Are Law And Medical School Becoming Unaffordable? The Impact Of New Federal Loan Limits

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Are Law and Medical School Becoming Unaffordable? The Impact of New Federal Loan Limits

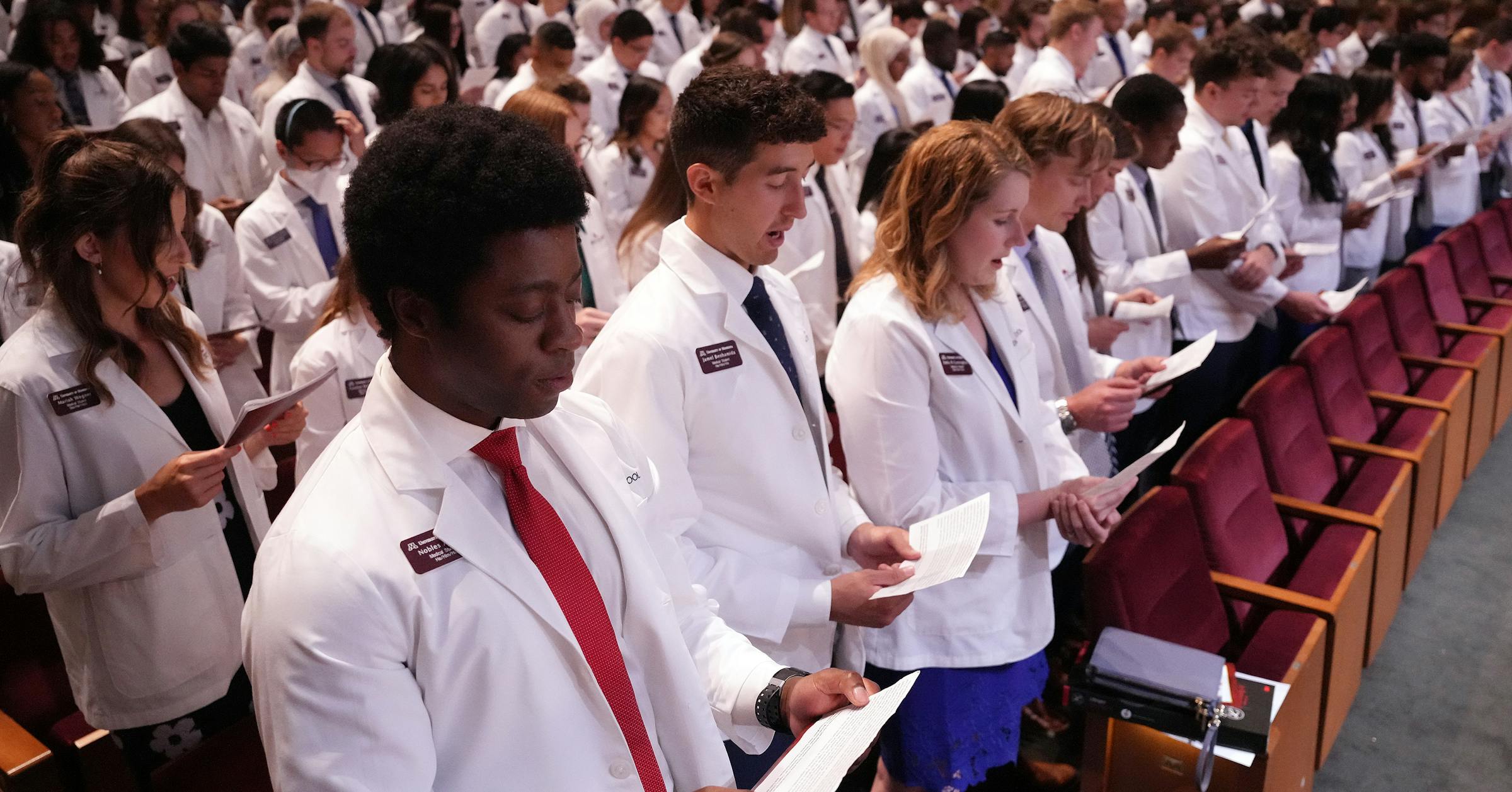

The soaring cost of higher education is a national concern, but for aspiring doctors and lawyers, the financial burden is particularly acute. With new federal loan limits impacting funding for professional degrees, the question on everyone's mind is: are law and medical school becoming unaffordable? The answer, unfortunately, is increasingly complex, but leans towards a resounding yes for many.

The Crushing Weight of Debt:

The pursuit of a career in law or medicine traditionally involves significant financial investment. Tuition fees at prestigious institutions can reach hundreds of thousands of dollars, even before factoring in living expenses, books, and other associated costs. Students have historically relied heavily on federal student loans to bridge this gap. However, recent changes to federal loan limits are tightening the purse strings, making it harder for students to afford these demanding programs.

New Federal Loan Limits: A Double-Edged Sword:

While intended to address concerns about student loan debt, the new federal loan limits have unintended consequences for those pursuing advanced degrees. The limits, while varying by program and year, effectively cap the amount of federal funding available. This means many students will need to secure private loans – often with significantly higher interest rates – to cover the remaining costs. This can lead to exponentially larger debt burdens upon graduation.

The Impact on Accessibility:

This rising cost of attending professional schools has serious implications for accessibility. It disproportionately affects students from lower socioeconomic backgrounds who may lack the family resources to supplement federal loans. This creates a system where only the wealthiest can afford to pursue these crucial careers, potentially leading to a significant shortage of doctors and lawyers in underserved communities.

Alternative Funding Strategies: Navigating the Maze:

So, what options do prospective law and medical students have? The answer is multifaceted and requires careful planning:

- Scholarships and Grants: Aggressively pursuing scholarships and grants is crucial. Many organizations offer funding specifically for medical and law students, often based on merit or financial need. Thorough research and diligent application are key.

- Part-time Employment: Balancing studies with part-time work can alleviate some financial strain, though this can significantly impact study time and potentially academic performance.

- Careful Institutional Selection: Choosing a more affordable institution, even if it’s not the most prestigious, can significantly reduce overall costs.

- Exploring Loan Repayment Programs: Understanding the various loan repayment programs offered by the government and private institutions can help mitigate the long-term burden of student debt. Research programs like the Public Service Loan Forgiveness (PSLF) program for those entering public service.

Looking Ahead: A Call for Reform?

The rising cost of professional education and the impact of new federal loan limits highlight a critical issue within the higher education system. There's a growing need for broader discussions on affordable access to higher education and potential reforms to ensure that talented individuals, regardless of their financial background, can pursue their dreams of becoming doctors and lawyers. This will require collaboration between educational institutions, government agencies, and private organizations to find innovative and sustainable solutions.

Further Reading:

- [Link to a relevant article on student loan debt from a reputable source like the Department of Education or a major news outlet]

- [Link to a relevant article on scholarship opportunities for law or medical students]

Call to Action: Share your thoughts and experiences with the rising cost of professional education in the comments below. Let's start a conversation about how we can make these crucial fields more accessible to all.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Are Law And Medical School Becoming Unaffordable? The Impact Of New Federal Loan Limits. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Childcare Worker Arrested Accusations Of Child Sexual Abuse

Aug 01, 2025

Childcare Worker Arrested Accusations Of Child Sexual Abuse

Aug 01, 2025 -

Thi Truong Vang Bien Dong Manh Do Phat Bieu Cua Powell

Aug 01, 2025

Thi Truong Vang Bien Dong Manh Do Phat Bieu Cua Powell

Aug 01, 2025 -

Early Alzheimers Treatment Breakthrough Lifestyle Changes Show Positive Results

Aug 01, 2025

Early Alzheimers Treatment Breakthrough Lifestyle Changes Show Positive Results

Aug 01, 2025 -

Accidental Admission Trump Official Exposes Budget Programs Reality

Aug 01, 2025

Accidental Admission Trump Official Exposes Budget Programs Reality

Aug 01, 2025 -

Oyster Bay Womans 30 Million Fraud Scheme A Plea Of Guilty And Political Connections

Aug 01, 2025

Oyster Bay Womans 30 Million Fraud Scheme A Plea Of Guilty And Political Connections

Aug 01, 2025

Latest Posts

-

Robert Downey Jr S Massive Avengers Paycheck Doomsday Earnings Exposed

Aug 02, 2025

Robert Downey Jr S Massive Avengers Paycheck Doomsday Earnings Exposed

Aug 02, 2025 -

Trumps Tariff Legacy Short Term Gains Long Term Pain For The Global Market

Aug 02, 2025

Trumps Tariff Legacy Short Term Gains Long Term Pain For The Global Market

Aug 02, 2025 -

Hungarian Grand Prix Mc Larens Practice Pace Raises Championship Questions

Aug 02, 2025

Hungarian Grand Prix Mc Larens Practice Pace Raises Championship Questions

Aug 02, 2025 -

Global Trade And Trumps Tariffs Winners Losers And Lasting Economic Effects

Aug 02, 2025

Global Trade And Trumps Tariffs Winners Losers And Lasting Economic Effects

Aug 02, 2025 -

200 Million Ballroom A New Era Of White House Design

Aug 02, 2025

200 Million Ballroom A New Era Of White House Design

Aug 02, 2025