Are Fed Rate Cuts Worth The Risk? Analyzing The Potential Downsides

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Are Fed Rate Cuts Worth the Risk? Analyzing the Potential Downsides

The Federal Reserve's recent moves have ignited a heated debate: are interest rate cuts truly the silver bullet for a struggling economy, or do they carry significant, often overlooked risks? While rate cuts can stimulate borrowing and boost economic activity in the short term, a closer examination reveals potential downsides that could outweigh the benefits. This article delves into the complexities, analyzing the potential drawbacks of Fed rate cuts and prompting crucial questions for investors and policymakers alike.

The Allure of Lower Rates: A Double-Edged Sword

Lower interest rates are often presented as a panacea for economic woes. By making borrowing cheaper, they encourage businesses to invest, consumers to spend, and ultimately, boost economic growth. This approach, however, relies on a delicate balance. The effectiveness hinges on several factors, including consumer confidence, inflation levels, and the overall health of the financial system. A poorly timed or insufficient rate cut can fail to achieve its intended effect, while an overly aggressive approach can trigger unforeseen consequences.

Potential Downsides of Fed Rate Cuts:

-

Increased Inflation: One of the most significant risks associated with rate cuts is a surge in inflation. When money becomes cheaper, demand can outstrip supply, leading to rising prices. This is particularly concerning if the economy is already showing signs of overheating. [Link to article on inflation]

-

Asset Bubbles: Lower interest rates can inflate asset bubbles, particularly in the housing market and stock market. While this might seem positive in the short term, the inevitable bursting of these bubbles can trigger severe economic downturns, as witnessed in the 2008 financial crisis. [Link to article on 2008 financial crisis]

-

Weakened Currency: Rate cuts can lead to a weaker domestic currency as investors seek higher returns elsewhere. This can make imports more expensive and negatively impact the trade balance. [Link to article on currency exchange rates]

-

Increased Debt Levels: Lower borrowing costs might incentivize excessive borrowing by both consumers and businesses. This can lead to an unsustainable increase in debt levels, making the economy more vulnerable to future shocks.

-

Reduced Savings: Lower interest rates reduce the returns on savings accounts and other fixed-income investments. This can discourage saving and potentially harm long-term economic stability.

The Importance of Timing and Context:

The effectiveness of rate cuts depends heavily on the economic context. A rate cut during a recession might be a necessary stimulus, whereas a cut during a period of already high inflation could exacerbate existing problems. The Federal Reserve's decision-making process must carefully consider these nuances. [Link to Federal Reserve website]

What's Next for the Economy?

Predicting the future impact of Fed rate cuts is inherently complex. Multiple variables interact in intricate ways, making accurate forecasting challenging. However, carefully considering the potential downsides outlined above is crucial for both investors and policymakers. A balanced approach that considers the long-term consequences, rather than focusing solely on short-term gains, is essential for fostering sustainable economic growth.

Call to Action: Stay informed about economic developments and the Federal Reserve's policies to make informed financial decisions. Consult with a financial advisor to assess your personal risk tolerance and investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Are Fed Rate Cuts Worth The Risk? Analyzing The Potential Downsides. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Marijuanas Impact On Human Egg Cell Chromosomes A New Study

Sep 11, 2025

Marijuanas Impact On Human Egg Cell Chromosomes A New Study

Sep 11, 2025 -

Hamas Israel And Qatar Bowen On The Devastation Of Diplomatic Efforts

Sep 11, 2025

Hamas Israel And Qatar Bowen On The Devastation Of Diplomatic Efforts

Sep 11, 2025 -

Aoc And Bernie Sanders Campaign Spending Under Scrutiny After Upscale Hotel Stays

Sep 11, 2025

Aoc And Bernie Sanders Campaign Spending Under Scrutiny After Upscale Hotel Stays

Sep 11, 2025 -

Right Wing Medias Financial Backers Exposing The Conservative Networks Influence

Sep 11, 2025

Right Wing Medias Financial Backers Exposing The Conservative Networks Influence

Sep 11, 2025 -

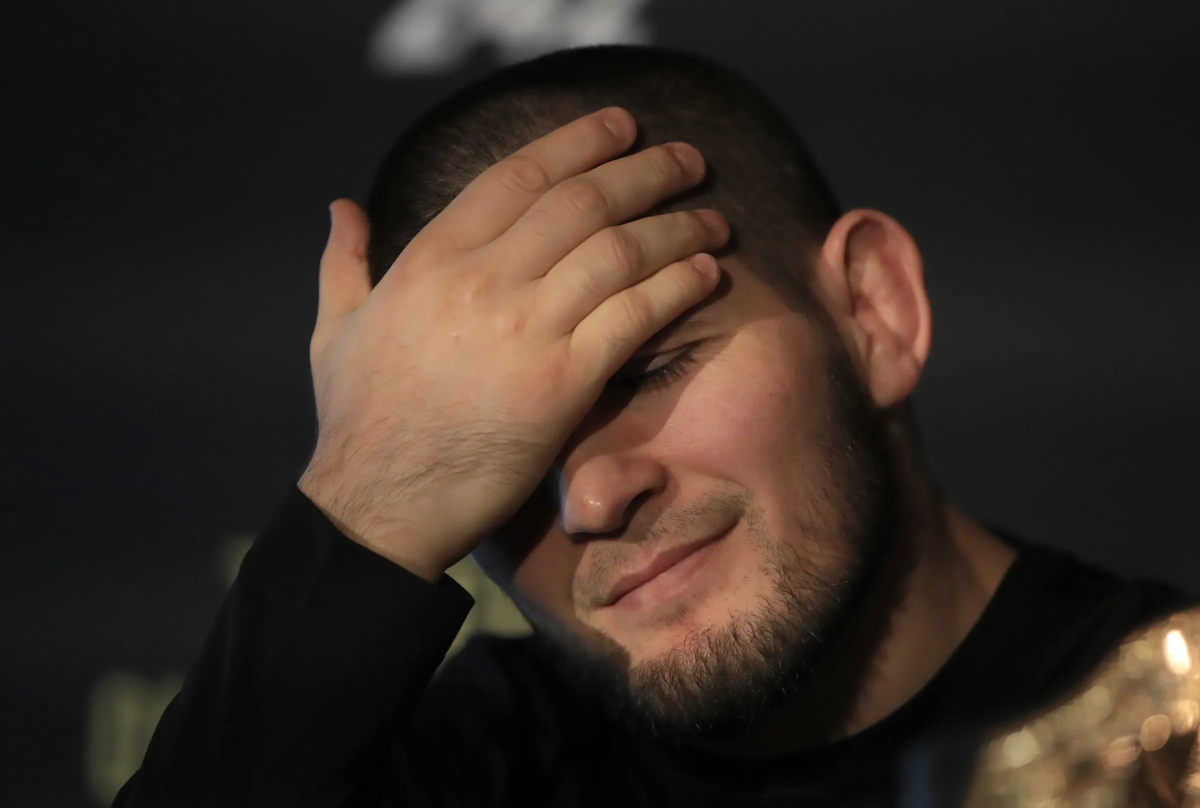

Rogans Asterisk Comment A Controversy Surrounding Khabib Nurmagomedovs Ufc Record

Sep 11, 2025

Rogans Asterisk Comment A Controversy Surrounding Khabib Nurmagomedovs Ufc Record

Sep 11, 2025

Latest Posts

-

Apples Latest I Phone A Deep Dive Into Specs And Innovations

Sep 11, 2025

Apples Latest I Phone A Deep Dive Into Specs And Innovations

Sep 11, 2025 -

Fugitive Father Found Dead Years Of Hiding Children End In Violence

Sep 11, 2025

Fugitive Father Found Dead Years Of Hiding Children End In Violence

Sep 11, 2025 -

New Filings Show Aocs Hotel Expenditures While Advocating Against Wealth Inequality

Sep 11, 2025

New Filings Show Aocs Hotel Expenditures While Advocating Against Wealth Inequality

Sep 11, 2025 -

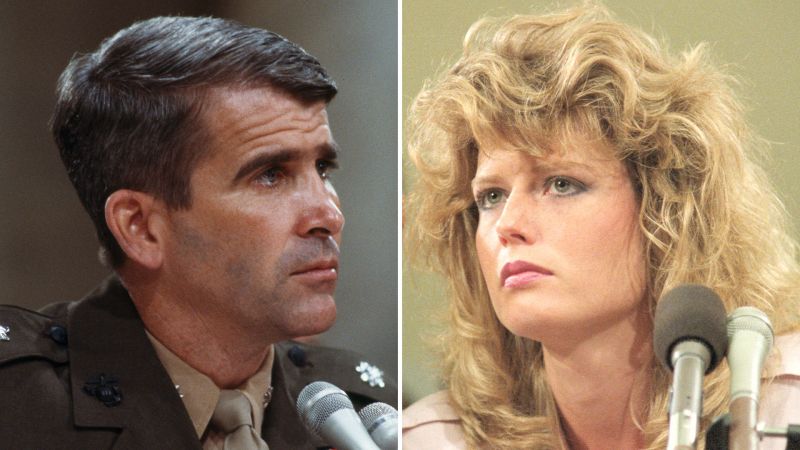

Oliver Norths Wife Fawn Hall Their Relationship Amidst The Iran Contra Controversy

Sep 11, 2025

Oliver Norths Wife Fawn Hall Their Relationship Amidst The Iran Contra Controversy

Sep 11, 2025 -

Bowen Qatars Diplomatic Efforts Collapse Following Israeli Strikes

Sep 11, 2025

Bowen Qatars Diplomatic Efforts Collapse Following Israeli Strikes

Sep 11, 2025