April's Government Borrowing Figures: Higher Than Projected

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

April's Government Borrowing Figures: Higher Than Projected, Raising Concerns

The UK government's borrowing figures for April have landed with a thud, significantly exceeding forecasts and sparking renewed concerns about the nation's public finances. The Office for National Statistics (ONS) revealed a borrowing figure considerably higher than anticipated, raising questions about the government's fiscal strategy and its impact on the economy. This unexpected surge necessitates a closer look at the contributing factors and potential consequences.

Higher Than Expected: The Numbers Reveal a Concerning Trend

The ONS reported that government borrowing in April reached [Insert Actual Figure Here] billion, a stark contrast to the projected [Insert Projected Figure Here] billion. This represents a [Percentage Increase]% increase compared to the same month last year and is [Description of increase/decrease compared to previous months/years – e.g., the highest April borrowing figure in five years]. This significant overshoot immediately throws the government's fiscal targets into doubt and adds pressure to already strained public services.

Factors Contributing to the Increased Borrowing

Several factors contributed to this unexpected surge in borrowing. These include:

-

Increased interest payments: The rising cost of servicing the national debt, driven by increased interest rates, significantly impacted the April figures. The Bank of England's efforts to combat inflation have inadvertently increased the government's borrowing costs. This is a key factor that financial analysts are closely monitoring.

-

Lower-than-expected tax revenues: Tax revenues, a crucial component of government income, fell short of projections. This shortfall could be attributed to various factors, including [mention specific factors like changes in economic activity, tax avoidance, etc. Cite sources where possible]. A detailed breakdown of tax revenue streams is expected in the coming weeks.

-

Increased government spending: While the government has committed to fiscal responsibility, increased spending in certain areas might also have played a role. This could include increased expenditure on [mention specific areas, e.g., social welfare programs, healthcare, etc.], which are crucial for maintaining essential public services.

Implications and Future Outlook: What Lies Ahead?

The higher-than-expected borrowing figures raise several crucial questions regarding the government's economic strategy and fiscal plans for the remainder of the year. This unexpectedly large deficit could:

-

Impact future investment: The increased borrowing might necessitate cuts in future public spending or limit the government's capacity to invest in essential infrastructure projects and social programs.

-

Increase national debt: This adds to the already substantial national debt, potentially impacting the UK's credit rating and increasing the long-term cost of borrowing.

-

Fuel inflationary pressures: The increased government borrowing could further fuel inflationary pressures, making the Bank of England's job even more challenging.

The government will likely face increased scrutiny over its fiscal management in the coming weeks and months. The Chancellor's response and any potential adjustments to fiscal policy will be closely watched by markets and the public alike. Further analysis is needed to fully understand the long-term implications of this significant increase in borrowing. Stay tuned for updates and further analysis as the situation unfolds.

Learn More:

- [Link to ONS release]

- [Link to relevant government website]

- [Link to reputable financial news source]

Call to Action: What are your thoughts on these latest borrowing figures? Share your opinions in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on April's Government Borrowing Figures: Higher Than Projected. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

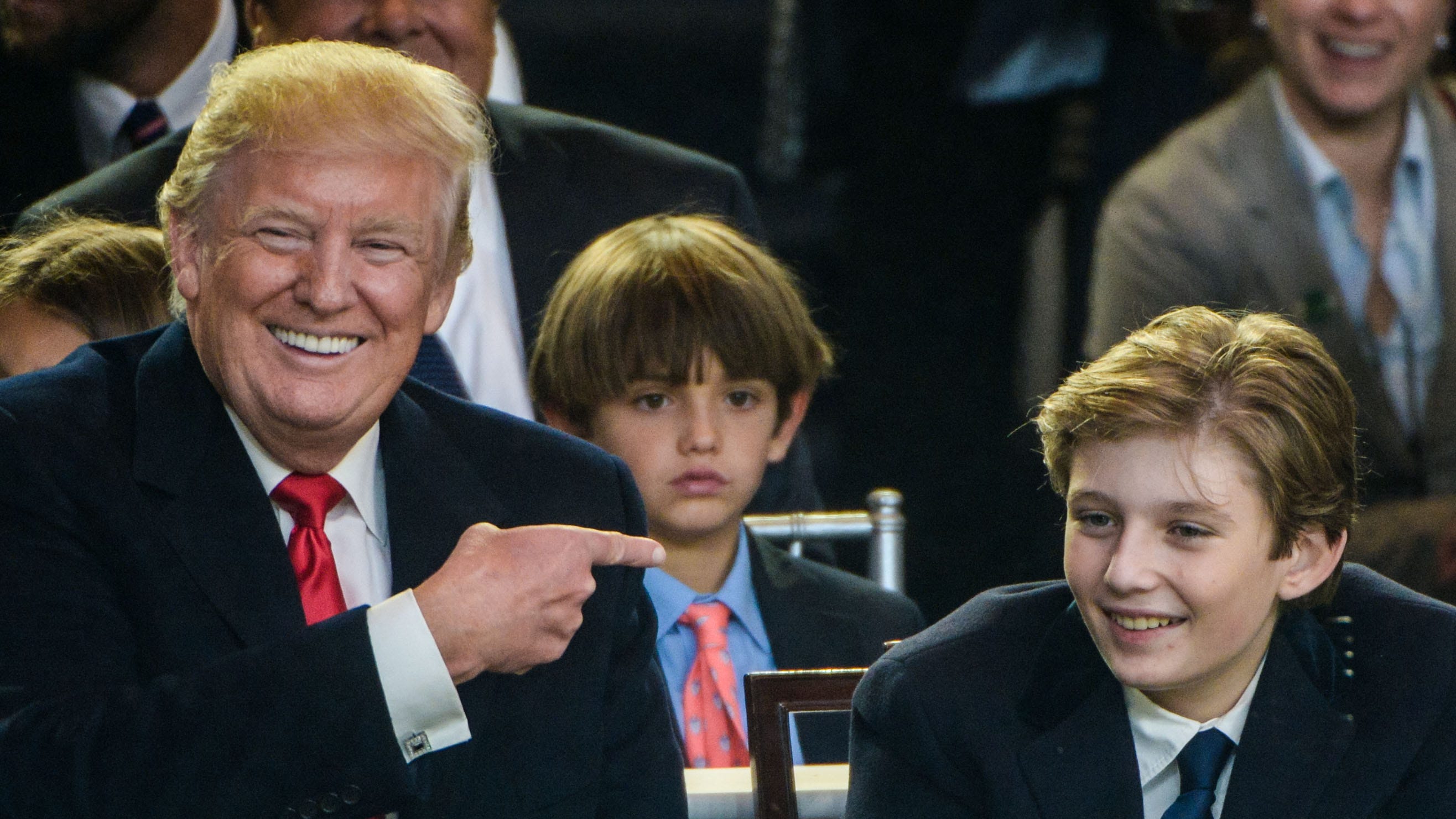

Barron Trumps College Plans Harvard Application And The Trump Childrens Education

May 24, 2025

Barron Trumps College Plans Harvard Application And The Trump Childrens Education

May 24, 2025 -

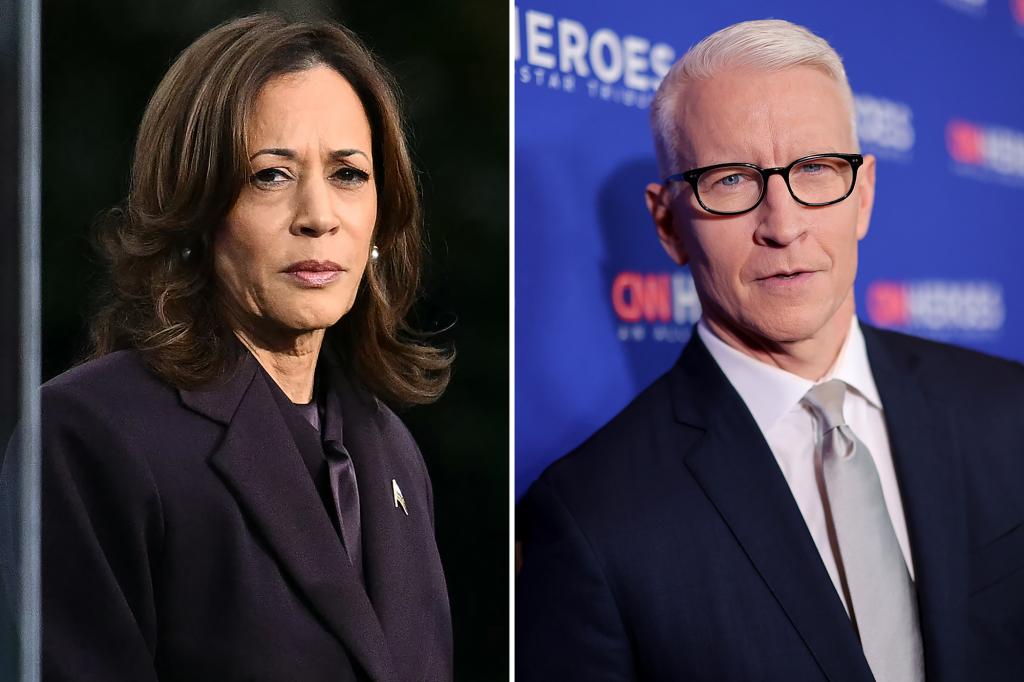

Motherf Er Remark Kamala Harris Addresses Heated Exchange With Anderson Cooper

May 24, 2025

Motherf Er Remark Kamala Harris Addresses Heated Exchange With Anderson Cooper

May 24, 2025 -

Court Blocks Uk Governments Chagos Islands Transfer

May 24, 2025

Court Blocks Uk Governments Chagos Islands Transfer

May 24, 2025 -

Pedro Pascal And Chris Evans A Viral Moment Fueled By A Pride And Prejudice Quote

May 24, 2025

Pedro Pascal And Chris Evans A Viral Moment Fueled By A Pride And Prejudice Quote

May 24, 2025 -

Fans Rush To Buy South Park Dvds Following Paramount Censorship Concerns

May 24, 2025

Fans Rush To Buy South Park Dvds Following Paramount Censorship Concerns

May 24, 2025