April Government Borrowing Surges Beyond Forecasts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

<h1>April Government Borrowing Surges Beyond Forecasts</h1>

Government borrowing in April soared to unprecedented levels, significantly exceeding economists' predictions and raising concerns about the nation's fiscal health. The unexpected surge has sparked debate about the effectiveness of current economic policies and fueled anxieties about future interest rate hikes.

<h2>Record-Breaking Deficit</h2>

Official figures released yesterday revealed that government borrowing reached £22.8 billion in April, a staggering £5 billion more than anticipated by City analysts. This represents the second-highest April borrowing figure on record, surpassed only by the peak borrowing seen during the height of the COVID-19 pandemic. The figure is particularly concerning given the expectation that economic growth would help to reduce the deficit. Instead, the opposite occurred, highlighting the complex interplay of economic factors at play.

<h3>Inflationary Pressures and Tax Revenue</h3>

Several factors contributed to this unexpected spike. Persistently high inflation continues to erode the real value of tax revenues, impacting the government's ability to meet its spending commitments. While tax receipts remain relatively strong compared to historical trends, the impact of inflation on real terms is substantial. Furthermore, the government's ongoing commitment to significant public spending programs, including healthcare and social welfare initiatives, adds to the pressure on public finances.

<h2>Impact on Interest Rates</h2>

The significant overshoot in borrowing figures has led many economists to predict further increases in interest rates. The Bank of England is already grappling with persistently high inflation, and the unexpectedly high borrowing figures strengthen the case for more aggressive monetary policy tightening. Higher interest rates, while aiming to curb inflation, could simultaneously dampen economic growth and potentially increase the government's debt servicing costs. This creates a delicate balancing act for the central bank.

<h3>Government Response</h3>

The government has yet to issue a formal response to the alarming figures, but whispers from within suggest a review of spending plans is underway. However, significant cuts to public services remain politically challenging. The situation underscores the difficulty faced by policymakers in navigating the complex economic landscape, balancing the need for fiscal responsibility with the demands of a population grappling with a cost-of-living crisis.

<h2>Looking Ahead: Uncertainty and Challenges</h2>

The unexpected surge in April's borrowing leaves considerable uncertainty about the government's fiscal trajectory for the remainder of the year. Analysts are now revising their forecasts upwards, anticipating further challenges in balancing the budget. The situation highlights the need for proactive and strategic fiscal planning, particularly in light of continued global economic instability and the persistent threat of inflation.

Key takeaways:

- April's government borrowing significantly exceeded forecasts.

- High inflation and continued spending are key contributing factors.

- Increased interest rates are likely in response to the higher-than-expected borrowing.

- The government faces a difficult balancing act between fiscal responsibility and public services.

This unprecedented situation warrants close monitoring. Stay tuned for further updates as the government responds and economists offer further analysis of this significant economic development. [Link to relevant government website for more information]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on April Government Borrowing Surges Beyond Forecasts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cnn Interview Comey Addresses Secret Service Meeting Controversy

May 23, 2025

Cnn Interview Comey Addresses Secret Service Meeting Controversy

May 23, 2025 -

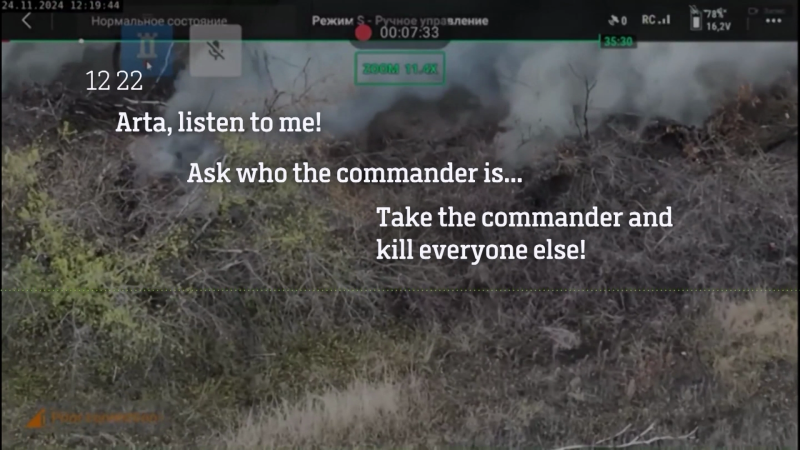

Take The Commander Kill The Rest Analysis Of Intercepted Russian Communications

May 23, 2025

Take The Commander Kill The Rest Analysis Of Intercepted Russian Communications

May 23, 2025 -

Is Taylor Swifts Comeback Sustainable Industry Experts Weigh In

May 23, 2025

Is Taylor Swifts Comeback Sustainable Industry Experts Weigh In

May 23, 2025 -

Viral Video Pedro Pascal Recites Pride And Prejudice In Rom Com Quiz

May 23, 2025

Viral Video Pedro Pascal Recites Pride And Prejudice In Rom Com Quiz

May 23, 2025 -

Left Wing Media Why Democrats Cant Replicate Joe Rogans Success

May 23, 2025

Left Wing Media Why Democrats Cant Replicate Joe Rogans Success

May 23, 2025

Latest Posts

-

Kill Everyone Else Analysis Of Disturbing Intercepted Russian Military Communication

May 24, 2025

Kill Everyone Else Analysis Of Disturbing Intercepted Russian Military Communication

May 24, 2025 -

I Phone 13 Owners Claim Your Free Apple Game Changing Offer

May 24, 2025

I Phone 13 Owners Claim Your Free Apple Game Changing Offer

May 24, 2025 -

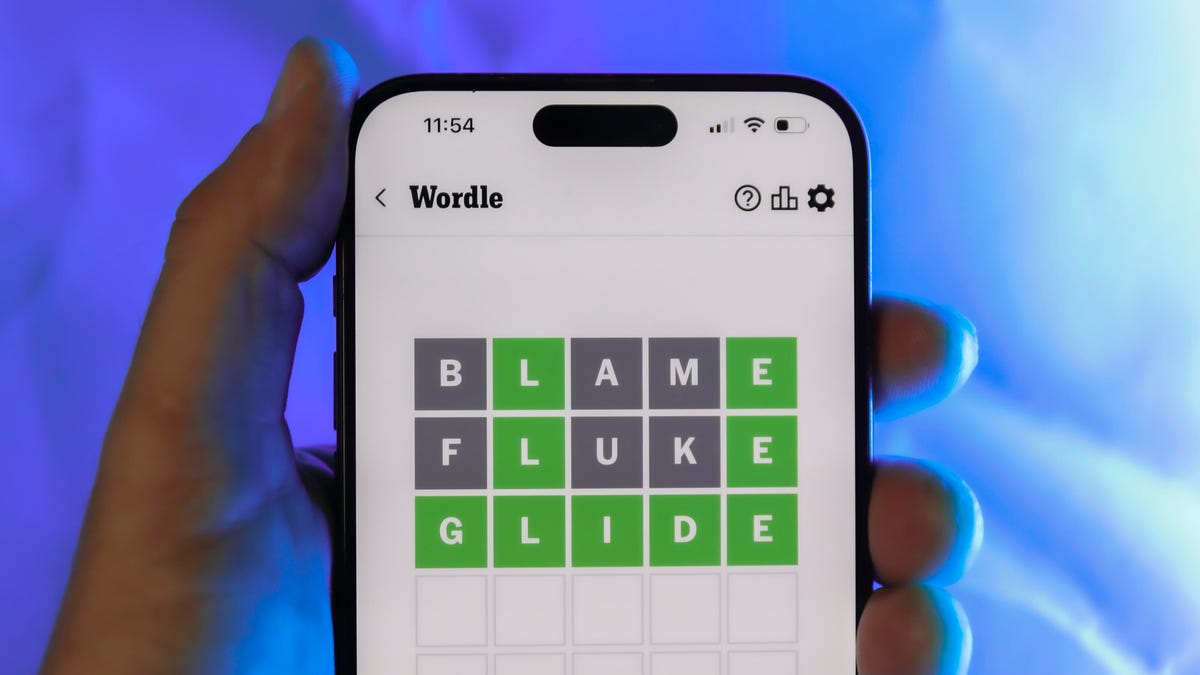

Wordle 1433 May 22 2024 Clues Answer And Gameplay Help

May 24, 2025

Wordle 1433 May 22 2024 Clues Answer And Gameplay Help

May 24, 2025 -

Record Spring Fuels Marine Heatwave Uk Sea Temperatures Soar

May 24, 2025

Record Spring Fuels Marine Heatwave Uk Sea Temperatures Soar

May 24, 2025 -

Sleeper Sci Fi Hit Arrives On Streaming Services

May 24, 2025

Sleeper Sci Fi Hit Arrives On Streaming Services

May 24, 2025