Analyzing The Recent Surge In Unusual Trades On Wall Street

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing the Recent Surge in Unusual Trades on Wall Street: A Deep Dive into Market Volatility

Wall Street is buzzing. Recent weeks have witnessed a dramatic increase in unusual trading activity, sending ripples through the financial markets and sparking intense speculation among analysts and investors alike. This surge, characterized by atypical volume spikes, rapid price swings, and unusual options trading patterns, demands a closer examination. Understanding the underlying causes is crucial for navigating the current market volatility and mitigating potential risks.

What Constitutes "Unusual" Trading Activity?

Before delving into the specifics of the recent surge, it's essential to define what constitutes unusual trading activity. It's not simply a matter of high trading volume; it encompasses a range of factors, including:

- High Volume in Low-Liquidity Stocks: A sudden and significant increase in trading volume for stocks that typically see low trading activity is a major red flag.

- Sharp Price Swings Without News: Dramatic price movements unrelated to any significant company announcements or market-wide news often signal manipulative activity or coordinated trading strategies.

- Unusual Options Activity: A disproportionate number of options contracts bought or sold, especially out-of-the-money options, can indicate speculative bets or attempts to manipulate the price.

- Short-Selling Frenzy: A sudden spike in short selling, which involves betting against a stock's price, can exacerbate downward pressure and lead to significant volatility.

Possible Explanations for the Recent Surge:

Several factors might contribute to the recent upswing in unusual trading activity on Wall Street:

1. Algorithmic Trading and High-Frequency Trading (HFT): The increased reliance on sophisticated algorithms and HFT strategies can amplify market fluctuations and create seemingly erratic price movements. These algorithms often react to minute changes in market data, leading to rapid buy and sell orders that can overwhelm traditional trading patterns.

2. Meme Stock Mania 2.0?: While the initial meme stock frenzy subsided, the underlying sentiment of retail investor influence remains. Social media platforms continue to play a significant role in coordinating trading activity, potentially fueling speculative bubbles and unusual price swings. Learn more about the impact of social media on stock markets in this insightful . (Note: This is an example external link; replace with a relevant and credible source.)

3. Geopolitical Uncertainty and Macroeconomic Factors: Global events, such as the ongoing war in Ukraine and rising inflation, contribute to market uncertainty and can trigger unusual trading patterns as investors react to evolving geopolitical and economic landscapes.

4. Increased Regulatory Scrutiny: While not a direct cause, increased regulatory scrutiny on market manipulation could ironically lead to more sophisticated and subtle attempts to circumvent regulations, resulting in a complex pattern of unusual trading activity.

5. The Rise of Retail Investors: The democratization of investing through online brokerage platforms has empowered retail investors, leading to increased market participation and potentially contributing to heightened volatility.

Navigating the Volatile Market:

The current market climate demands caution and a strategic approach. Investors should:

- Diversify their portfolios: Spreading investments across different asset classes reduces exposure to individual stock volatility.

- Conduct thorough due diligence: Before making any investment decisions, thoroughly research the underlying company and the broader market conditions.

- Stay informed: Keep abreast of market news and analysis to understand the factors driving price movements.

- Consider professional advice: Consulting with a financial advisor can provide valuable insights and guidance.

Conclusion:

The recent surge in unusual trades on Wall Street highlights the complexities and challenges of modern financial markets. While pinpointing the exact cause remains a subject of ongoing analysis, understanding the contributing factors is crucial for investors seeking to navigate the current volatility and protect their portfolios. Staying informed and adopting a cautious, well-researched approach is paramount in these turbulent times.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing The Recent Surge In Unusual Trades On Wall Street. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dramatic Rescue Passing Motorists Save Woman From Fiery Car Wreck

Jun 14, 2025

Dramatic Rescue Passing Motorists Save Woman From Fiery Car Wreck

Jun 14, 2025 -

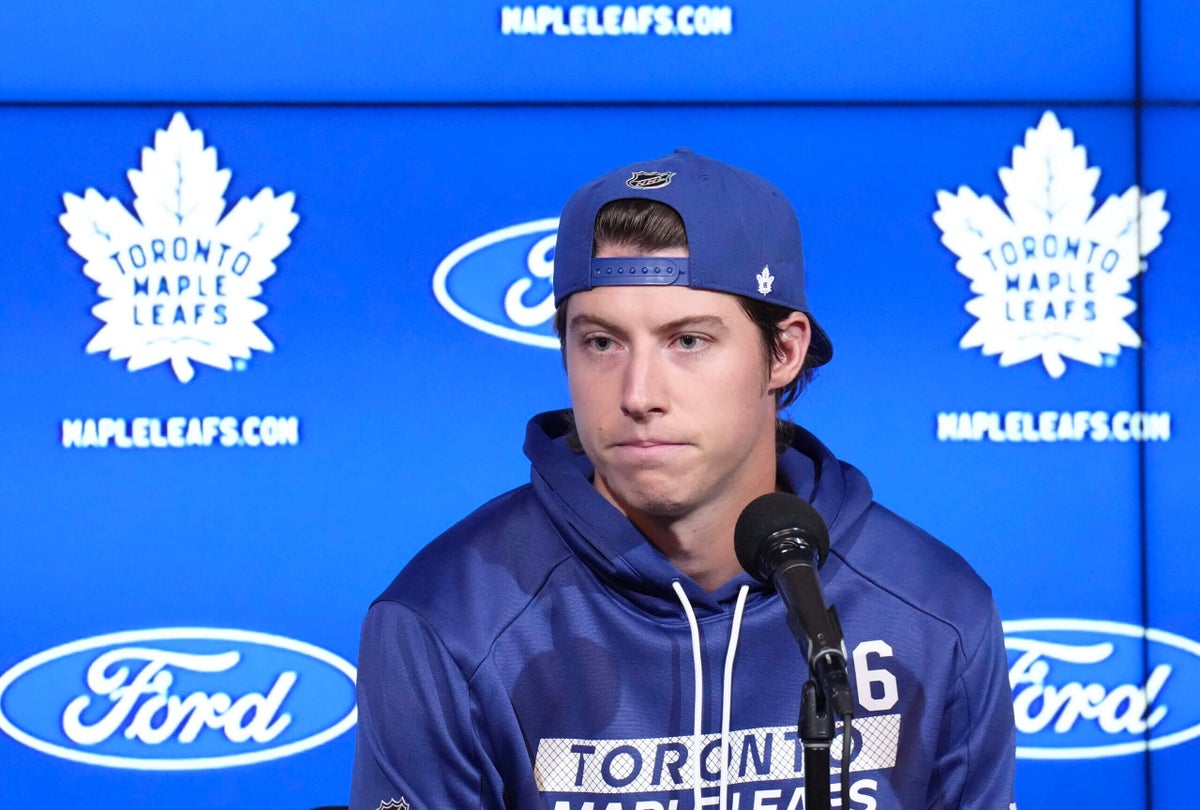

The Weight Of Expectations Mitch Marners Next Nhl Contract

Jun 14, 2025

The Weight Of Expectations Mitch Marners Next Nhl Contract

Jun 14, 2025 -

Congressional Picnic At The White House Trump Clears Up Confusion Over Pauls Invitation

Jun 14, 2025

Congressional Picnic At The White House Trump Clears Up Confusion Over Pauls Invitation

Jun 14, 2025 -

Love Island Usa Episode Schedule June 11th Update

Jun 14, 2025

Love Island Usa Episode Schedule June 11th Update

Jun 14, 2025 -

Payson Area Road Closure Sr 87 Southbound Shut Down Due To Brush Fire

Jun 14, 2025

Payson Area Road Closure Sr 87 Southbound Shut Down Due To Brush Fire

Jun 14, 2025

Latest Posts

-

Analyzing The Projected Cut Line For The 2025 Us Open

Jun 15, 2025

Analyzing The Projected Cut Line For The 2025 Us Open

Jun 15, 2025 -

Spencers Stride A Performance Decline

Jun 15, 2025

Spencers Stride A Performance Decline

Jun 15, 2025 -

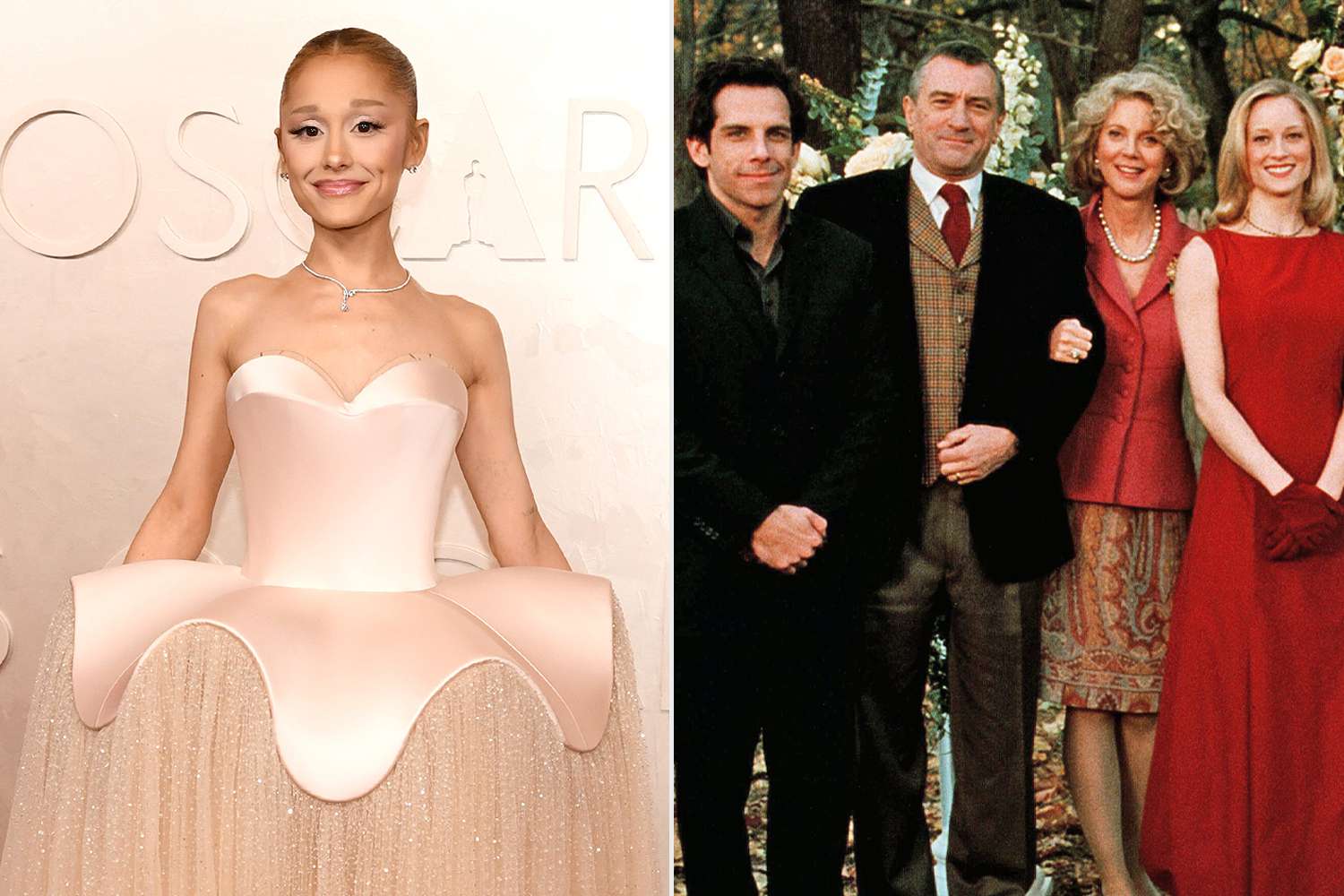

Meet The Parents 4 Ben Stiller Confirms Ariana Grandes Key Role And Comedic Prowess

Jun 15, 2025

Meet The Parents 4 Ben Stiller Confirms Ariana Grandes Key Role And Comedic Prowess

Jun 15, 2025 -

Analyzing Spencers Recent Performance Slump

Jun 15, 2025

Analyzing Spencers Recent Performance Slump

Jun 15, 2025 -

Baja De Rivero El Once Ideal De Barcelona Para Enfrentar A Manta

Jun 15, 2025

Baja De Rivero El Once Ideal De Barcelona Para Enfrentar A Manta

Jun 15, 2025