Analyzing Trump's Stance On Tip Taxation: Implications For The Service Industry

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Trump's Stance on Tip Taxation: Implications for the Service Industry

Introduction: The debate surrounding tip taxation in the United States has resurfaced, particularly in light of past statements and policies proposed by former President Donald Trump. Understanding his stance and its potential implications for the service industry is crucial for workers, business owners, and policymakers alike. This article delves into the complexities of this issue, examining the potential economic and social ramifications of altering the current system.

Trump's Past Statements on Tip Taxation: While a concrete, comprehensive policy proposal on tip taxation from the Trump administration wasn't explicitly unveiled, his pronouncements on tax reform and his general approach to economic issues offer insight into a potential approach. His emphasis on tax cuts, particularly for businesses, could have implied a desire to simplify the tax code, potentially affecting how tips are treated. However, concrete details regarding his preferred method remain largely absent from the public record. This lack of clarity leaves room for interpretation and speculation, contributing to ongoing uncertainty within the service industry.

The Current System: A Complex Landscape: The current system for taxing tips in the US is already intricate. Servers and other tipped employees are required to report their tips to the IRS, even if they don't receive a Form W-2 reflecting those earnings. This often relies on self-reporting and the honor system, leading to potential discrepancies and challenges in enforcement. Employers also play a role, sometimes requiring tipped employees to contribute a portion of their tips to cover shared expenses like credit card processing fees. This further complicates the already complex tax landscape for those working in the service sector.

Potential Impacts of Policy Changes: Any significant changes to the tip taxation system would have cascading effects.

- Increased Compliance: A simplified system could potentially increase compliance, reducing the burden on both employees and the IRS. However, this also depends on the specifics of the proposed changes. A overly simplistic system could inadvertently disadvantage lower-income workers.

- Wage Adjustments: Changes in tip taxation could influence employers' decisions regarding base wages. If tips become less reliably factored into income, employers might be compelled to adjust base pay accordingly to maintain worker compensation. This would have significant implications for businesses' operating costs.

- Impact on Tipping Culture: Alterations to the system could potentially impact the tipping culture itself. A perceived unfairness or complexity could lead to changes in customer tipping behavior, which could significantly affect the livelihoods of tipped employees.

H3: Who Would Be Affected?

The service industry – encompassing restaurants, bars, hotels, salons, and many other sectors – would be most directly impacted. Millions of Americans rely on tips as a substantial portion of their income. The implications for these workers are significant, affecting their financial stability and overall well-being. The ripple effect would extend to business owners who would need to adapt to new tax regulations and potential changes in labor costs.

Conclusion: The potential impact of altering tip taxation under a different administration remains a topic of discussion and debate. The lack of specific proposals from former President Trump regarding this issue prevents a definitive analysis. However, examining the existing system and its inherent complexities highlights the importance of a carefully considered approach to any future reforms. Any policy changes must be thoroughly evaluated to ensure fairness, equity, and practicality for both employees and businesses within the service industry. Further research and public discourse are crucial to ensuring a well-informed and responsible approach to this complex issue.

Call to Action: Stay informed about ongoing discussions and legislative proposals related to tip taxation and its impact on the service industry. Engage in respectful dialogue to advocate for fair and effective policies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Trump's Stance On Tip Taxation: Implications For The Service Industry. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

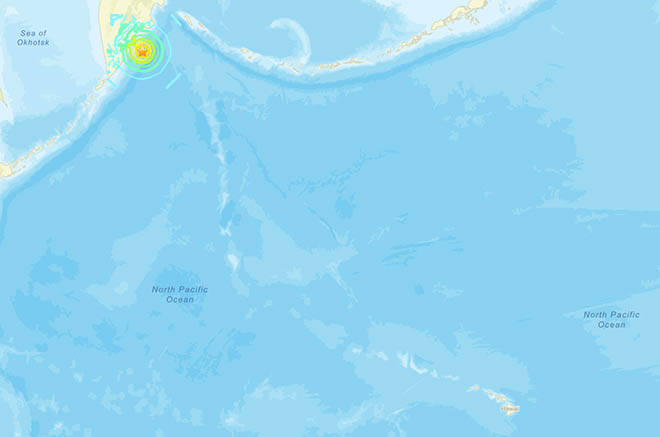

7 4 Magnitude Quake Off Russia Hawaii Tsunami Threat Ends

Jul 21, 2025

7 4 Magnitude Quake Off Russia Hawaii Tsunami Threat Ends

Jul 21, 2025 -

Aftermath Of Deadly Police Training Facility Explosion Exclusive Cnn Video

Jul 21, 2025

Aftermath Of Deadly Police Training Facility Explosion Exclusive Cnn Video

Jul 21, 2025 -

List Of Disabled Gear In Destiny 2 Raid Race Bug Breakdown

Jul 21, 2025

List Of Disabled Gear In Destiny 2 Raid Race Bug Breakdown

Jul 21, 2025 -

White House Officials Voice Concerns Over Netanyahus Middle East Approach

Jul 21, 2025

White House Officials Voice Concerns Over Netanyahus Middle East Approach

Jul 21, 2025 -

Heavyweight Boxing Usyks Knockout Win Secures Second Undisputed Title

Jul 21, 2025

Heavyweight Boxing Usyks Knockout Win Secures Second Undisputed Title

Jul 21, 2025