Another RBA Rate Cut On The Horizon: Hope For Australian Homeowners

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Another RBA Rate Cut on the Horizon: Hope for Australian Homeowners?

The Australian housing market has been grappling with rising interest rates for months, leaving many homeowners feeling the pinch. But could relief be on the way? Whispers of another Reserve Bank of Australia (RBA) rate cut are circulating, sparking renewed hope among borrowers and fueling speculation about a potential shift in monetary policy. This article delves into the current economic climate, examining the likelihood of a rate cut and its potential impact on Australian homeowners.

The Current Economic Landscape: A Balancing Act

The RBA's primary mandate is to maintain price stability and full employment. Inflation, while easing, remains stubbornly above the target range, forcing the central bank to tread carefully. Recent economic data shows a mixed bag: while unemployment remains relatively low, consumer confidence is wavering, and there are concerns about slowing economic growth. This delicate balance makes predicting the RBA's next move challenging.

Arguments for a Rate Cut:

- Easing Inflation: While still elevated, inflation shows signs of cooling. This provides some leeway for the RBA to consider easing monetary policy.

- Weakening Consumer Spending: Rising interest rates have significantly impacted consumer spending, potentially leading to a slowdown in economic activity. A rate cut could stimulate spending and boost economic growth.

- Housing Market Distress: The housing market is undeniably feeling the pressure of higher interest rates. A rate cut could offer much-needed relief to struggling homeowners, preventing further distress.

- Global Economic Slowdown: The global economy faces considerable uncertainty, with potential recessions looming in several major economies. A proactive rate cut could act as a buffer against external economic shocks.

Arguments Against a Rate Cut:

- Persistent Inflation: Inflation, while declining, remains above the RBA's target range. A premature rate cut risks reigniting inflationary pressures.

- Wage Growth: Strong wage growth could further fuel inflation, making a rate cut a risky proposition. The RBA needs to carefully monitor wage increases to avoid exacerbating inflationary pressures.

- Potential for Further Rate Hikes: Depending on upcoming economic data, the RBA could still opt for further interest rate hikes to maintain price stability.

What Does This Mean for Australian Homeowners?

A rate cut would undoubtedly bring relief to many Australian homeowners facing mortgage stress. Lower interest rates would translate to lower monthly repayments, freeing up disposable income and boosting consumer confidence. However, it's crucial to remember that the impact will vary depending on individual circumstances and loan types.

Looking Ahead: What to Expect

The RBA's next move remains uncertain. The central bank will closely monitor economic indicators, including inflation, employment, and consumer spending, before making a decision. While a rate cut is a possibility, it's not guaranteed. Homeowners should continue to monitor the economic situation and consult with financial advisors to plan for various scenarios. Staying informed is key to navigating the complexities of the Australian housing market.

Call to Action: Stay informed about the latest RBA announcements and economic data by following reputable financial news sources. Consider consulting a financial advisor to discuss your individual circumstances and plan for potential changes in interest rates. Understanding your financial situation is crucial in navigating these uncertain times. Learn more about [link to relevant government website or financial advice resource].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Another RBA Rate Cut On The Horizon: Hope For Australian Homeowners. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Exploring Air Canada And Aeroplan Perks For Us Passengers

Jul 09, 2025

Exploring Air Canada And Aeroplan Perks For Us Passengers

Jul 09, 2025 -

Understanding Jnim The Al Qaeda Affiliate Terrorizing Mali

Jul 09, 2025

Understanding Jnim The Al Qaeda Affiliate Terrorizing Mali

Jul 09, 2025 -

Dramatic Footage Texas Home Transported By Floodwaters Cnn Reports

Jul 09, 2025

Dramatic Footage Texas Home Transported By Floodwaters Cnn Reports

Jul 09, 2025 -

Live Stream Space X Launches 28 Starlink Satellites From Cape Canaveral

Jul 09, 2025

Live Stream Space X Launches 28 Starlink Satellites From Cape Canaveral

Jul 09, 2025 -

Are Texas Childrens Camps Located In Floodplains A Safety Audit Needed

Jul 09, 2025

Are Texas Childrens Camps Located In Floodplains A Safety Audit Needed

Jul 09, 2025

Latest Posts

-

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025 -

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

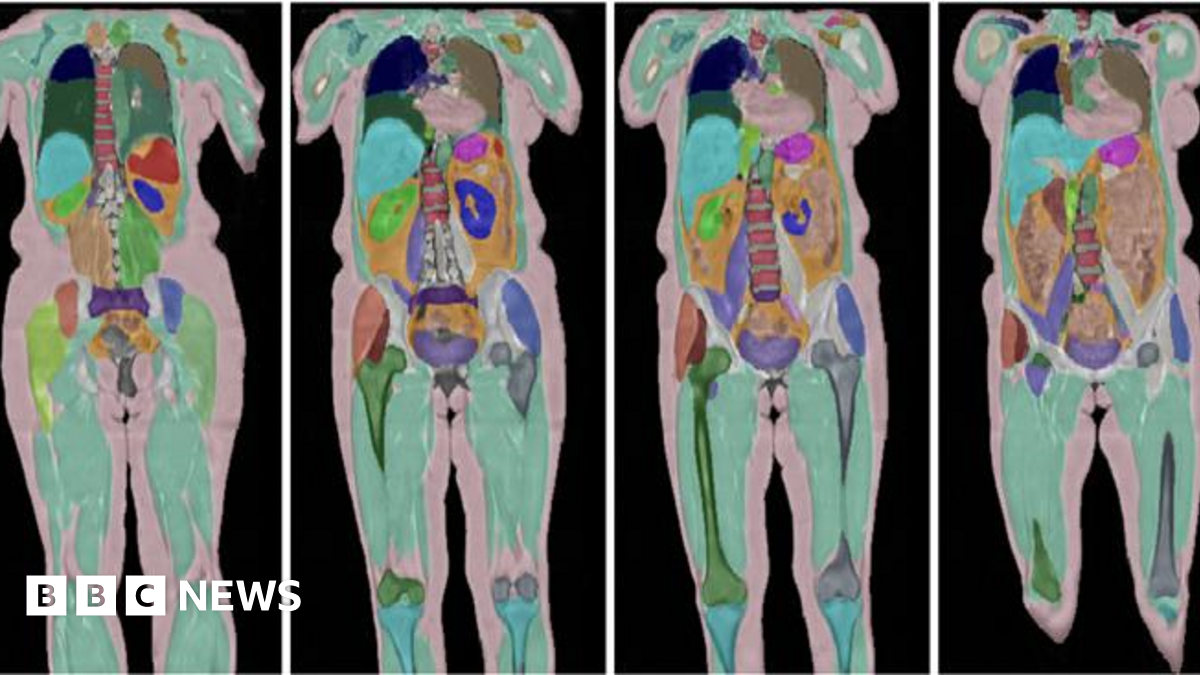

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025