Another RBA Rate Cut Inevitable: Good News For Australian Mortgages?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Another RBA Rate Cut Inevitable: Good News for Australian Mortgages?

Australia's economic landscape is shifting, and whispers of another Reserve Bank of Australia (RBA) rate cut are growing louder. The question on everyone's mind, particularly homeowners and prospective buyers, is: will this translate into good news for Australian mortgages? Let's delve into the potential implications.

Recent economic indicators paint a picture of slowing growth, with inflation stubbornly persistent but showing signs of easing. The RBA, tasked with maintaining price stability and full employment, is walking a tightrope. While inflation remains above the target band, the slowing economy necessitates careful consideration of further monetary policy adjustments.

The Case for a Rate Cut:

Several factors point towards the likelihood of another RBA rate cut in the coming months:

- Weakening Economic Growth: Data suggests a significant slowdown in key economic sectors, impacting consumer confidence and spending. This sluggish growth reduces the pressure on inflation.

- Falling Unemployment, but…: While the unemployment rate remains relatively low, there are concerns about the quality of jobs and potential future job losses as economic uncertainty persists.

- Global Economic Headwinds: The global economic outlook remains precarious, with potential repercussions for the Australian economy through trade and investment.

What This Means for Australian Mortgages:

A rate cut by the RBA would likely translate to lower interest rates for variable-rate mortgages. This could mean:

- Lower Monthly Repayments: Homeowners with variable-rate mortgages could see a reduction in their monthly repayments, freeing up some disposable income.

- Increased Borrowing Power: Prospective homebuyers could find it easier to secure a mortgage with a potentially larger loan amount due to lower interest rates.

- Boost to the Property Market: Lower interest rates can stimulate demand in the property market, potentially leading to increased activity and a rise in property values. However, this is not guaranteed and depends on other market factors.

However, It's Not All Rosy:

While a rate cut offers potential benefits, it's crucial to consider the nuances:

- Inflationary Pressures: While easing, inflation still remains a concern. A rate cut could potentially reignite inflationary pressures if not carefully managed.

- Impact on Savers: Lower interest rates mean lower returns on savings accounts, potentially impacting retirees and those relying on interest income.

- Uncertain Economic Outlook: The overall economic outlook remains uncertain, and a rate cut is just one piece of the puzzle. Other factors, such as global economic conditions and government policy, will significantly impact the property market and the economy as a whole.

What to Do Now:

If you're a homeowner or prospective buyer, it's crucial to:

- Monitor Economic Indicators: Stay informed about economic news and RBA announcements to understand the evolving situation.

- Speak to Your Lender: If you have a variable-rate mortgage, contact your lender to understand the potential impact of a rate cut on your repayments.

- Seek Professional Advice: Consult with a financial advisor for personalized advice tailored to your individual circumstances.

In conclusion, while another RBA rate cut appears increasingly likely, its impact on Australian mortgages is complex and multifaceted. It’s vital to weigh the potential benefits against the risks and consider your individual financial situation before making any major decisions. Stay informed, stay proactive, and seek expert guidance to navigate this dynamic economic environment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Another RBA Rate Cut Inevitable: Good News For Australian Mortgages?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Assam Influencer Babydoll Archis Viral Video And Kendra Lust Photo

Jul 09, 2025

Assam Influencer Babydoll Archis Viral Video And Kendra Lust Photo

Jul 09, 2025 -

Dramatic Footage Texas Home Transported By Floodwaters Cnn Reports

Jul 09, 2025

Dramatic Footage Texas Home Transported By Floodwaters Cnn Reports

Jul 09, 2025 -

Baby Shower Fallout Woman Exits After Hosts Infertility Remarks

Jul 09, 2025

Baby Shower Fallout Woman Exits After Hosts Infertility Remarks

Jul 09, 2025 -

Neillsville Woman Sentenced For Tampering With Lottery Tickets

Jul 09, 2025

Neillsville Woman Sentenced For Tampering With Lottery Tickets

Jul 09, 2025 -

Influencer Archita Phukans Struggle A R25 Lakh Escape From Prostitution

Jul 09, 2025

Influencer Archita Phukans Struggle A R25 Lakh Escape From Prostitution

Jul 09, 2025

Latest Posts

-

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025 -

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

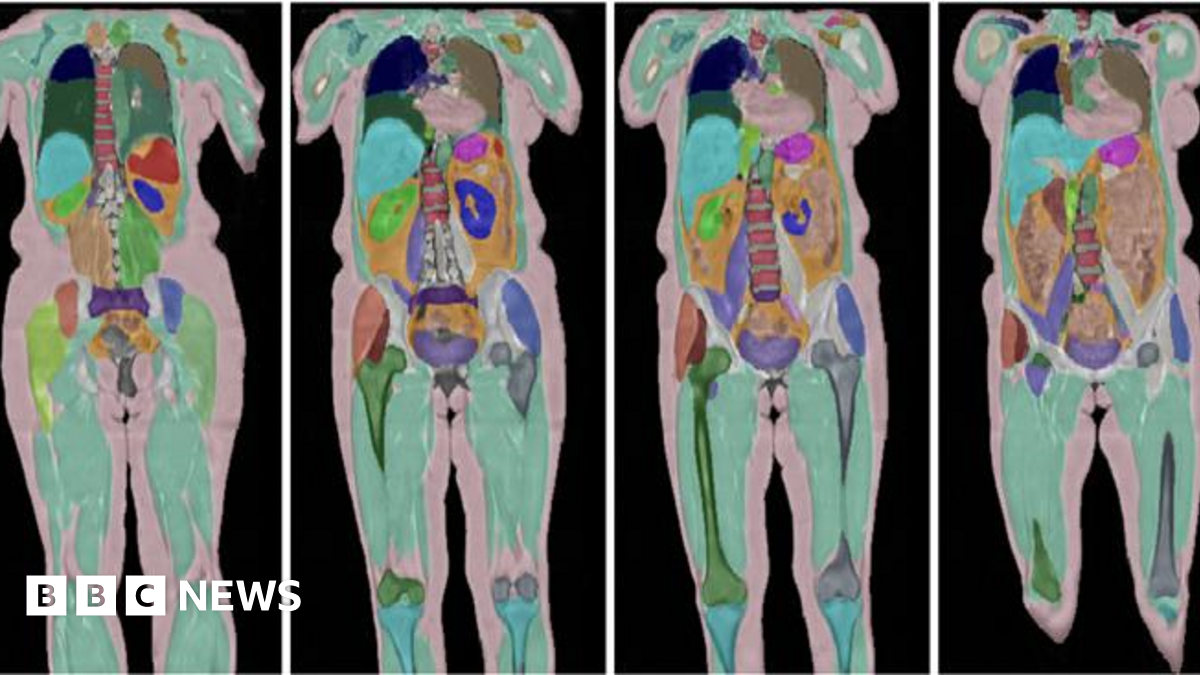

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025