Analyzing The Meteoric Rise Of SBET Stock: What Fueled The 1000% Surge?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing the Meteoric Rise of SBET Stock: What Fueled the 1000% Surge?

The stock market is a rollercoaster, and few rides have been as exhilarating – and terrifying – as the recent performance of SBET stock. This relatively unknown company saw its share price skyrocket by over 1000% in a matter of months, leaving investors both bewildered and incredibly wealthy (or incredibly regretful, depending on their timing). But what fueled this meteoric rise? Let's delve into the factors behind SBET's astonishing growth and explore the potential implications for the future.

The Speculative Frenzy: Social Media and the Meme Stock Effect

One cannot discuss SBET's surge without acknowledging the powerful influence of social media. Similar to other "meme stocks" like GME and AMC, SBET became a focal point for online investment communities, particularly on platforms like Reddit's r/WallStreetBets. The collective action of these groups, driven by a combination of genuine belief in the company's potential and a desire to challenge traditional financial institutions, created a powerful upward pressure on the share price. This speculative frenzy, fueled by hype and social momentum, played a significant role in the initial price explosion.

Unexpected Earnings and Positive News:

While social media hype was a catalyst, it wasn't the sole driver. Several key events contributed to the legitimacy of the SBET surge, albeit with some controversy. The company unexpectedly announced strong Q3 earnings, significantly exceeding analyst expectations. This positive news bolstered investor confidence and attracted further investment. Moreover, several positive press releases regarding new partnerships and product launches further fueled the upward trend. However, a closer look at these releases reveals some ambiguity, raising concerns about potential overstatement or selective reporting. Independent verification of these claims remains crucial for a thorough analysis.

Analyzing the Risks: The Volatility Factor

The rapid ascent of SBET stock carries significant inherent risks. Such dramatic price swings are rarely sustainable in the long term. The high volatility makes it a risky investment for those with a lower risk tolerance. A sudden shift in sentiment, fueled by negative news or a change in the narrative on social media, could easily trigger a sharp and rapid decline. Investors need to carefully evaluate their own risk appetite before considering any investment in highly volatile stocks like SBET.

Understanding the Fundamentals: A Deeper Dive is Necessary

While the speculative element is undeniable, understanding the underlying fundamentals of SBET is crucial for a complete picture. Analyzing the company's financials, competitive landscape, and long-term growth potential is vital to determining whether the current valuation is justified. Independent research and due diligence are absolutely essential before making any investment decision. This might involve examining the company's balance sheet, reviewing industry reports, and comparing SBET's performance to its competitors.

The Future of SBET: A Question Mark Remains

The future trajectory of SBET stock remains uncertain. While the company has shown some promising signs, the significant influence of speculative trading makes predicting its future performance extremely difficult. The long-term success of SBET will depend on its ability to deliver on its promises, maintain sustainable growth, and navigate the challenging dynamics of the market. Investors should remain cautious and avoid making impulsive decisions based solely on short-term price fluctuations.

Conclusion: Proceed with Caution

The 1000% surge of SBET stock serves as a compelling case study of the intersection of social media, speculative trading, and traditional market forces. While the story is fascinating, it also highlights the inherent risks of investing in highly volatile assets. Thorough research, a careful assessment of personal risk tolerance, and a long-term investment strategy are crucial for navigating the complexities of the stock market. Remember, past performance is not indicative of future results.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Conduct your own thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing The Meteoric Rise Of SBET Stock: What Fueled The 1000% Surge?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Day 7 The Big Match And A Movie Night

May 31, 2025

Day 7 The Big Match And A Movie Night

May 31, 2025 -

Kemi Badenoch Under Fire Insiders Reveal Extent Of Leadership Concerns

May 31, 2025

Kemi Badenoch Under Fire Insiders Reveal Extent Of Leadership Concerns

May 31, 2025 -

French Open 2024 Day 7 Match Analysis And Djokovic Vs Misolic Prediction

May 31, 2025

French Open 2024 Day 7 Match Analysis And Djokovic Vs Misolic Prediction

May 31, 2025 -

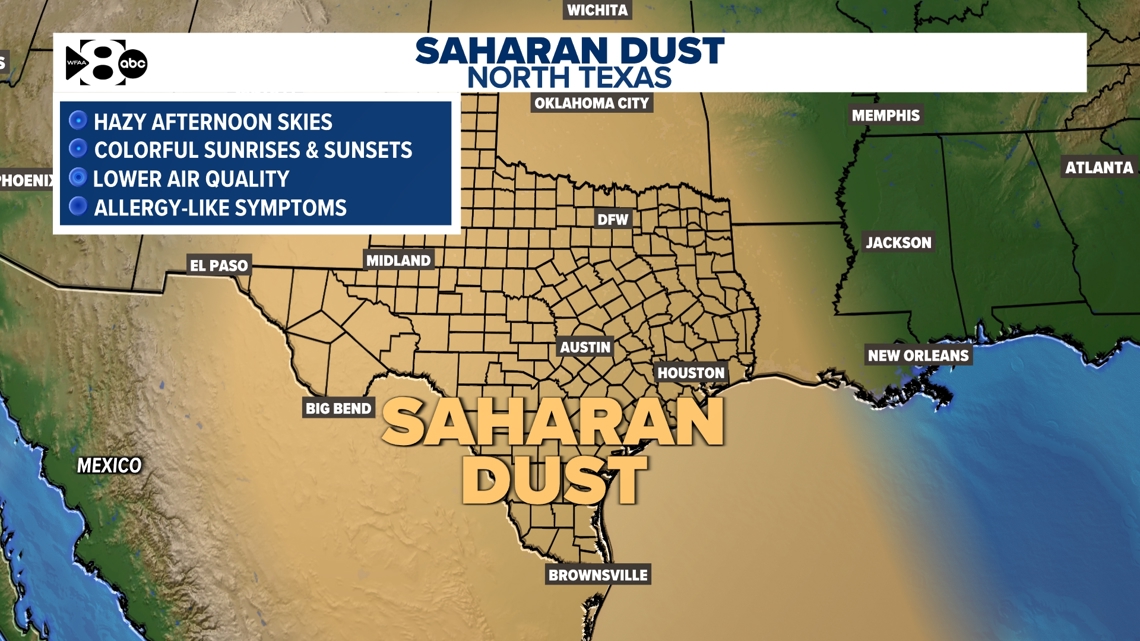

Saharan Dust Cloud Understanding Its 5 000 Mile Trek To North Texas

May 31, 2025

Saharan Dust Cloud Understanding Its 5 000 Mile Trek To North Texas

May 31, 2025 -

Rune Advances At French Open American Challenger Falls In Third Round Match

May 31, 2025

Rune Advances At French Open American Challenger Falls In Third Round Match

May 31, 2025

Latest Posts

-

Jannik Sinner Vs Carlos Alcaraz A Us Open 2025 Draw Comparison

Aug 23, 2025

Jannik Sinner Vs Carlos Alcaraz A Us Open 2025 Draw Comparison

Aug 23, 2025 -

Epping Asylum Hotel Government Challenges Court Ruling

Aug 23, 2025

Epping Asylum Hotel Government Challenges Court Ruling

Aug 23, 2025 -

Government Launches Appeal Against Epping Asylum Hotel Ruling

Aug 23, 2025

Government Launches Appeal Against Epping Asylum Hotel Ruling

Aug 23, 2025 -

Us Open 2025 Preview Comparing Sinner And Alcarazs Draw Challenges

Aug 23, 2025

Us Open 2025 Preview Comparing Sinner And Alcarazs Draw Challenges

Aug 23, 2025 -

Detroit Lions Vs Houston Texans Preseason Game Your Complete Viewing Guide

Aug 23, 2025

Detroit Lions Vs Houston Texans Preseason Game Your Complete Viewing Guide

Aug 23, 2025