April's Government Debt: A Deeper Look At The Higher-Than-Expected Figures

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

April's Government Debt: A Deeper Look at the Higher-Than-Expected Figures

Government debt soared to unexpected heights in April, leaving economists and policymakers scrambling for answers. The figures, released earlier this week by [Insert Source, e.g., the Treasury Department], paint a concerning picture of the nation's fiscal health and raise serious questions about future economic stability. This article delves into the reasons behind this alarming increase, exploring the contributing factors and analyzing the potential implications for the economy.

The Shocking Numbers:

The official figures revealed a [Insert Percentage]% increase in government debt compared to April of the previous year, significantly exceeding the projected [Insert Percentage]% rise predicted by leading financial analysts. This represents a substantial jump of [Insert Dollar Amount] in just one month, adding to the already considerable national debt burden. This unexpected surge immediately sparked debate amongst experts, with many questioning the government's fiscal management strategies.

Factors Contributing to the Rise:

Several key factors contributed to this dramatic increase in government debt. These include:

-

Increased Spending on [Specific Program/Area]: A significant portion of the debt increase can be attributed to heightened expenditure in [Specific Program/Area, e.g., healthcare, infrastructure]. This surge in spending, while arguably necessary in some cases, has placed considerable strain on public finances.

-

Lower-Than-Expected Tax Revenue: Government revenue fell short of projections, likely due to [Explain reasons for lower revenue, e.g., economic slowdown, tax evasion]. This shortfall exacerbated the impact of increased spending, contributing to the widening deficit.

-

Impact of [Recent Economic Event/Policy]: The [Recent Economic Event/Policy, e.g., recent recession, new tax cuts] also played a significant role, impacting both government revenue and expenditure. Further analysis is needed to fully understand the extent of this impact.

Analyzing the Implications:

The implications of this higher-than-expected debt are far-reaching and potentially significant. Increased borrowing costs could lead to:

-

Higher Interest Rates: Increased government borrowing could push up interest rates, making borrowing more expensive for businesses and consumers, potentially stifling economic growth. [Link to an article about interest rates]

-

Inflationary Pressures: A larger national debt can fuel inflation, eroding purchasing power and impacting the overall economic stability of the country. [Link to an article about inflation]

-

Reduced Government Spending in Other Areas: The need to service the increased debt may force the government to cut spending in other crucial areas, potentially impacting essential public services.

What's Next?

The government faces a crucial decision in addressing this escalating debt. Possible solutions include:

-

Implementing Austerity Measures: This could involve cuts to government spending and/or increases in taxation. However, such measures often prove unpopular and can have negative consequences for the economy.

-

Stimulating Economic Growth: Increased economic activity could boost tax revenue, helping to alleviate the debt burden. This requires a well-defined economic strategy focused on [mention potential strategies].

-

Long-Term Fiscal Reform: A comprehensive review of government spending and revenue streams is crucial for developing sustainable long-term fiscal plans. This requires a bipartisan effort and a long-term vision.

Conclusion:

April's government debt figures serve as a stark reminder of the challenges facing the nation's fiscal health. Addressing this issue requires a comprehensive and carefully considered strategy involving both short-term and long-term solutions. The government's response will be crucial in determining the future trajectory of the economy and its impact on citizens. We will continue to monitor this situation closely and provide updates as they become available. Stay informed and subscribe to our newsletter for the latest economic news.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on April's Government Debt: A Deeper Look At The Higher-Than-Expected Figures. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Exclusive Four A List Actors In Contention For Street Fighter Roles

May 23, 2025

Exclusive Four A List Actors In Contention For Street Fighter Roles

May 23, 2025 -

Remembering George Wendt Cheers Star Dies At Age 76

May 23, 2025

Remembering George Wendt Cheers Star Dies At Age 76

May 23, 2025 -

After A Short Lived Truce Us And Chinas Trade Dispute Reignites

May 23, 2025

After A Short Lived Truce Us And Chinas Trade Dispute Reignites

May 23, 2025 -

Todays Wordle May 22 1433 Hints And The Full Solution

May 23, 2025

Todays Wordle May 22 1433 Hints And The Full Solution

May 23, 2025 -

Wordle Hints And Answer Puzzle 1433 May 22 2024

May 23, 2025

Wordle Hints And Answer Puzzle 1433 May 22 2024

May 23, 2025

Latest Posts

-

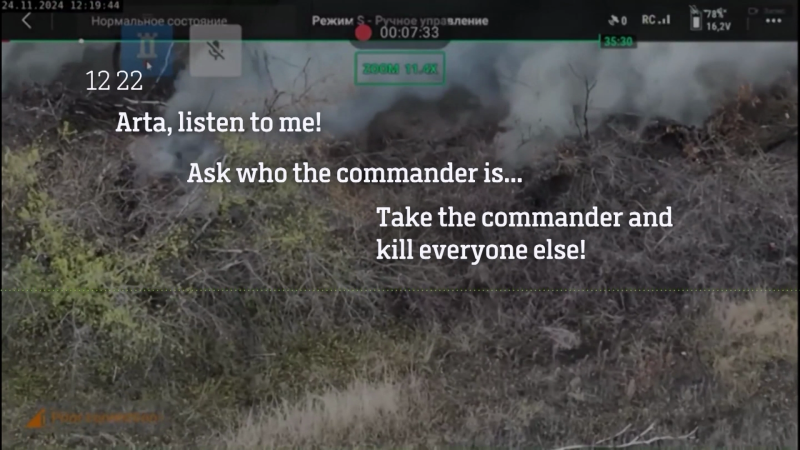

Chilling Audio Russian Commanders Kill Orders Exposed By Cnn

May 23, 2025

Chilling Audio Russian Commanders Kill Orders Exposed By Cnn

May 23, 2025 -

Pedro Pascal Quotes Pride And Prejudice To Chris Evans The Internets Reaction

May 23, 2025

Pedro Pascal Quotes Pride And Prejudice To Chris Evans The Internets Reaction

May 23, 2025 -

Ai Revolutionizes Publishing Melania Trump Memoir Uses Cutting Edge Technology

May 23, 2025

Ai Revolutionizes Publishing Melania Trump Memoir Uses Cutting Edge Technology

May 23, 2025 -

Angela Marmol Cuenta Su Experiencia Con Tom Cruise Un Escupitajo Y Una Anecdota Viral

May 23, 2025

Angela Marmol Cuenta Su Experiencia Con Tom Cruise Un Escupitajo Y Una Anecdota Viral

May 23, 2025 -

Pedro Pascals Pride And Prejudice Quote Steals Hearts Chris Evans Eye Contact Moment Explained

May 23, 2025

Pedro Pascals Pride And Prejudice Quote Steals Hearts Chris Evans Eye Contact Moment Explained

May 23, 2025