Are These Wall Street Trades A Sign Of Trouble? Analyzing Recent Market Volatility

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Are These Wall Street Trades a Sign of Trouble? Analyzing Recent Market Volatility

The recent surge in market volatility has sent ripples through Wall Street, leaving investors wondering: is this just a temporary blip, or a harbinger of more significant trouble to come? Unusual trading patterns and heightened uncertainty are fueling concerns, prompting a closer look at the underlying factors driving these dramatic swings.

Uncertain Economic Outlook Fuels Volatility

The global economic landscape is currently a complex tapestry woven with threads of inflation, rising interest rates, and geopolitical instability. These interconnected factors contribute to the market's jitters. High inflation, stubbornly persistent in many developed nations, forces central banks to maintain aggressive interest rate hikes. This, in turn, increases borrowing costs for businesses and consumers, potentially slowing economic growth and impacting corporate profits. The ongoing war in Ukraine adds another layer of complexity, disrupting supply chains and fueling energy price volatility. These macroeconomic headwinds are significant drivers of the recent market uncertainty.

Analyzing the Unusual Trading Patterns

Several key indicators point to a potential shift in market sentiment. We've seen a significant increase in:

- Increased Volatility Index (VIX): The VIX, often referred to as the "fear gauge," measures market volatility. Its recent spike reflects heightened investor anxiety. [Link to a reputable financial news source showing VIX data]

- Defensive Stock Outperformance: Investors are increasingly shifting towards safer investments, like government bonds and utility stocks, traditionally seen as defensive plays during periods of economic uncertainty. This "flight to safety" is a classic indicator of market apprehension.

- Increased Short Selling: A rise in short selling activity suggests that some investors are betting against further market gains, anticipating potential downturns. This bearish sentiment contributes to the overall volatility.

- Bond Market Signals: The bond market, often considered a leading indicator, is also sending mixed signals. Yield curve inversions, where long-term bond yields fall below short-term yields, are often seen as a predictor of future recessions. [Link to an article explaining yield curve inversions]

What Do These Trends Mean for Investors?

The current market volatility presents a complex scenario for investors. While panic selling is rarely a sound strategy, a cautious approach is warranted. It's crucial to:

- Diversify your portfolio: Spreading investments across different asset classes can help mitigate risk during periods of market uncertainty.

- Re-evaluate your risk tolerance: Investors should assess their comfort level with risk and adjust their portfolios accordingly. Those nearing retirement may need to consider shifting towards more conservative investments.

- Consult a financial advisor: Seeking professional advice is particularly important during times of market volatility. A financial advisor can help create a personalized investment strategy tailored to your individual needs and goals.

Looking Ahead: Navigating Uncertainty

Predicting the future direction of the market is impossible. However, understanding the underlying economic factors and analyzing market trends can help investors make informed decisions. The current volatility underscores the importance of long-term investment strategies and a thorough understanding of your own risk profile. Staying informed about economic developments and market news is crucial for navigating these uncertain times.

Call to Action: Stay informed and make smart financial decisions. Subscribe to our newsletter for regular updates on market trends and investment strategies. [Link to newsletter signup]

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Are These Wall Street Trades A Sign Of Trouble? Analyzing Recent Market Volatility. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Adot Announces Sr 87 Closure Due To Brush Fire Near Payson

Jun 14, 2025

Adot Announces Sr 87 Closure Due To Brush Fire Near Payson

Jun 14, 2025 -

Brush Fire Blazes Near Paysons Beeline Highway Watch The Video

Jun 14, 2025

Brush Fire Blazes Near Paysons Beeline Highway Watch The Video

Jun 14, 2025 -

Sr 87 South Of Payson Shut Down By Adot Because Of Brush Fire

Jun 14, 2025

Sr 87 South Of Payson Shut Down By Adot Because Of Brush Fire

Jun 14, 2025 -

Engagement Confirmed Dua Lipa And Callum Turners Relationship Milestone

Jun 14, 2025

Engagement Confirmed Dua Lipa And Callum Turners Relationship Milestone

Jun 14, 2025 -

U S Open Up And Down First Round For Illinois Fighting Illini

Jun 14, 2025

U S Open Up And Down First Round For Illinois Fighting Illini

Jun 14, 2025

Latest Posts

-

Illinis Fortunes Fluctuate A First Round Report From The U S Open

Jun 14, 2025

Illinis Fortunes Fluctuate A First Round Report From The U S Open

Jun 14, 2025 -

How 7 Eleven Became Japans Snack King An Inside Look At Production

Jun 14, 2025

How 7 Eleven Became Japans Snack King An Inside Look At Production

Jun 14, 2025 -

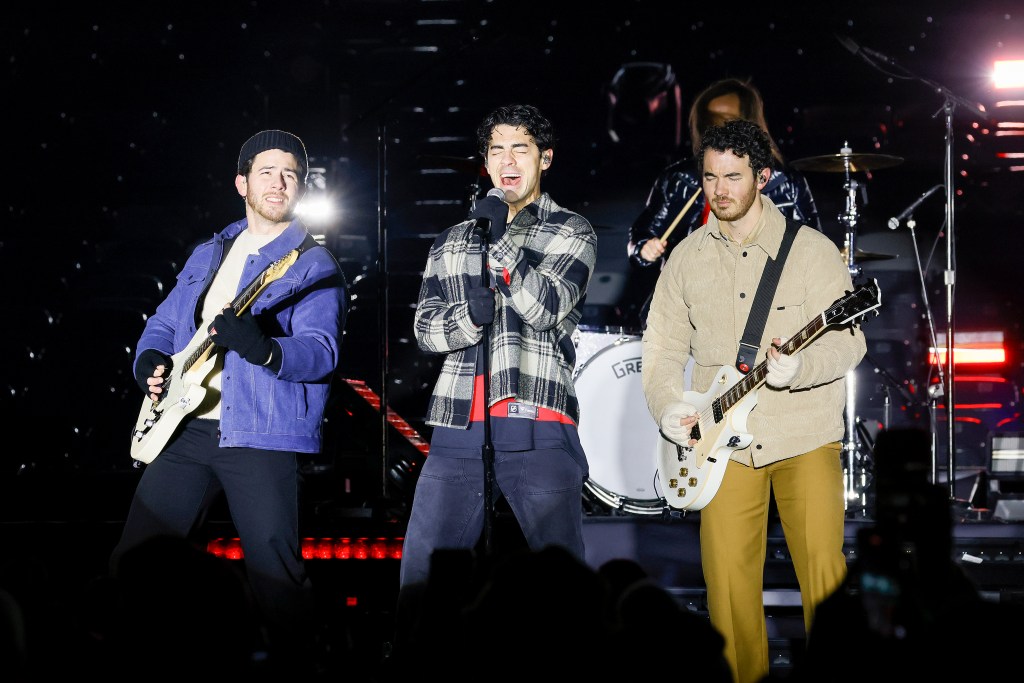

Jonas Brothers Cancel Chicagos Wrigley Field Show What We Know

Jun 14, 2025

Jonas Brothers Cancel Chicagos Wrigley Field Show What We Know

Jun 14, 2025 -

Mitch Marners Future In Toronto Contract Talks And The Weight Of Expectations

Jun 14, 2025

Mitch Marners Future In Toronto Contract Talks And The Weight Of Expectations

Jun 14, 2025 -

Mixed Results For Illini Players In The U S Opens First Round

Jun 14, 2025

Mixed Results For Illini Players In The U S Opens First Round

Jun 14, 2025