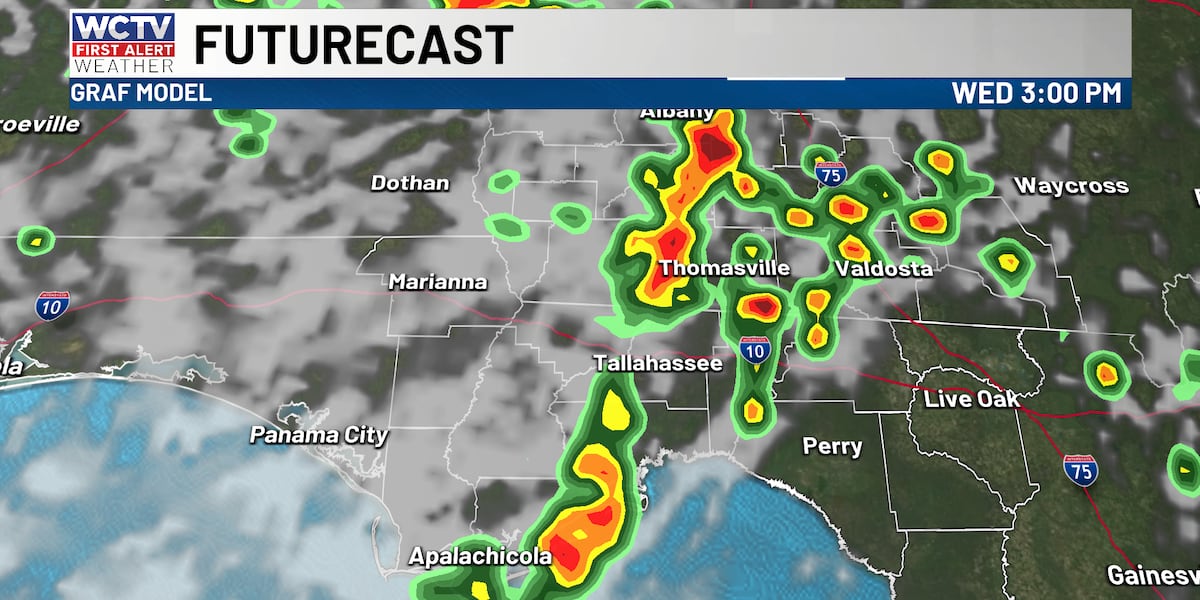

Austins Weather Latest On Tropical System Erin And Todays Storm Potential

Aug 23, 2025

Austins Weather Latest On Tropical System Erin And Todays Storm Potential

Aug 23, 2025