April's Government Borrowing: A Significant Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

April's Government Borrowing: A Significant Increase Sparks Concern

Government debt continues its upward trajectory, with April's borrowing figures revealing a substantial increase that has sent ripples through financial markets and sparked concerns amongst economists. The surge surpasses expectations, prompting questions about the government's fiscal strategy and its long-term implications for the national economy.

The Office for National Statistics (ONS) released the data this morning, showing a borrowing figure significantly higher than predicted by analysts. This sharp increase follows a period of relative stability, raising eyebrows and triggering debate about the underlying causes.

Understanding the Numbers: A Deeper Dive

The ONS reported that government borrowing in April reached [Insert Actual Figure Here], exceeding the anticipated [Insert Predicted Figure Here] by a considerable margin. This represents a [Calculate Percentage Increase]% increase compared to the same period last year. Several factors contribute to this significant jump:

- Increased spending on public services: The government's commitment to bolstering key public services, including healthcare and education, has undeniably contributed to the rise in borrowing. While necessary, this increased spending places pressure on the national budget.

- Inflationary pressures: The persistent inflationary environment has driven up the cost of government procurement, further impacting the borrowing figures. Higher prices across the board translate to increased spending across all government departments.

- Economic slowdown: Concerns about a potential economic slowdown, or even a recession, may have played a role. Reduced tax revenue during periods of economic uncertainty inevitably leads to a wider budget deficit.

Expert Analysis and Market Reaction

Financial markets reacted swiftly to the news, with [mention specific market indices and their reactions]. Leading economists are divided on the long-term implications.

"This significant rise in borrowing is a cause for concern," stated [Quote from a reputable economist], highlighting the potential risks associated with sustained high levels of government debt. Others argue that the increase is a necessary investment in crucial public services and infrastructure, crucial for long-term economic growth. The debate continues on whether the government's spending is sustainable in the long run.

Looking Ahead: What Does the Future Hold?

The government's response to this significant increase in borrowing will be closely scrutinized. Further analysis is needed to fully understand the contributing factors and determine the most effective strategies for managing public finances. Potential solutions could include:

- Targeted spending cuts: Identifying areas where spending can be reduced without compromising essential public services.

- Tax increases: Considering potential tax reforms to increase government revenue.

- Economic growth strategies: Implementing policies to stimulate economic growth and boost tax revenues.

This situation underscores the delicate balancing act between investing in crucial public services and maintaining fiscal responsibility. The coming months will be crucial in observing how the government navigates this challenge and the overall impact on the UK economy. Stay tuned for further updates as the situation unfolds.

Keywords: Government borrowing, UK debt, national debt, public spending, fiscal policy, inflation, economic growth, ONS, budget deficit, economic slowdown, recession, government finance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on April's Government Borrowing: A Significant Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Viral Tik Tok Womans Unexpected Encounter With Pope Leo Her Former Bishop

May 23, 2025

Viral Tik Tok Womans Unexpected Encounter With Pope Leo Her Former Bishop

May 23, 2025 -

Taylor Swift Back In The Studio Details On Her Next Album

May 23, 2025

Taylor Swift Back In The Studio Details On Her Next Album

May 23, 2025 -

The Light At The End Of The Tunnel Townsends Post Concussion Recovery

May 23, 2025

The Light At The End Of The Tunnel Townsends Post Concussion Recovery

May 23, 2025 -

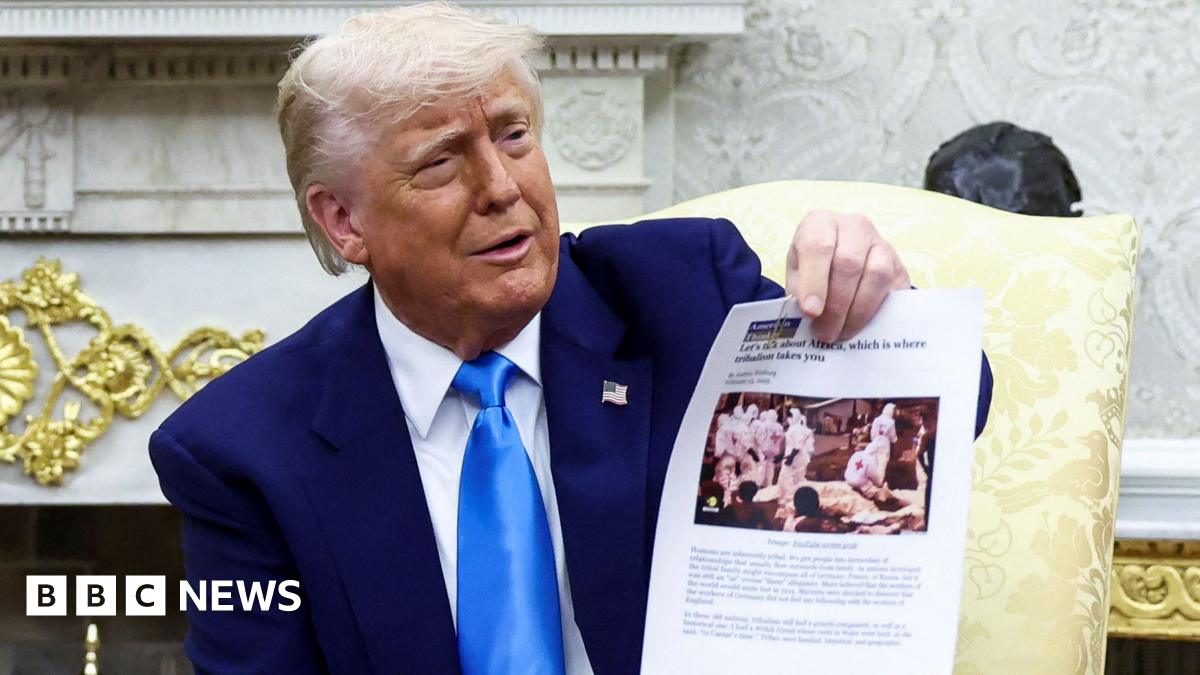

Cool Under Pressure Ramaphosa Faces Trumps Criticism

May 23, 2025

Cool Under Pressure Ramaphosa Faces Trumps Criticism

May 23, 2025 -

Public Health England Announces August Rollout Of Gonorrhoea Vaccine

May 23, 2025

Public Health England Announces August Rollout Of Gonorrhoea Vaccine

May 23, 2025

Latest Posts

-

Mauritius Chagos Islands Claim Faces Setback Due To Legal Action

May 23, 2025

Mauritius Chagos Islands Claim Faces Setback Due To Legal Action

May 23, 2025 -

Unexpected Increase In Government Borrowing For April

May 23, 2025

Unexpected Increase In Government Borrowing For April

May 23, 2025 -

Las Vegas To Host Pacquiaos Comeback Fight Against Mario Barrios

May 23, 2025

Las Vegas To Host Pacquiaos Comeback Fight Against Mario Barrios

May 23, 2025 -

Early Release Program For Violent Criminals Public Outcry And Concerns

May 23, 2025

Early Release Program For Violent Criminals Public Outcry And Concerns

May 23, 2025 -

Updated Italian Citizenship Law Great Grandparent Descent Route

May 23, 2025

Updated Italian Citizenship Law Great Grandparent Descent Route

May 23, 2025