Analyzing The Republican Retirement Plan: A $420,000 Hit To Millennials?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing the Republican Retirement Plan: A $420,000 Hit to Millennials?

The proposed Republican retirement plan has sparked intense debate, with some analysts claiming it could cost millennials up to $420,000 in retirement savings. This alarming figure has ignited a firestorm of controversy, leaving many young Americans questioning the long-term financial security of the proposed legislation. But is this figure accurate, and what are the potential implications for this crucial demographic? Let's delve into the details.

The Republican plan, while aiming to simplify the existing retirement system, includes provisions that critics argue disproportionately impact younger generations. Key concerns revolve around changes to tax benefits for retirement savings and potential limitations on contribution limits. These changes, according to some financial experts, could significantly reduce the growth potential of millennial retirement accounts over their working lives.

H2: Breaking Down the $420,000 Claim

The $420,000 figure isn't plucked from thin air. Several financial modeling studies have attempted to quantify the potential impact of the proposed changes. These models typically factor in:

- Reduced Tax Advantages: The plan might reduce or eliminate certain tax deductions currently available for retirement contributions, thus lowering the after-tax return on investment.

- Lower Contribution Limits: Potential caps on contributions could limit the amount millennials can save each year, compounding the negative impact over time.

- Increased Fees: Some proposals could inadvertently lead to higher fees associated with managing retirement accounts.

It's crucial to understand that these models rely on several assumptions, including projected investment returns and individual saving habits. The actual impact will vary depending on individual circumstances and market fluctuations. However, the consistent finding across multiple analyses is that the proposed changes could significantly reduce the accumulated savings of millennials by the time they reach retirement age.

H2: The Long-Term Implications for Millennials

The potential loss of $420,000, or even a substantially smaller amount, represents a significant blow to the financial well-being of millennials, who are already facing considerable economic headwinds. This generation is saddled with student loan debt, rising housing costs, and stagnant wage growth. A weakened retirement system could further exacerbate these challenges, potentially delaying retirement, reducing quality of life in later years, or forcing them to rely heavily on Social Security, which itself faces long-term sustainability concerns.

H2: Counterarguments and Alternative Perspectives

While the potential negative impacts are significant, it's important to consider counterarguments. Supporters of the Republican plan argue that its simplification will encourage greater participation in retirement savings overall. They also point to potential benefits such as increased investment choices and streamlined administration. However, these arguments often fail to address the specific concerns of millennials regarding the potentially devastating financial impact of the proposed changes.

H2: What Millennials Can Do Now

Given the uncertainty surrounding the future of retirement savings, millennials should proactively take steps to secure their financial futures:

- Maximize Current Contributions: Take advantage of all available tax advantages and contribute the maximum amount allowed to retirement accounts like 401(k)s and IRAs.

- Diversify Investments: Spread your investments across different asset classes to mitigate risk.

- Seek Professional Advice: Consult with a financial advisor to create a personalized retirement plan that accounts for your specific circumstances.

- Stay Informed: Keep abreast of developments regarding retirement legislation and adjust your savings strategy as needed.

H2: Conclusion: A Call for Further Discussion

The debate surrounding the Republican retirement plan and its impact on millennials is far from over. The potential $420,000 loss is a significant concern that warrants further investigation and public discussion. Millennials, in particular, need to actively engage in the conversation, advocate for policies that protect their financial future, and take personal responsibility for securing their retirement. The future of retirement security for this generation hinges on informed action and thoughtful policymaking. It is imperative that policymakers consider the long-term consequences of their decisions and strive to create a retirement system that is fair and equitable for all generations.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing The Republican Retirement Plan: A $420,000 Hit To Millennials?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

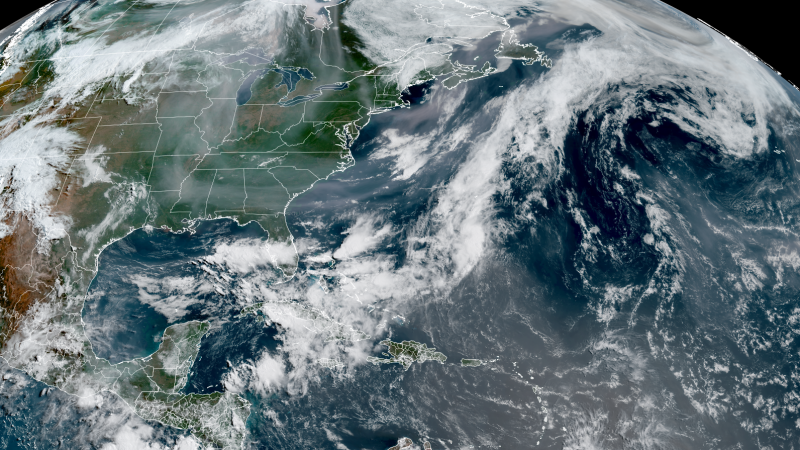

Wildfire Smoke And Dust Plume Convergence Forecast For Southern Us

Jun 05, 2025

Wildfire Smoke And Dust Plume Convergence Forecast For Southern Us

Jun 05, 2025 -

The Impact Of Daily Grooming Abuse Survivors Experiences

Jun 05, 2025

The Impact Of Daily Grooming Abuse Survivors Experiences

Jun 05, 2025 -

Mike Lindells Business And Political Journey A Cnn Deep Dive

Jun 05, 2025

Mike Lindells Business And Political Journey A Cnn Deep Dive

Jun 05, 2025 -

Billionaire Buffetts Strategic Shift From Bank Of America To A Consumer Giant

Jun 05, 2025

Billionaire Buffetts Strategic Shift From Bank Of America To A Consumer Giant

Jun 05, 2025 -

Energy Storage Firm Powin Announces Financial Difficulties Reflecting Sector Trends

Jun 05, 2025

Energy Storage Firm Powin Announces Financial Difficulties Reflecting Sector Trends

Jun 05, 2025

Latest Posts

-

Understanding The Trump Putin Alaska Meeting 5 Crucial Takeaways

Aug 17, 2025

Understanding The Trump Putin Alaska Meeting 5 Crucial Takeaways

Aug 17, 2025 -

Everything We Know About The Upcoming Lo L Champion Zaahen

Aug 17, 2025

Everything We Know About The Upcoming Lo L Champion Zaahen

Aug 17, 2025 -

Prayers For Ukraine Global Response To The Ongoing Conflict

Aug 17, 2025

Prayers For Ukraine Global Response To The Ongoing Conflict

Aug 17, 2025 -

New Report Northwest Lags Behind In Quality Of Life

Aug 17, 2025

New Report Northwest Lags Behind In Quality Of Life

Aug 17, 2025 -

Trumps Legacy Massive Troop Deployment To Latin America Targets Drug Cartels

Aug 17, 2025

Trumps Legacy Massive Troop Deployment To Latin America Targets Drug Cartels

Aug 17, 2025