April Government Borrowing Figures Exceed Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

April Government Borrowing Figures Exceed Expectations: Is This a Sign of Economic Trouble?

The UK government's borrowing figures for April have significantly exceeded expectations, sparking concerns about the country's economic outlook. Official data released today revealed a borrowing figure of £20.6 billion, a stark contrast to the £14 billion predicted by economists. This represents a substantial increase compared to the £1.6 billion borrowed in April 2022, and has sent ripples through financial markets.

The unexpectedly high borrowing figure raises significant questions about the government's fiscal strategy and the overall health of the UK economy. Experts are now scrambling to analyze the contributing factors and predict the potential consequences.

What Contributed to the Higher-Than-Expected Borrowing?

Several factors likely contributed to this surprising surge in government borrowing:

- Inflationary Pressures: Soaring inflation continues to impact government spending. Increased costs across various sectors, from healthcare to social welfare programs, put immense pressure on public finances. The high cost of living is also impacting tax revenues, as individuals and businesses struggle.

- Interest Rate Hikes: The Bank of England's aggressive interest rate hikes, aimed at curbing inflation, are increasing the cost of government debt servicing. This means a larger portion of government revenue is now allocated to paying interest on existing loans.

- Reduced Tax Revenues: While tax revenues are generally higher than in previous years, economic uncertainty and the impact of inflation have dampened growth, potentially resulting in lower-than-projected tax income. This shortfall further contributes to the increased borrowing.

- Energy Support Schemes: While crucial in mitigating the impact of the energy crisis, the considerable cost of government energy support schemes has undeniably placed a strain on public finances. These schemes, while vital for households and businesses, add significantly to the government's spending commitments.

What Does This Mean for the UK Economy?

The exceeding borrowing figures cast a shadow over the UK's economic prospects. The increased national debt raises concerns about long-term economic stability and the government's ability to manage its finances effectively.

Potential Consequences:

- Increased Interest Rates: This could lead to further interest rate hikes by the Bank of England, potentially impacting mortgage holders and businesses reliant on borrowing.

- Reduced Government Spending: The government may be forced to implement austerity measures, potentially cutting back on public services or delaying infrastructure projects.

- Impact on Investor Confidence: The high borrowing figures may negatively affect investor confidence in the UK economy, potentially leading to decreased investment and slower economic growth.

Looking Ahead: What Can We Expect?

The coming months will be crucial in determining the full impact of April's borrowing figures. The government's response, along with economic developments, will dictate the trajectory of the UK economy. Analysts are closely monitoring economic indicators and government announcements for clues on how the situation might evolve. Further analysis is needed to fully understand the underlying causes and potential solutions to address this significant fiscal challenge. Keep an eye on updates from the Office for National Statistics (ONS) and the Treasury for further insights. Staying informed about these developments is crucial for businesses and individuals alike.

Call to Action: Follow us for regular updates on the UK economy and important financial news. Understanding these trends is vital for making informed financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on April Government Borrowing Figures Exceed Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Government Considers Early Release For Violent Criminals Based On Good Behavior

May 23, 2025

Government Considers Early Release For Violent Criminals Based On Good Behavior

May 23, 2025 -

Chagos Islands Deal Halted Legal Challenge Delays Decolonization

May 23, 2025

Chagos Islands Deal Halted Legal Challenge Delays Decolonization

May 23, 2025 -

Norm From Cheers No More George Wendt Passes Away At Age 76

May 23, 2025

Norm From Cheers No More George Wendt Passes Away At Age 76

May 23, 2025 -

Dakota Johnson Chris Evans And Pedro Pascals Hilarious Rom Com Quiz

May 23, 2025

Dakota Johnson Chris Evans And Pedro Pascals Hilarious Rom Com Quiz

May 23, 2025 -

Must See Sci Fi Movie Of 2024 Finally Streaming

May 23, 2025

Must See Sci Fi Movie Of 2024 Finally Streaming

May 23, 2025

Latest Posts

-

The Search For A Progressive Media Voice Democrats Post 2024 Strategy

May 24, 2025

The Search For A Progressive Media Voice Democrats Post 2024 Strategy

May 24, 2025 -

Fda Mandates Expanded Warnings For Covid 19 Vaccines Regarding Myocarditis And Pericarditis

May 24, 2025

Fda Mandates Expanded Warnings For Covid 19 Vaccines Regarding Myocarditis And Pericarditis

May 24, 2025 -

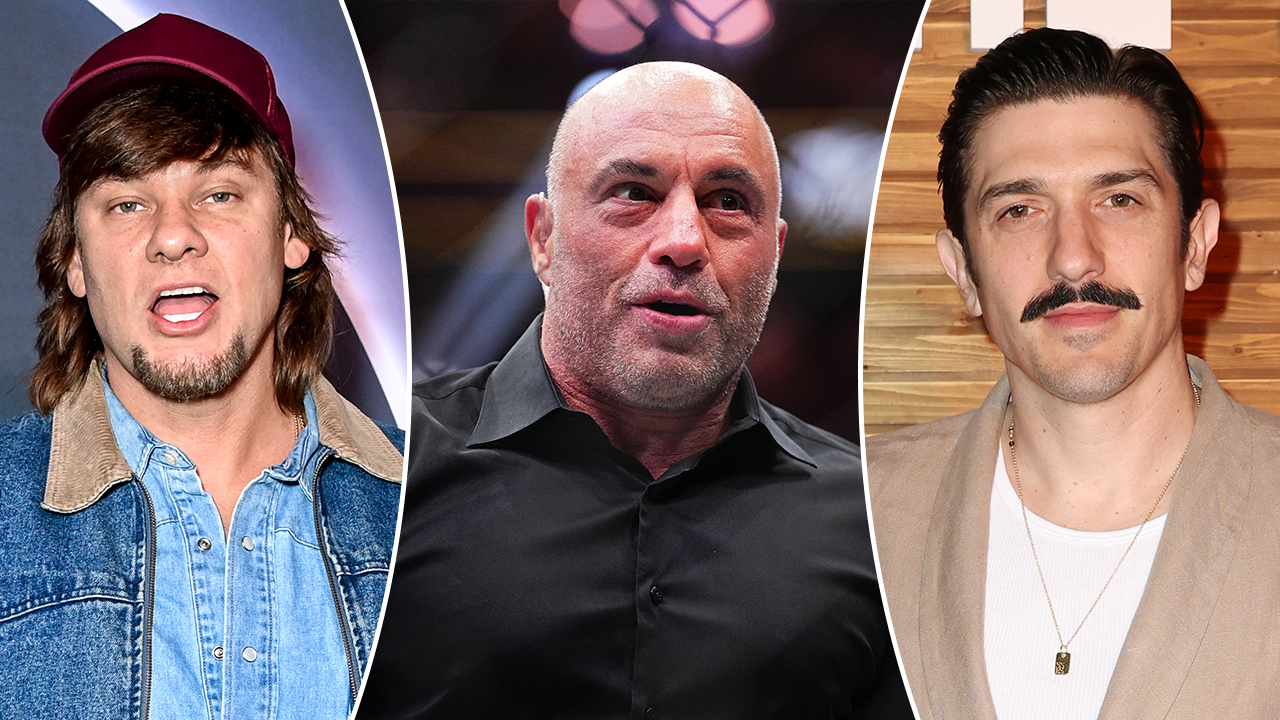

The Democratic Partys Struggle To Create A Counterpart To Joe Rogan

May 24, 2025

The Democratic Partys Struggle To Create A Counterpart To Joe Rogan

May 24, 2025 -

Must See Sci Fi Movie Of 2024 Streaming Debut

May 24, 2025

Must See Sci Fi Movie Of 2024 Streaming Debut

May 24, 2025 -

Melania Trump Leverages Ai Technology For Audiobook Project

May 24, 2025

Melania Trump Leverages Ai Technology For Audiobook Project

May 24, 2025