Analyzing Trump's Tip Tax Policy: Implications For The American Workforce

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Analyzing Trump's Proposed Tip Tax Policy: Implications for the American Workforce

Introduction: The debate surrounding former President Trump's proposed changes to how tips are taxed continues to spark controversy and raise critical questions about their potential impact on the American workforce. This article delves into the specifics of the proposal, analyzes its potential consequences for tipped employees, and explores the broader economic implications. Understanding this complex issue is crucial for both workers and policymakers alike.

Understanding the Proposed Changes: Trump's plan, while never fully implemented, aimed to alter the way the IRS treats tips reported by employees. The core proposal involved a shift in how the employer's responsibility intersects with the employee's reporting obligations. While details varied across different iterations of the proposal, the central theme involved potential increases in the level of employer oversight and reporting, along with implications for the tip credit – a mechanism that allows employers to reduce their minimum wage obligations for tipped employees. This effectively meant exploring ways to ensure better compliance with existing tip reporting regulations and potentially streamlining the process.

Potential Impacts on Tipped Employees: The implications for tipped workers are multifaceted and potentially significant.

- Increased Scrutiny: Enhanced employer reporting could lead to increased scrutiny of employee tip income, potentially leading to disputes and misinterpretations.

- Wage Adjustments: Changes to the tip credit could directly affect hourly wages, potentially leading to either increases or decreases depending on the specifics of the implementation. This is a major point of contention, as supporters argued it could reduce employer costs, while critics feared it could lower actual take-home pay for workers.

- Compliance Burden: More complex reporting procedures could place an added burden on already busy tipped employees, many of whom work in fast-paced environments with limited administrative support.

Economic Implications: The broader economic impact of such a policy is a subject of ongoing debate among economists.

- Employer Costs: While some argue that stricter enforcement could reduce employer costs related to minimum wage compliance, others counter that increased administrative burdens and potential litigation could offset these savings.

- Consumer Prices: Changes in labor costs could potentially translate to changes in consumer prices, although the magnitude of such changes is uncertain and depends on various market factors.

- Tax Revenue: The impact on overall tax revenue is also difficult to predict definitively. Increased reporting could lead to higher tax collection, but this might be countered by potential reductions in the overall wages of tipped workers.

Comparison with Existing Regulations: Currently, the Fair Labor Standards Act (FLSA) outlines regulations surrounding tipped employees, including minimum wage requirements and tip reporting. Trump's proposals would have amended or modified aspects of this existing legal framework. Understanding the nuances of the FLSA is crucial to fully comprehending the potential changes. [Link to relevant FLSA information on government website].

Conclusion: The analysis of Trump's proposed tip tax policy reveals a complex interplay of economic, social, and legal considerations. While the intention might have been to improve tax compliance and potentially reduce employer costs, the potential consequences for the American workforce, particularly for tipped employees, warrant careful examination. Further research and discussion are necessary to fully understand the long-term implications of such policy changes and to ensure fair treatment for all workers. The debate highlights the need for a nuanced approach to tax policy that considers both compliance and the wellbeing of the workforce.

Call to Action: Stay informed about updates on employment law and tax regulations affecting your industry. Consult with a tax professional or employment lawyer for advice specific to your situation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Analyzing Trump's Tip Tax Policy: Implications For The American Workforce. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nyt Connections Puzzle 770 July 20 A Step By Step Solution

Jul 23, 2025

Nyt Connections Puzzle 770 July 20 A Step By Step Solution

Jul 23, 2025 -

Anniversary Post Draws Criticism Kamala Harris Presidential Bid Under Scrutiny

Jul 23, 2025

Anniversary Post Draws Criticism Kamala Harris Presidential Bid Under Scrutiny

Jul 23, 2025 -

Violence Mars Epping Protest Flares And Bottles Fly

Jul 23, 2025

Violence Mars Epping Protest Flares And Bottles Fly

Jul 23, 2025 -

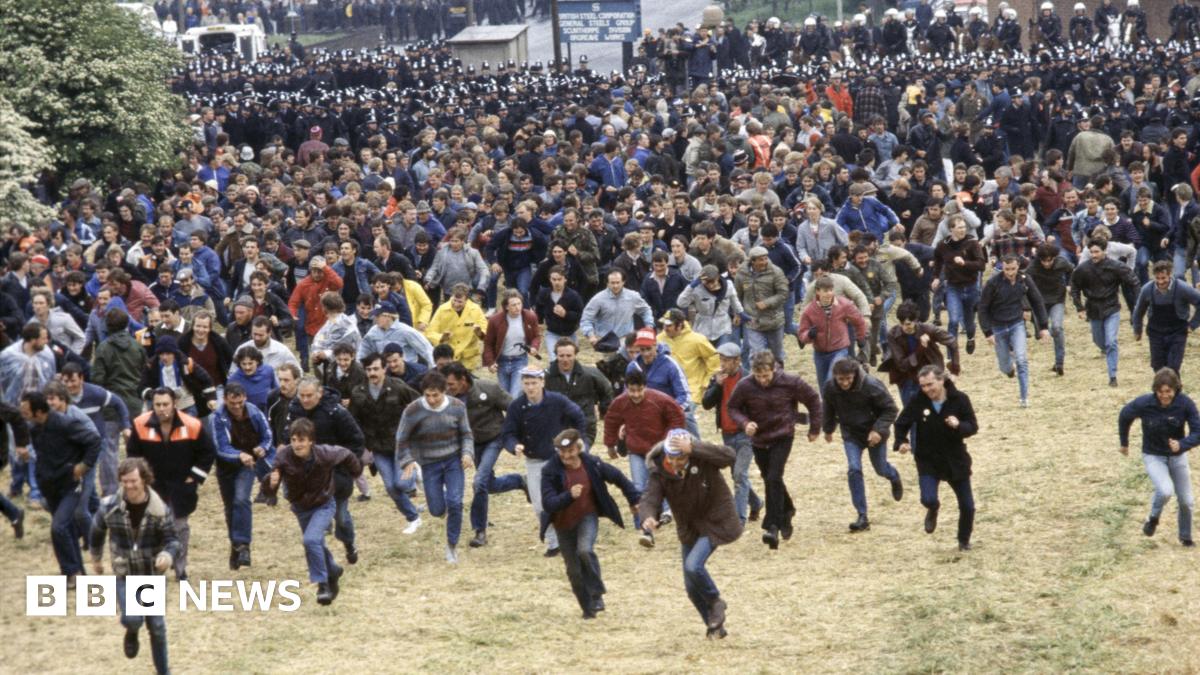

Orgreave National Inquiry Greenlit Following Yvette Coopers Announcement

Jul 23, 2025

Orgreave National Inquiry Greenlit Following Yvette Coopers Announcement

Jul 23, 2025 -

Power Outage In South Omaha Investigation Reveals Faulty Switch

Jul 23, 2025

Power Outage In South Omaha Investigation Reveals Faulty Switch

Jul 23, 2025

Californias Vandenberg Air Force Base Key To Space Xs Starlink Satellite Deployments

Californias Vandenberg Air Force Base Key To Space Xs Starlink Satellite Deployments

American Dream Fulfilled Normandy Adventure For Two

American Dream Fulfilled Normandy Adventure For Two