Are Fed Rate Cuts A Risky Gamble? Exploring The Potential Downsides

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Are Fed Rate Cuts a Risky Gamble? Exploring the Potential Downsides

The Federal Reserve's (Fed) recent interest rate cuts have sparked heated debate amongst economists and investors alike. While intended to stimulate economic growth and combat inflation, these cuts carry significant risks that could potentially outweigh the benefits. Are we witnessing a calculated move or a risky gamble with potentially severe downsides for the US economy? Let's delve into the potential pitfalls.

The Allure of Rate Cuts: A Double-Edged Sword

Lowering interest rates makes borrowing cheaper for businesses and consumers, theoretically boosting investment and spending. This increased economic activity is the desired outcome, often leading to job creation and a healthier GDP. However, the effectiveness of rate cuts depends heavily on various factors, including the overall economic climate, consumer confidence, and the availability of credit.

Potential Downsides: A Closer Look

While the intention behind rate cuts is positive, several potential downsides need careful consideration:

1. Increased Inflation: One of the most significant risks is reigniting inflation. If rate cuts lead to excessive spending and borrowing without a corresponding increase in productivity, it could push prices higher, eroding purchasing power and potentially leading to a stagflationary environment – a dangerous combination of slow economic growth and high inflation.

2. Asset Bubbles: Lower interest rates can inflate asset prices, particularly in sectors like real estate and stocks. While this might initially appear positive, it creates a fragile market vulnerable to sudden crashes if interest rates rise again unexpectedly or if investor confidence wanes. This vulnerability can have devastating consequences for the broader economy.

3. Weakened Dollar: Rate cuts can weaken the US dollar relative to other currencies. This can make imports more expensive and potentially fuel inflation further. Furthermore, a weaker dollar can impact international trade balances and global financial stability.

4. Reduced Savings Incentives: Lower interest rates reduce the returns on savings accounts and other fixed-income investments. This can discourage saving and potentially hinder long-term economic growth. .

5. Ineffectiveness in a Debt-Driven Economy: In an economy already burdened by high levels of debt, rate cuts might not be as effective as intended. Businesses and consumers might prioritize debt repayment rather than increased spending or investment, limiting the stimulative effect.

Alternatives and Considerations:

Instead of solely relying on rate cuts, the Fed could explore alternative strategies, such as targeted fiscal policies or regulatory changes aimed at specific sectors. A balanced approach that considers the long-term consequences is crucial.

Conclusion: A Cautious Approach is Necessary

While rate cuts can provide short-term economic boosts, they are not a panacea. The potential downsides, including increased inflation, asset bubbles, and a weakened dollar, must be carefully weighed against the potential benefits. The Fed's decision-making process requires a nuanced understanding of the economic landscape and a commitment to long-term stability rather than short-term gains. The current situation demands a cautious and strategic approach, ensuring that the cure doesn't prove worse than the disease. What are your thoughts on the recent rate cuts? Share your opinions in the comments below.

(Note: Replace "/link-to-relevant-article-on-savings" with an actual link if you have a relevant article on your site.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Are Fed Rate Cuts A Risky Gamble? Exploring The Potential Downsides. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Research Marijuana Use Associated With Chromosomal Defects In Female Reproductive Cells

Sep 11, 2025

New Research Marijuana Use Associated With Chromosomal Defects In Female Reproductive Cells

Sep 11, 2025 -

Starmers Downing Street Meeting With Israels President Herzog A Focus On Bilateral Relations

Sep 11, 2025

Starmers Downing Street Meeting With Israels President Herzog A Focus On Bilateral Relations

Sep 11, 2025 -

Newsoms Twitter Behavior A Comedians Critical Take

Sep 11, 2025

Newsoms Twitter Behavior A Comedians Critical Take

Sep 11, 2025 -

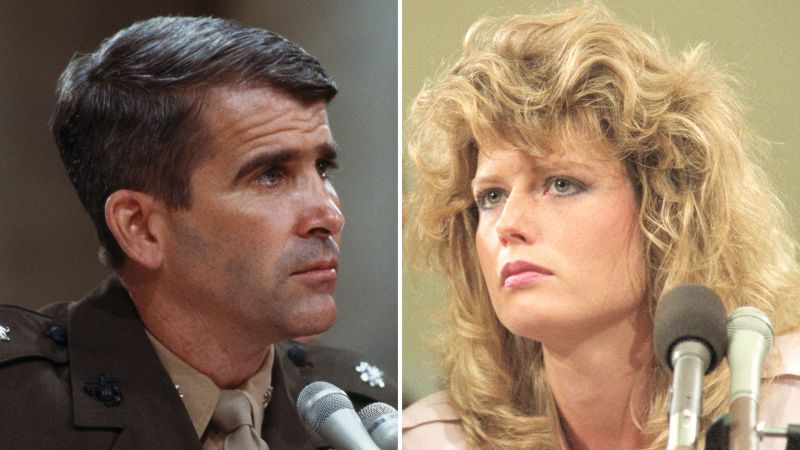

Oliver Norths Wife Fawn Hall Their Relationship Amidst Scandal

Sep 11, 2025

Oliver Norths Wife Fawn Hall Their Relationship Amidst Scandal

Sep 11, 2025 -

English Channel Tragedy Migrant Dies Amidst Deflation Crisis

Sep 11, 2025

English Channel Tragedy Migrant Dies Amidst Deflation Crisis

Sep 11, 2025

Latest Posts

-

Royal Charity Prince Harry Donates 1 1 Million To Children In Need

Sep 11, 2025

Royal Charity Prince Harry Donates 1 1 Million To Children In Need

Sep 11, 2025 -

Parental Rights Under Siege Schools Silencing Parents On Transgender Policies

Sep 11, 2025

Parental Rights Under Siege Schools Silencing Parents On Transgender Policies

Sep 11, 2025 -

Us Official Proposed Israeli Action Against Doha Is Detrimental To Security Goals

Sep 11, 2025

Us Official Proposed Israeli Action Against Doha Is Detrimental To Security Goals

Sep 11, 2025 -

Pennsylvania Court Summons Luigi Mangione

Sep 11, 2025

Pennsylvania Court Summons Luigi Mangione

Sep 11, 2025 -

High End Hotel Bills Examining Aocs Campaign Finances Amidst Anti Establishment Messaging

Sep 11, 2025

High End Hotel Bills Examining Aocs Campaign Finances Amidst Anti Establishment Messaging

Sep 11, 2025