Australian Central Bank Holds Interest Rates: Inflation The Key Factor

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Australian Central Bank Holds Interest Rates: Inflation Remains the Key Factor

The Reserve Bank of Australia (RBA) has once again opted to hold the official cash rate steady at 4.1%, marking a pause in its aggressive tightening cycle that began in May 2022. This decision, announced on [Date of announcement], comes as the central bank carefully assesses the impact of previous rate hikes on inflation and the broader Australian economy. While inflation remains stubbornly high, signs of easing price pressures and concerns about a potential economic slowdown have led the RBA to adopt a more cautious approach.

Inflation: The Balancing Act

The RBA's primary focus remains the fight against inflation. Headline inflation, while easing slightly from its peak, is still significantly above the central bank's target range of 2-3%. [Cite relevant inflation statistics here, linking to ABS data]. The bank acknowledges that progress is being made, but the persistent strength of inflation in certain sectors, particularly housing and services, necessitates ongoing vigilance.

The RBA's statement emphasized the complex interplay between inflation, employment, and economic growth. While the unemployment rate remains low [cite unemployment rate statistic and link to ABS], there are increasing concerns about the potential for a significant economic slowdown. Higher interest rates, while effective in curbing inflation, can also dampen consumer spending and business investment, potentially leading to job losses.

What the Pause Means for Australians

This pause in rate hikes offers some short-term relief to Australian homeowners with mortgages. While repayments won't decrease, the absence of further increases provides some certainty and stability. However, it’s crucial to remember that interest rates are still significantly higher than they were a year ago, and the impact on household budgets continues to be felt.

For businesses, the pause may offer some breathing room to adjust to the already elevated interest rate environment. However, the ongoing uncertainty surrounding inflation and the potential for future rate rises mean that businesses need to remain cautious in their investment plans.

Looking Ahead: Further Rate Hikes on the Horizon?

The RBA has clearly indicated that its decision to hold rates steady is not a signal that the tightening cycle is definitively over. Future rate decisions will be heavily influenced by incoming economic data, particularly inflation figures and labor market conditions. The bank will continue to monitor global economic developments and assess the impact of previous rate hikes on the Australian economy. A further increase in rates remains a possibility if inflation fails to moderate sufficiently.

Key Takeaways:

- Rate Hold: The RBA has held the official cash rate at 4.1%.

- Inflation Focus: Inflation remains the central bank's primary concern.

- Cautious Approach: The RBA is adopting a more cautious approach, balancing inflation concerns with economic growth.

- Uncertainty Remains: Future rate decisions will depend on incoming economic data.

Further Reading:

- [Link to RBA statement]

- [Link to ABS inflation data]

- [Link to relevant news articles on Australian economy]

This pause in rate hikes provides a temporary reprieve, but the battle against inflation is far from over. Australians should continue to monitor economic developments closely and prepare for potential future adjustments to monetary policy. The RBA's next decision will be keenly awaited, offering further insights into the direction of Australia's economic future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Australian Central Bank Holds Interest Rates: Inflation The Key Factor. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Texas Facing Catastrophic Flooding 78 Fatalities Dozens Unaccounted For Further Rain Expected

Jul 09, 2025

Texas Facing Catastrophic Flooding 78 Fatalities Dozens Unaccounted For Further Rain Expected

Jul 09, 2025 -

Us Flyers Should You Choose Air Canada And Aeroplan

Jul 09, 2025

Us Flyers Should You Choose Air Canada And Aeroplan

Jul 09, 2025 -

Assessing Uk Safety A 20 Year Retrospective On Counter Terrorism Since 7 7

Jul 09, 2025

Assessing Uk Safety A 20 Year Retrospective On Counter Terrorism Since 7 7

Jul 09, 2025 -

Texas Flooding Disaster Survivors Recount Terrifying Escape

Jul 09, 2025

Texas Flooding Disaster Survivors Recount Terrifying Escape

Jul 09, 2025 -

Flash Flood Disaster Texas Home Carried Away By Raging Waters Cnn Footage

Jul 09, 2025

Flash Flood Disaster Texas Home Carried Away By Raging Waters Cnn Footage

Jul 09, 2025

Latest Posts

-

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025 -

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

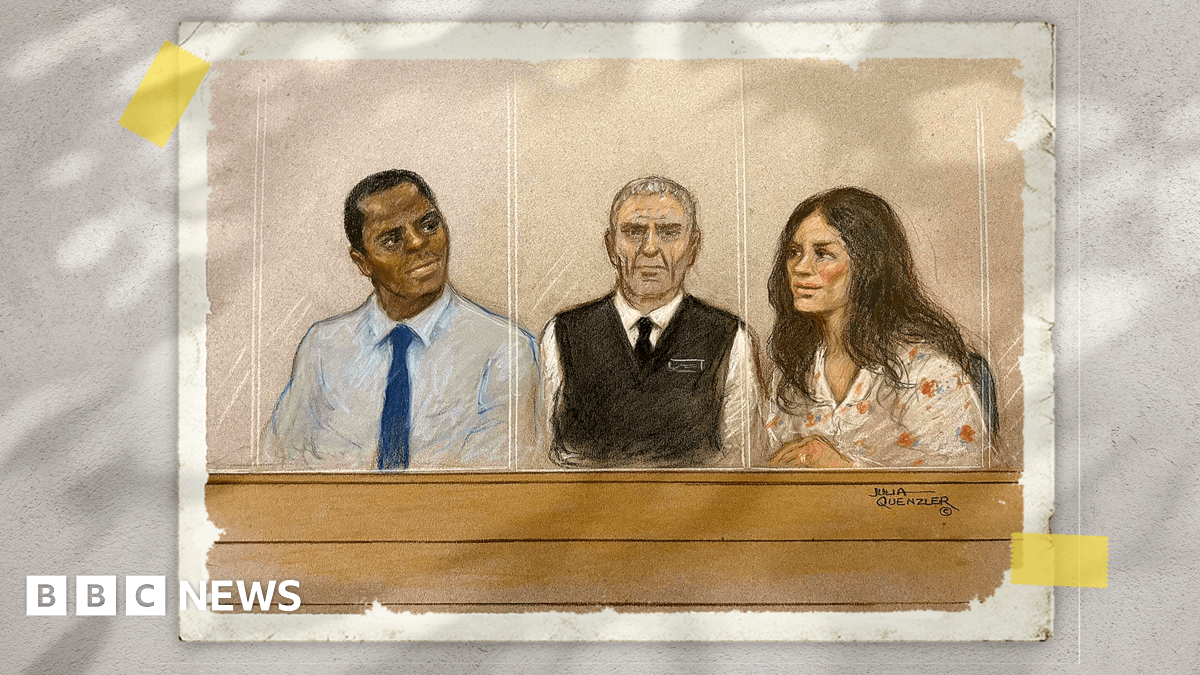

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

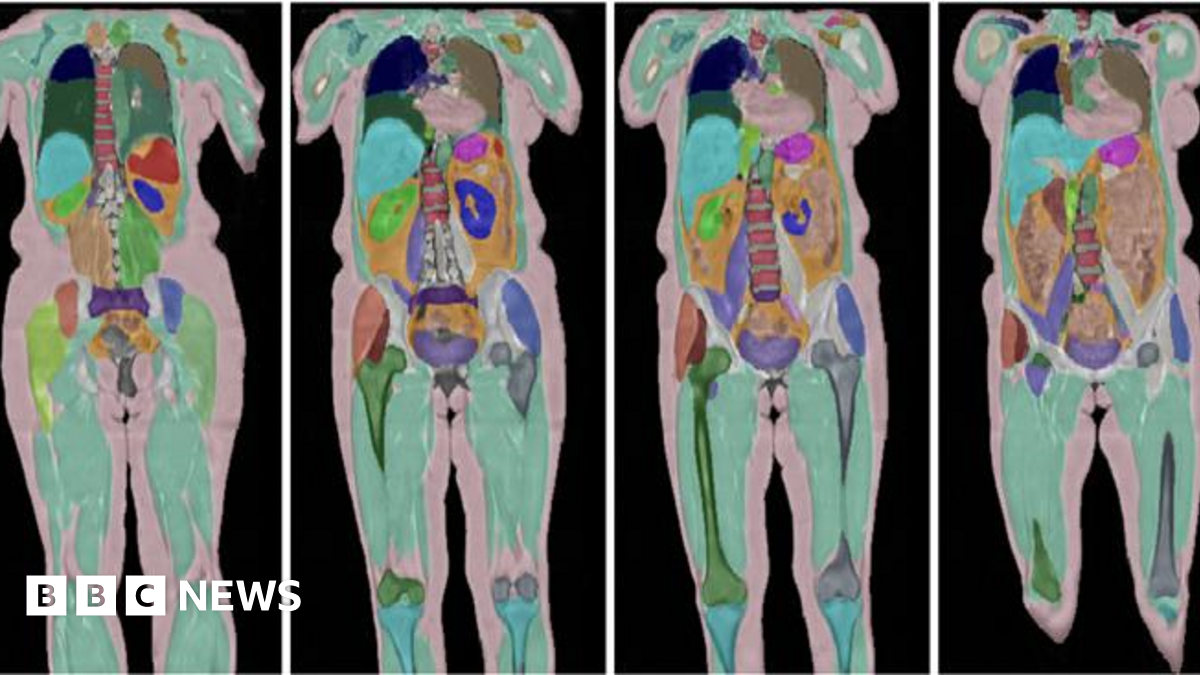

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025