Are Wall Street's Strange Trades A Sign Of Trouble? Analysis And Insights.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Are Wall Street's Strange Trades a Sign of Trouble? Analysis and Insights

Wall Street, the engine of global finance, has lately been exhibiting some unusual behavior. Are these "strange trades," as some are calling them, a mere anomaly, or a harbinger of larger economic woes? This article delves into the recent market activity, analyzing the trends and offering insights into potential implications.

The past few months have witnessed a surge in what analysts describe as erratic trading patterns. These aren't your typical buy-low, sell-high strategies. Instead, we're seeing a rise in high-frequency trading algorithms exhibiting unusual volatility, coupled with seemingly inexplicable shifts in large institutional investment strategies. While individual trades are often opaque, the collective effect is raising eyebrows and prompting serious questions about market stability.

What constitutes a "strange trade"?

Defining "strange" requires context. It's not simply about a single trade resulting in a loss. Instead, the focus is on the patterns:

- High-Frequency Trading Anomalies: Algorithms designed for rapid execution are showing unprecedented levels of volatility and seemingly contradictory actions, suggesting potential flaws in their programming or unpredictable market responses.

- Increased Volatility in Options Markets: The options market, often used for hedging and speculation, is showing heightened volatility, potentially indicating increased uncertainty among investors.

- Discordant Signals from Institutional Investors: Large institutional investors, who typically act as market stabilizers, are displaying inconsistent trading behaviors, potentially reflecting internal disagreements about future market direction.

These anomalies, taken individually, might be dismissed as noise. However, their combined presence is creating a climate of uncertainty, making it crucial to understand the underlying causes.

Potential Explanations and Underlying Concerns:

Several factors could contribute to these unusual trading patterns:

- Inflation and Interest Rate Hikes: The ongoing battle against inflation and the subsequent interest rate hikes by central banks are creating significant market uncertainty. This uncertainty can lead to unpredictable trading activity as investors grapple with shifting economic realities. For further information on the impact of interest rate hikes, you can refer to resources from the Federal Reserve [link to Federal Reserve website].

- Geopolitical Instability: Global geopolitical events, including the ongoing war in Ukraine and escalating tensions in other regions, contribute to market volatility and unpredictable investor behavior.

- Technological Advancements: The increasing sophistication of algorithmic trading, while offering efficiency, also introduces the potential for unforeseen consequences and systemic risk. The complexity of these algorithms can make it difficult to fully understand their impact on market stability.

- Market Manipulation?: While difficult to prove, the possibility of market manipulation, albeit unlikely on a large scale, cannot be entirely discounted.

The Implications for Investors:

The current market situation demands caution. While panic selling is rarely advisable, investors should:

- Diversify their portfolios: Spreading investments across different asset classes can help mitigate risks associated with market volatility.

- Monitor market trends closely: Staying informed about current economic and geopolitical events is crucial for making informed investment decisions.

- Consider risk tolerance: Investors should assess their risk tolerance and adjust their portfolios accordingly, given the increased uncertainty.

Conclusion:

The recent spate of "strange trades" on Wall Street warrants careful consideration. While it's premature to declare a full-blown crisis, the unusual patterns underscore the need for vigilance and a deeper understanding of the forces shaping the current market environment. Further analysis and close monitoring are crucial to assess the long-term implications of these trends. The coming months will likely be pivotal in determining whether this is a temporary blip or a more significant shift in market dynamics. Stay informed and adapt your strategies accordingly.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Are Wall Street's Strange Trades A Sign Of Trouble? Analysis And Insights.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Deceptive Relocation Son Awarded In Lawsuit Against Parents

Jun 14, 2025

Deceptive Relocation Son Awarded In Lawsuit Against Parents

Jun 14, 2025 -

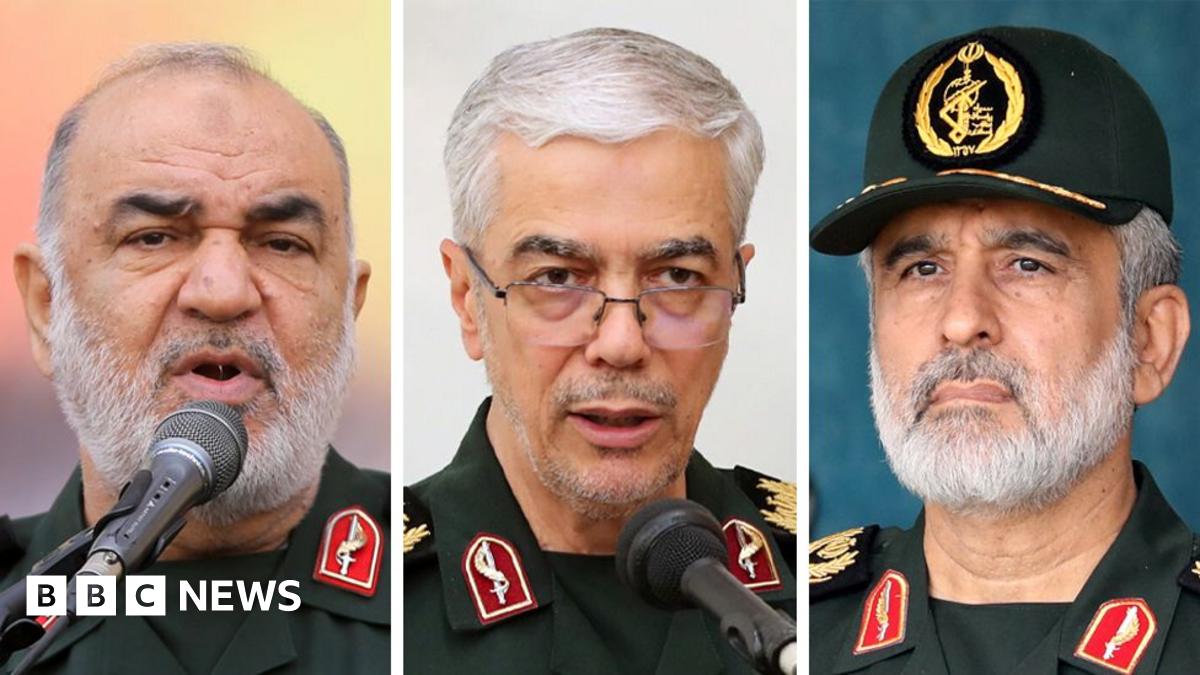

Iranian Commanders Killed In Israeli Airstrike Full List Of Casualties

Jun 14, 2025

Iranian Commanders Killed In Israeli Airstrike Full List Of Casualties

Jun 14, 2025 -

Will The Pacers Take A Commanding Lead Nba Finals Game 4 Betting Predictions

Jun 14, 2025

Will The Pacers Take A Commanding Lead Nba Finals Game 4 Betting Predictions

Jun 14, 2025 -

Families Took Refuge In Attics Amidst Racially Motivated Violence

Jun 14, 2025

Families Took Refuge In Attics Amidst Racially Motivated Violence

Jun 14, 2025 -

Indiana Pacers Shock The Thunder Unlikely Heroes Lead The Charge

Jun 14, 2025

Indiana Pacers Shock The Thunder Unlikely Heroes Lead The Charge

Jun 14, 2025

Latest Posts

-

New Video Israel Details Its Operation Against Iranian Target

Jun 15, 2025

New Video Israel Details Its Operation Against Iranian Target

Jun 15, 2025 -

Unexpected Food Aversion Paige Bueckers Opens Up

Jun 15, 2025

Unexpected Food Aversion Paige Bueckers Opens Up

Jun 15, 2025 -

Differing Responses To Iran Trump And Republicans At Odds After Recent Attack

Jun 15, 2025

Differing Responses To Iran Trump And Republicans At Odds After Recent Attack

Jun 15, 2025 -

Conner Mc Cafferys Social Media Hints At Trouble In Relationship With Caitlin Clark

Jun 15, 2025

Conner Mc Cafferys Social Media Hints At Trouble In Relationship With Caitlin Clark

Jun 15, 2025 -

Antonio Brown Police Issue Arrest Warrant On Attempted Murder Charges

Jun 15, 2025

Antonio Brown Police Issue Arrest Warrant On Attempted Murder Charges

Jun 15, 2025