April's Government Borrowing Figures Higher Than Forecast

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

April's Government Borrowing Figures Higher Than Forecast: A Worrying Trend?

The UK government's borrowing figures for April have landed with a thud, exceeding forecasts and sparking concerns about the nation's fiscal health. The Office for National Statistics (ONS) revealed a significantly higher-than-anticipated borrowing figure, raising questions about the government's economic strategy and future spending plans. This unexpected surge throws a shadow over the previously optimistic economic outlook and fuels debate about the effectiveness of current fiscal policies.

A Deeper Dive into the Numbers

The ONS reported that government borrowing in April reached £20.6 billion, considerably surpassing the £18 billion predicted by economists. This represents a significant increase compared to April 2022, when borrowing stood at £13.7 billion. The larger-than-expected deficit is primarily attributed to lower-than-anticipated tax revenues and higher-than-expected government spending.

Several factors contributed to this concerning outcome. Inflation, stubbornly high despite recent interest rate hikes by the Bank of England, continues to erode the real value of tax revenues. Furthermore, increased government spending on public services, particularly in areas like healthcare and social welfare, added to the pressure on public finances. This highlights the ongoing struggle to balance the need for vital public services with the imperative of fiscal responsibility.

Implications for the UK Economy

This unexpected jump in borrowing figures casts a long shadow over the UK's economic prospects. The increased borrowing will undoubtedly add to the national debt, potentially impacting the government's ability to invest in crucial infrastructure projects and social programs in the future. Furthermore, it raises concerns about the sustainability of the current economic model and may impact investor confidence.

The government’s response will be crucial in managing this situation. Options include implementing further austerity measures, increasing taxation, or focusing on economic growth strategies to boost tax revenues. Each option presents its own challenges and potential drawbacks, requiring careful consideration and potentially unpopular decisions.

What Lies Ahead?

The increased April borrowing figures serve as a stark reminder of the challenges facing the UK economy. While the government maintains its commitment to fiscal responsibility, the current situation demands careful monitoring and strategic adjustments. Future borrowing figures will be closely scrutinized, with analysts and economists keenly watching for signs of improvement or further deterioration. The government's upcoming budget announcements will be vital in understanding its planned approach to address this significant fiscal challenge.

- Key Takeaways:

- April's government borrowing significantly exceeded forecasts.

- High inflation and increased government spending contributed to the deficit.

- This raises concerns about the UK's fiscal sustainability and future economic prospects.

- The government's response will be crucial in managing this situation.

This situation underscores the complexity of navigating the UK economy, particularly in the face of persistent inflationary pressures. The coming months will be critical in observing the government's response and the overall impact on the nation's financial health. We will continue to monitor and report on further developments in this evolving story.

Related Articles:

- [Link to a relevant article on UK inflation]

- [Link to a relevant article on UK government spending]

- [Link to a relevant article on the Bank of England's interest rate decisions]

(Note: Replace bracketed links with actual links to relevant articles.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on April's Government Borrowing Figures Higher Than Forecast. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Street Fighter Movie Casting Update Andrew Koji Noah Centineo And More

May 23, 2025

Street Fighter Movie Casting Update Andrew Koji Noah Centineo And More

May 23, 2025 -

Recap Boston College Eagles Continued Struggles May 22 2025

May 23, 2025

Recap Boston College Eagles Continued Struggles May 22 2025

May 23, 2025 -

Chagos Islands Deal Halted Last Minute Legal Challenge Delays Transfer

May 23, 2025

Chagos Islands Deal Halted Last Minute Legal Challenge Delays Transfer

May 23, 2025 -

Quentin Tarantinos Once Upon A Time In Hollywood Book Publication Details And Release Date

May 23, 2025

Quentin Tarantinos Once Upon A Time In Hollywood Book Publication Details And Release Date

May 23, 2025 -

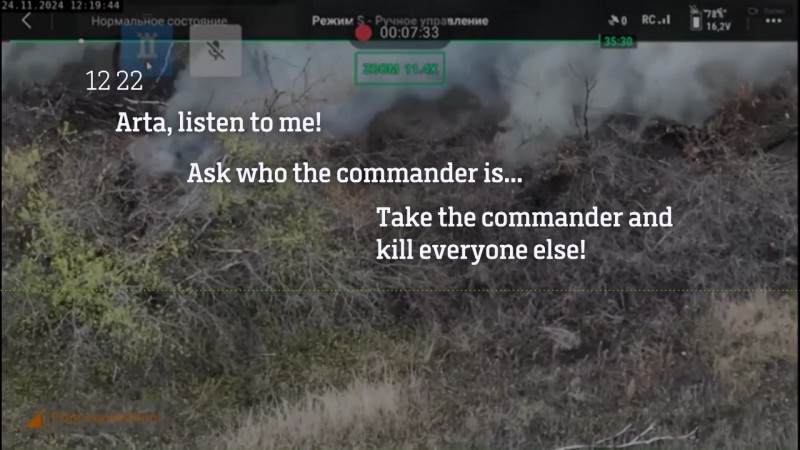

Cnn Obtains Shocking Russian Military Communication Kill Everyone Else

May 23, 2025

Cnn Obtains Shocking Russian Military Communication Kill Everyone Else

May 23, 2025

Latest Posts

-

Melania Trumps Ai Assisted Memoir A New Chapter

May 23, 2025

Melania Trumps Ai Assisted Memoir A New Chapter

May 23, 2025 -

New Fda Warning Increased Risk Of Heart Inflammation After Covid 19 Vaccination

May 23, 2025

New Fda Warning Increased Risk Of Heart Inflammation After Covid 19 Vaccination

May 23, 2025 -

Conquer Wordle 1433 Hints And The May 22 Answer

May 23, 2025

Conquer Wordle 1433 Hints And The May 22 Answer

May 23, 2025 -

Post I Os 18 5 Installation Six Crucial I Phone Configurations

May 23, 2025

Post I Os 18 5 Installation Six Crucial I Phone Configurations

May 23, 2025 -

My First Six Actions After Installing I Os 18 5 A Guide

May 23, 2025

My First Six Actions After Installing I Os 18 5 A Guide

May 23, 2025